Peter's blend

This scenario is for illustration purposes only.

For financial intermediary use only.

PETER's blend 2025

This scenario is for illustration purposes only.

For financial intermediary use only.

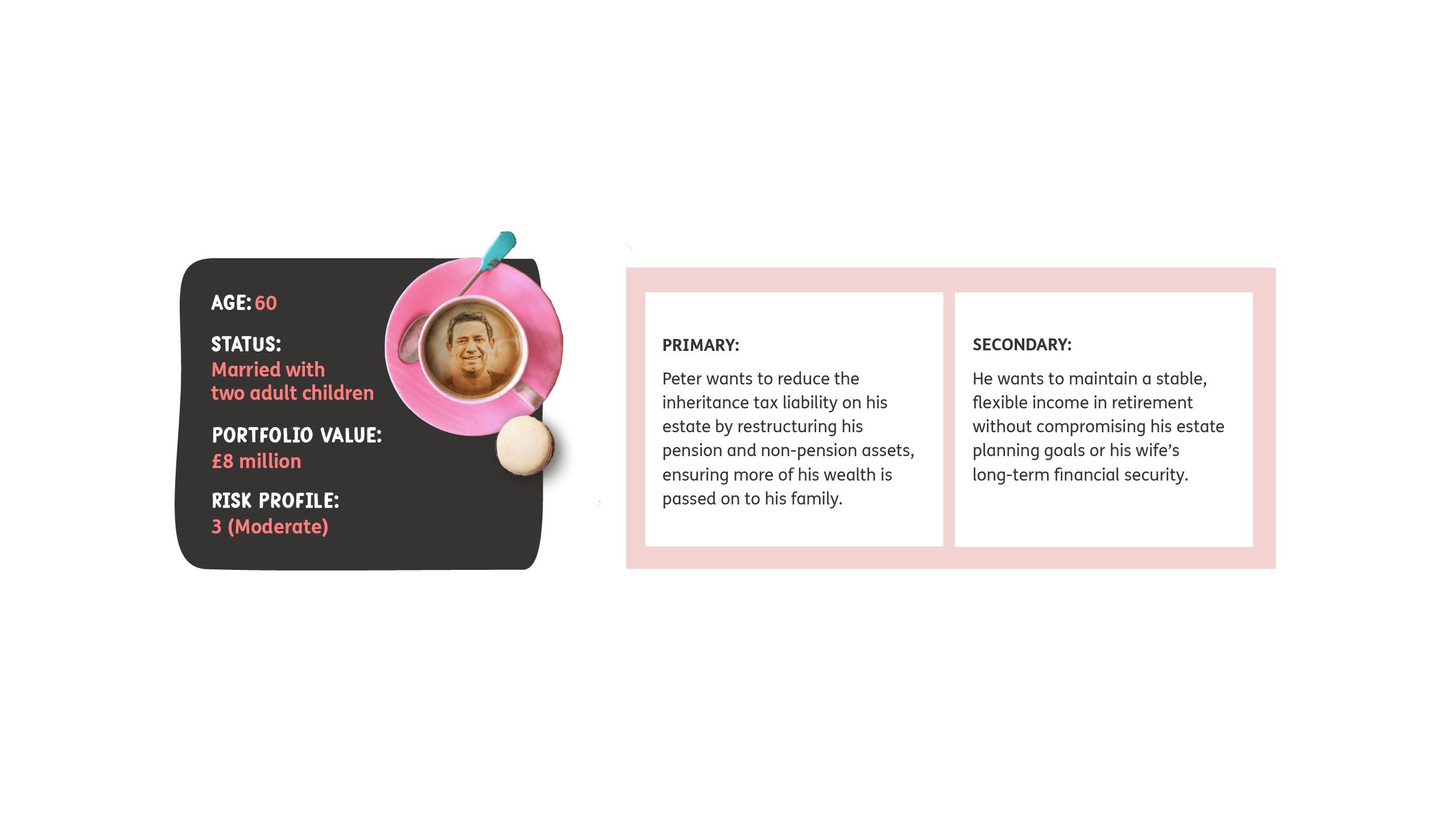

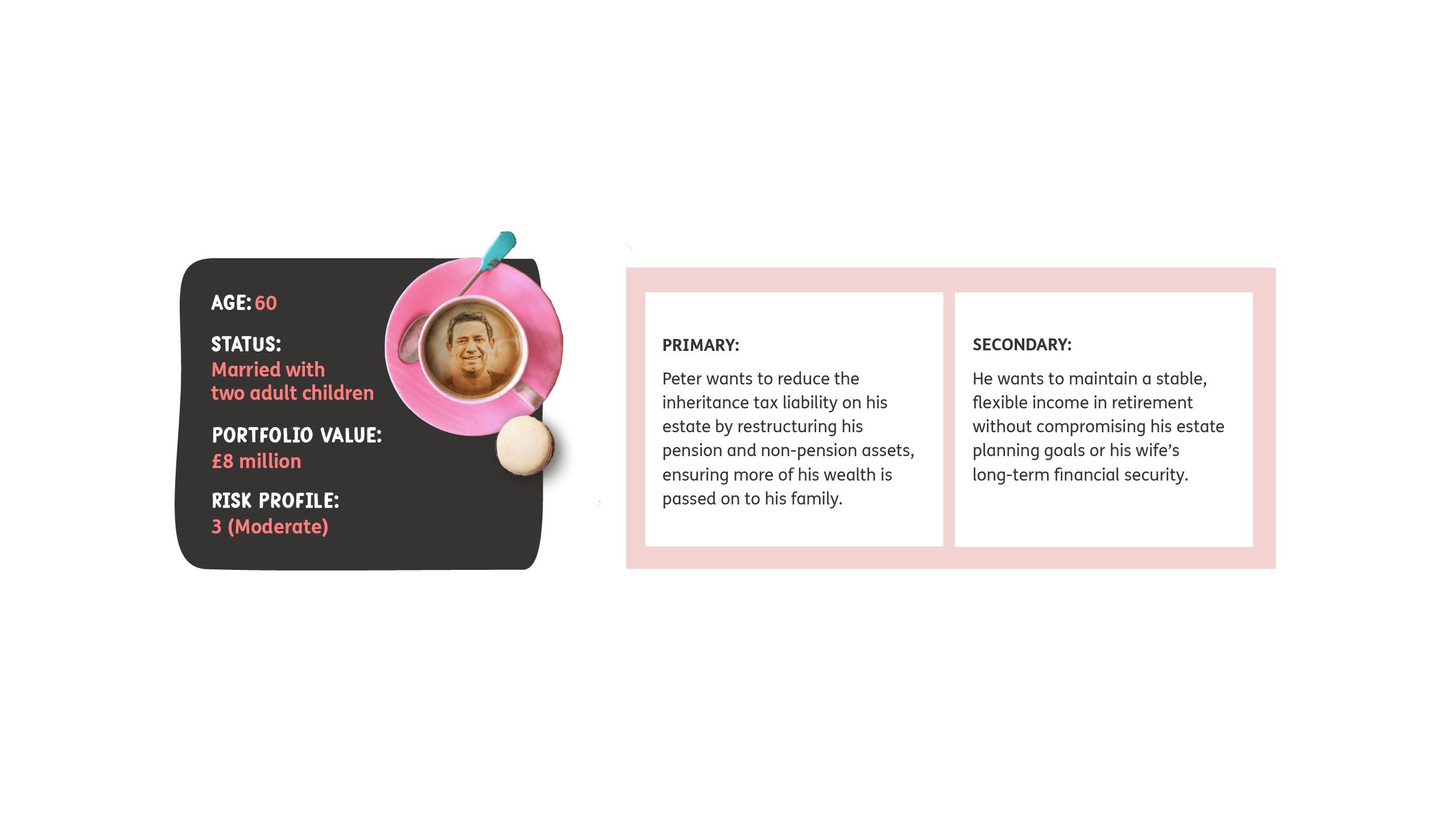

Peter, a 60-year-old semi-retired consultant, has spent years carefully building his wealth to secure both his retirement and his family’s future. He and his wife, Susan (55), have two adult children and a combined asset base of £8 million, including £3 million in pension savings and £5 million in other investments and property. With a Defined Benefit (DB) pension, consultancy income, and future State Pension (£11,500 per year), Peter has no immediate need to draw from his pension for retirement income.

His original strategy was to use a combination of his State Pension, DB Pension and income from his non-pension asset as his primary source of income in retirement. He planned to leave much of his pension untouched and pass it to his beneficiaries tax-free on his death. However, following the UK Government’s planned Inheritance Tax (IHT) changes in 2027, unused pension assets are expected to be included in a person’s estate for IHT purposes. This has prompted Peter to rethink his approach—his priority is now to preserve financial flexibility whilst helping to ensure Susan is secure and optimising his overall tax efficiency.

Peter, a 60-year-old semi-retired consultant, has spent years carefully building his wealth to secure both his retirement and his family’s future. He and his wife, Susan (55), have two adult children and a combined asset base of £8 million, including £3 million in pension savings and £5 million in other investments and property. With a Defined Benefit (DB) pension, consultancy income, and future State Pension (£11,500 per year), Peter has no immediate need to draw from his pension for retirement income.

His original strategy was to use a combination of his State Pension, DB Pension and income from his non-pension asset as his primary source of income in retirement. He planned to leave much of his pension untouched and pass it to his beneficiaries tax-free on his death. However, following the UK Government’s planned Inheritance Tax (IHT) changes in 2027, unused pension assets are expected to be included in a person’s estate for IHT purposes. This has prompted Peter to rethink his approach—his priority is now to preserve financial flexibility whilst helping to ensure Susan is secure and optimising his overall tax efficiency.

Not sure which blend is right for your client?

Speak to the Just team today.

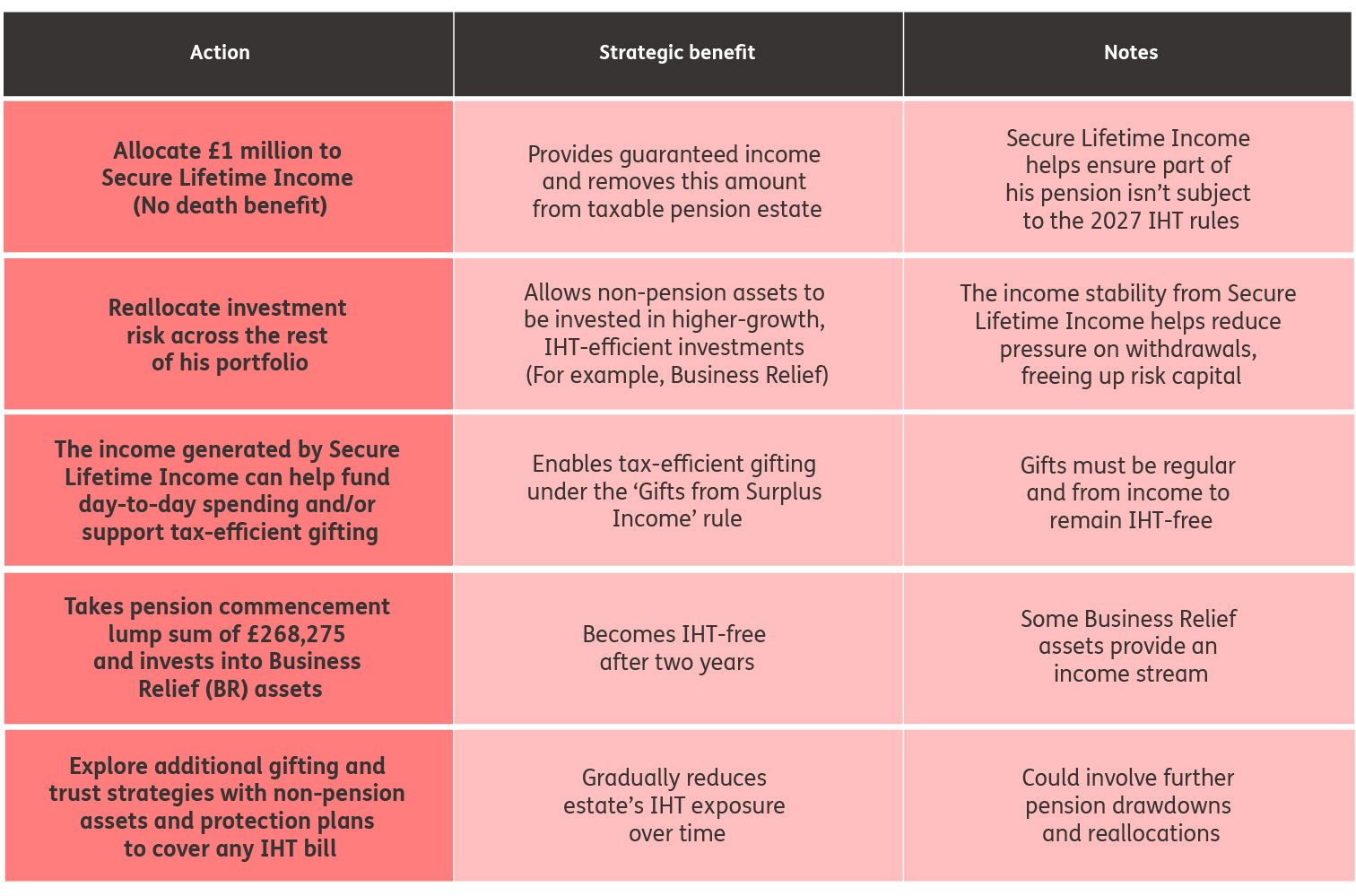

Peter’s Financial Planning Strategy

With the 2027 IHT changes, Peter’s goal isn’t just investment growth—it’s ensuring his assets are structured to optimise tax position while maintaining control over his retirement income. His adviser outlined a holistic strategy that ensures income stability, IHT efficiency, and growth potential for his estate. The plan includes:

By implementing this approach, Peter ensures that his pension de-risking strategy enables smarter estate planning, allowing him to preserve more of his wealth for his family.

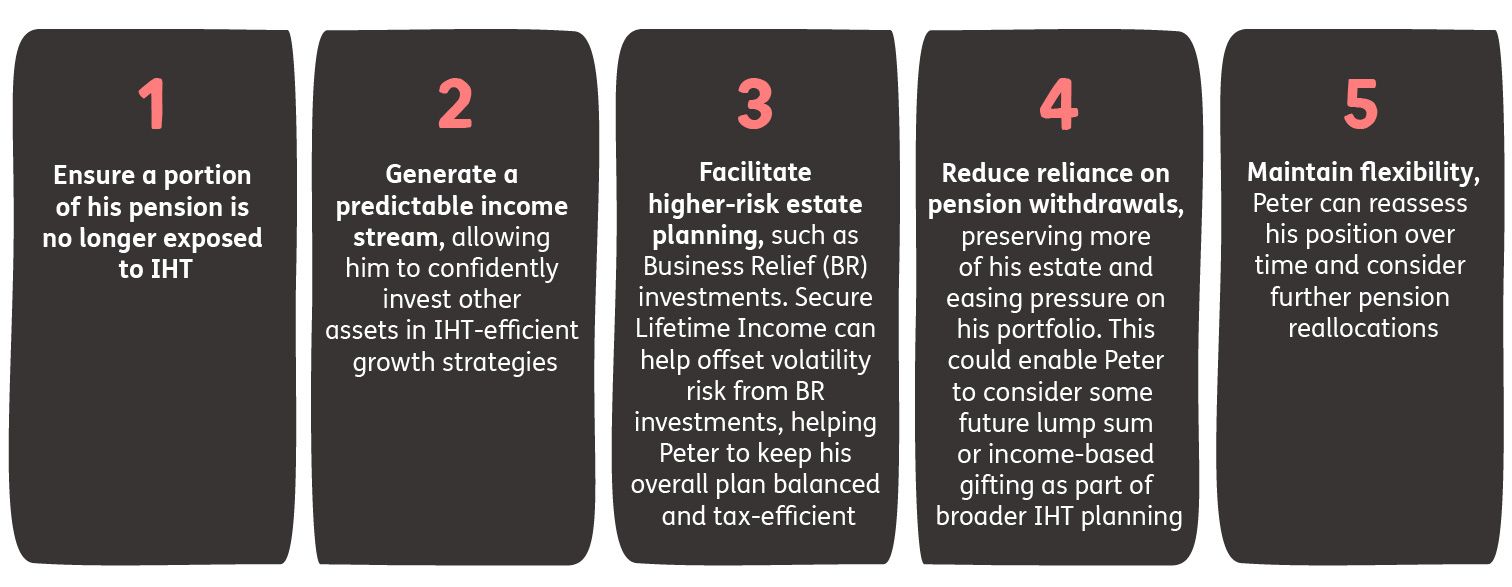

How secure lifetime income helps

Peter’s adviser introduced Secure Lifetime Income as a way to create income certainty while supporting broader estate planning objectives. By allocating £1 million of his pension to Secure Lifetime Income, Peter could:

Secure Lifetime Income isn’t a direct IHT solution, but it helps act as a stabilising force in Peter’s financial plan, ensuring he retains control over how his wealth is distributed while optimising tax efficiency. By providing a predictable income stream, Secure Lifetime Income allows Peter to confidently implement estate planning strategies—such as Business Relief investments and gifting—without disrupting his financial security.

Adviser talking points

- “Peter, Secure Lifetime Income isn’t just about reducing your pension’s IHT exposure—it’s about giving you financial stability so you can optimise the rest of your estate.”

- “By securing a guaranteed income stream, you have the flexibility to take a more tax-efficient approach across your other assets, including Business Relief investments and gifting strategies.”

- “Your goal isn’t just tax savings—it’s ensuring you’re making the smartest use of your wealth. Secure Lifetime Income enables you to do that without compromising financial security.”

- “And by offsetting the higher risk of some IHT strategies with a low-risk income stream from your pension, we can help ensure your total portfolio remains aligned to your risk profile.”

Validation

Peter’s financial strategy isn’t just about preserving wealth—it’s about optimising his assets under the new 2027 IHT rules to ensure he can sustain income, reduce unnecessary tax exposure, and pass on more to his beneficiaries.

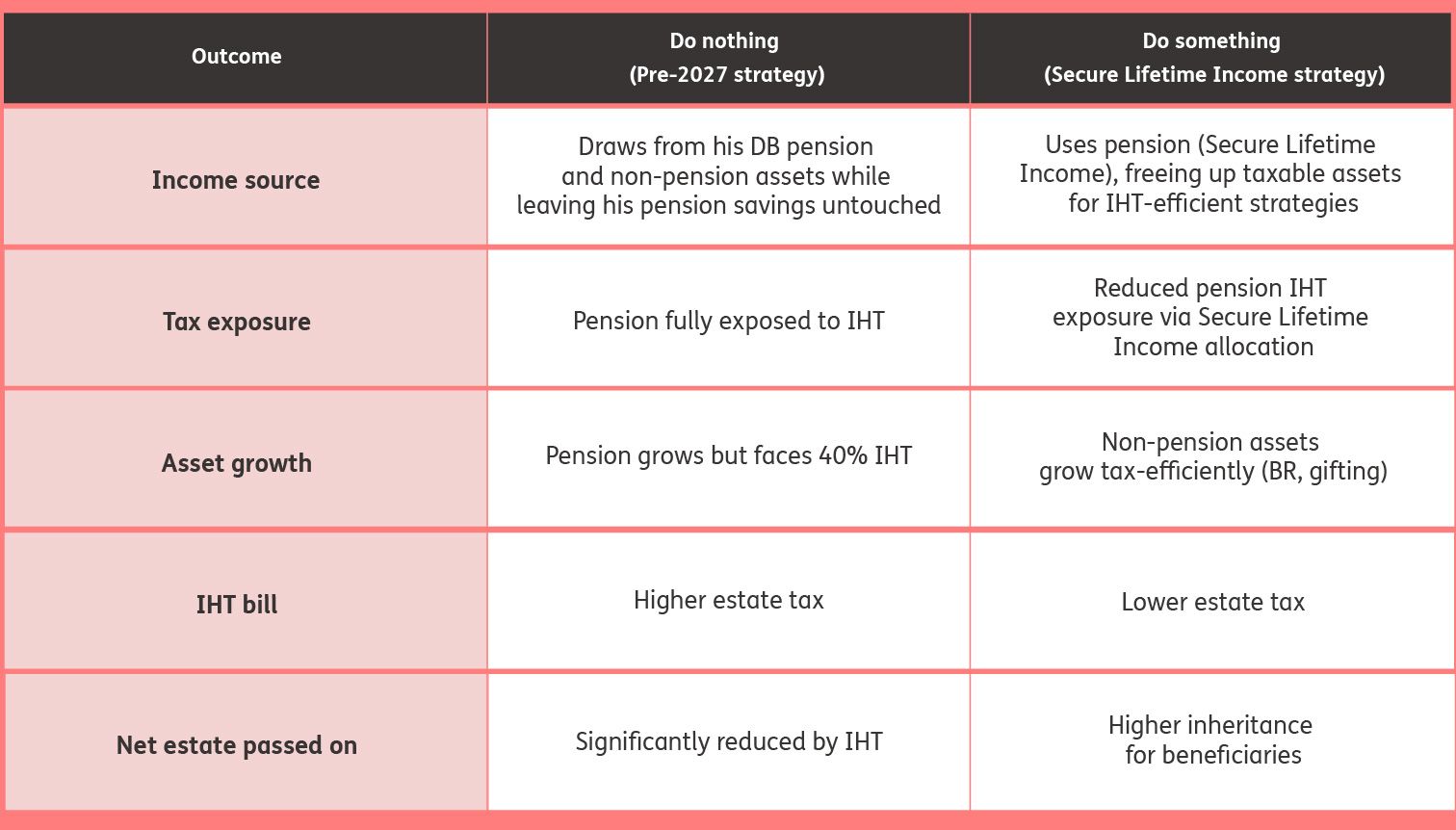

To validate this, we compare two clear scenarios:

- Peter continues using non-pension assets as his primary income source, leaving his pension untouched.

- Since pensions are now subject to IHT, his estate grows, but so does his tax liability.

- At age 90, his pension remains large but his estate faces a significant IHT bill.

- Peter uses part of his pension for income via Secure Lifetime Income, freeing up non-pension assets for IHT-efficient investments (for example, BR schemes, gifting).

- By actively managing his taxable estate, he reduces his exposure to IHT.

- At age 90, he passes on more wealth net of tax to his beneficiaries.

KEY OUTCOMES

Income Mix Over Time

Impact of changing the financial plan post-2027

- Do nothing: Peter uses his DB pension and non-pension assets for income, leaving his pension exposed to IHT.

- Do something: Peter uses his DB pension and pension-based income (Secure Lifetime Income) which lowers withdrawals from taxable assets, reducing IHT exposure.

- Result: A more balanced income strategy that aligns with tax efficiency.

Gross asset position with and without strategy change

- Do nothing: Large pension remains untouched but fully exposed to IHT.

- Do something: Peter reallocates assets into IHT-efficient structures, preserving more of his estate.

- Result: More of Peter’s wealth is structured to pass on tax-efficiently.

Asset Breakdown at Age 90

Estate and TAX STATUS at Age 90

How the IHT bill impacts the final estate passed on

- Do nothing: Peter’s IHT bill is higher, reducing what his family could inherit.

- Do something: IHT liability is significantly reduced, increasing the net estate passed to beneficiaries.

- Result: By planning proactively, Peter preserves more of his family’s wealth.

Impact of changing the financial plan post-2027

- Do nothing: Peter uses his DB pension and non-pension assets for income, leaving his pension exposed to IHT.

- Do something: Peter uses his DB pension and pension-based income (Secure Lifetime Income) which lowers withdrawals from taxable assets, reducing IHT exposure.

- Result: A more balanced income strategy that aligns with tax efficiency.

Income Mix Over Time

(Click to find out more)

Gross asset position with and without strategy change

- Do nothing: Large pension remains untouched but fully exposed to IHT.

- Do something: Peter reallocates assets into IHT-efficient structures, preserving more of his estate.

- Result: More of Peter’s wealth is structured to pass on tax-efficiently.

Asset Breakdown at Age 90

(Click to find out more)

How the IHT bill impacts the final estate passed on

- Do nothing: Peter’s IHT bill is higher, reducing what his family could inherit.

- Do something: IHT liability is significantly reduced, increasing the net estate passed to beneficiaries.

- Result: By planning proactively, Peter preserves more of his family’s wealth.

Estate and TAX STATUS at Age 90

(Click to find out more)

key benefits of the blended solution for PETER

The potential new IHT rules could require a shift in strategy. Pensions are no longer an automatic lower risk IHT shield post-2027.

By adapting to the post-2027 tax landscape, Peter ensures that his family receives more of his wealth, rather than losing it to unnecessary taxation.

Notes:

This scenario is based on the proposed changes to pension inheritance tax rules announced in the UK Government’s Autumn Statement (October 2024). The proposals state that from 6 April 2027, unused defined contribution pension funds will be brought into scope for IHT.

The strategy outlined in this scenario reflects one possible planning approach under the proposed rules and is designed to illustrate how Secure Lifetime Income could support broader estate planning objectives.

These assumptions are intended for illustrative purposes only. Clients and advisers should revisit any estate planning or pension strategies once the final policy is confirmed. Tax rules may change.

Scenario numbers are illustrative only and correct as at 27 March 2025 to show how a guaranteed income producing asset can be included alongside equities and bond assets within a drawdown SIPP portfolio. The State Pension figures used are for the 2024/25 tax year. For modelling purposes, we assume a 2% per annum escalation in line with the Bank of England inflation target. Actual State Pension increases are determined by the triple lock (the highest of average earnings growth, CPI inflation, or 2.5%).

Projections shown are hypothetical and based on modelled assumptions. They are not a reliable indicator of future performance and should not form the sole basis for investment decisions. Investment returns may vary.

The example is based on a 60-year old male, in good health, non-smoker, with a total portfolio value of £8 million and assumes a total fee of 1.75%.

Figures are generated using our internal modeller, with capital market assumptions provided by Milliman.