Annabel's Blend

This scenario is for illustration purposes only.

For financial intermediary use only.

Annabel's Blend

This scenario is for illustration purposes only.

For financial intermediary use only.

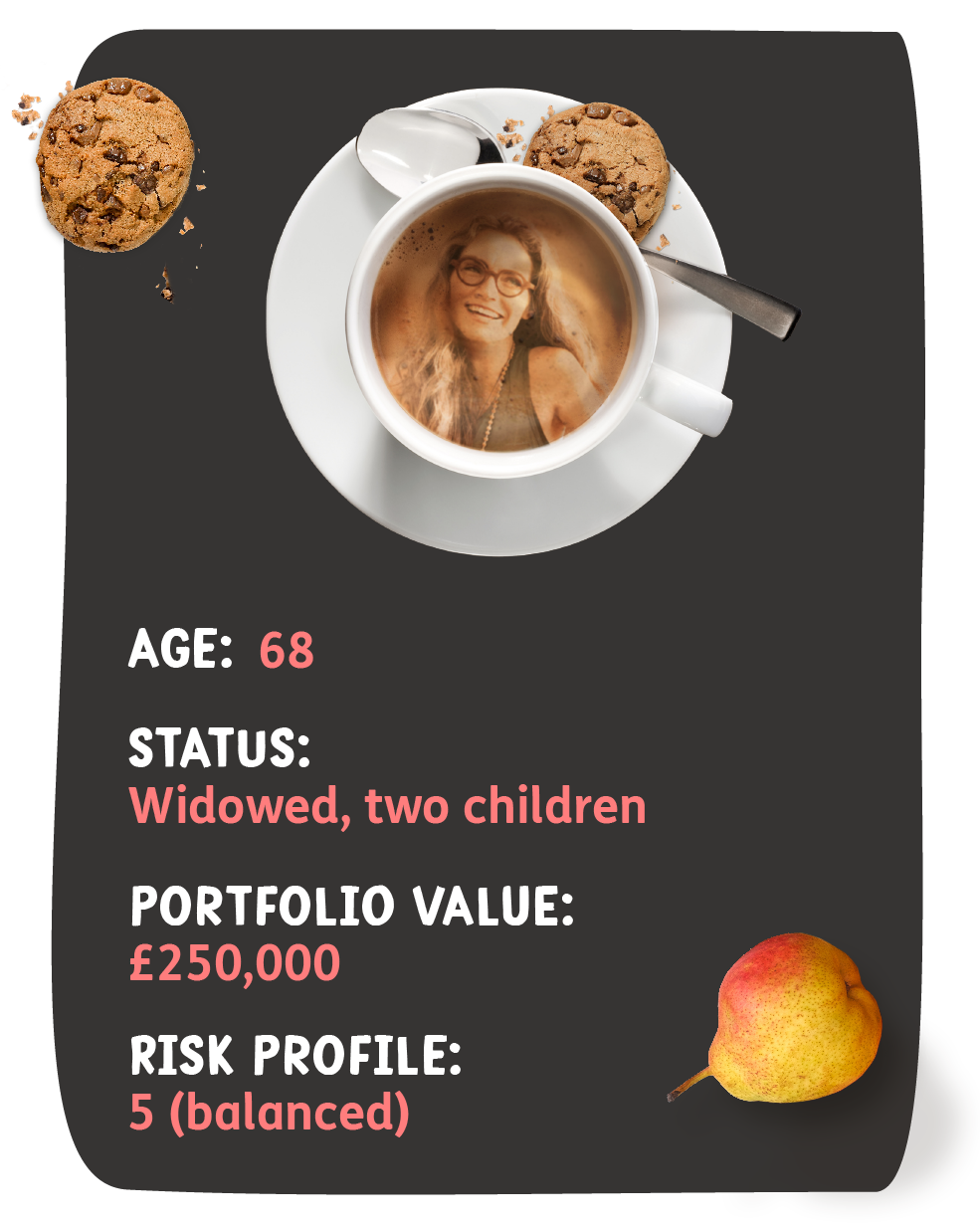

- Annabel is 68 and currently in good health.

- She lost her husband, Bob, ten years ago and has two children who are financially stable.

- Together with her ‘balanced’ attitude to risk, Annabel has a low capacity for loss.

- Her investment portfolio is currently worth £250,000.

- Apart from receiving a full State Pension, Annabel has no other sources of income.

- Guarantees are very important to her as she needs an additional stable and sustainable £10,000 pa adjusted for inflation.

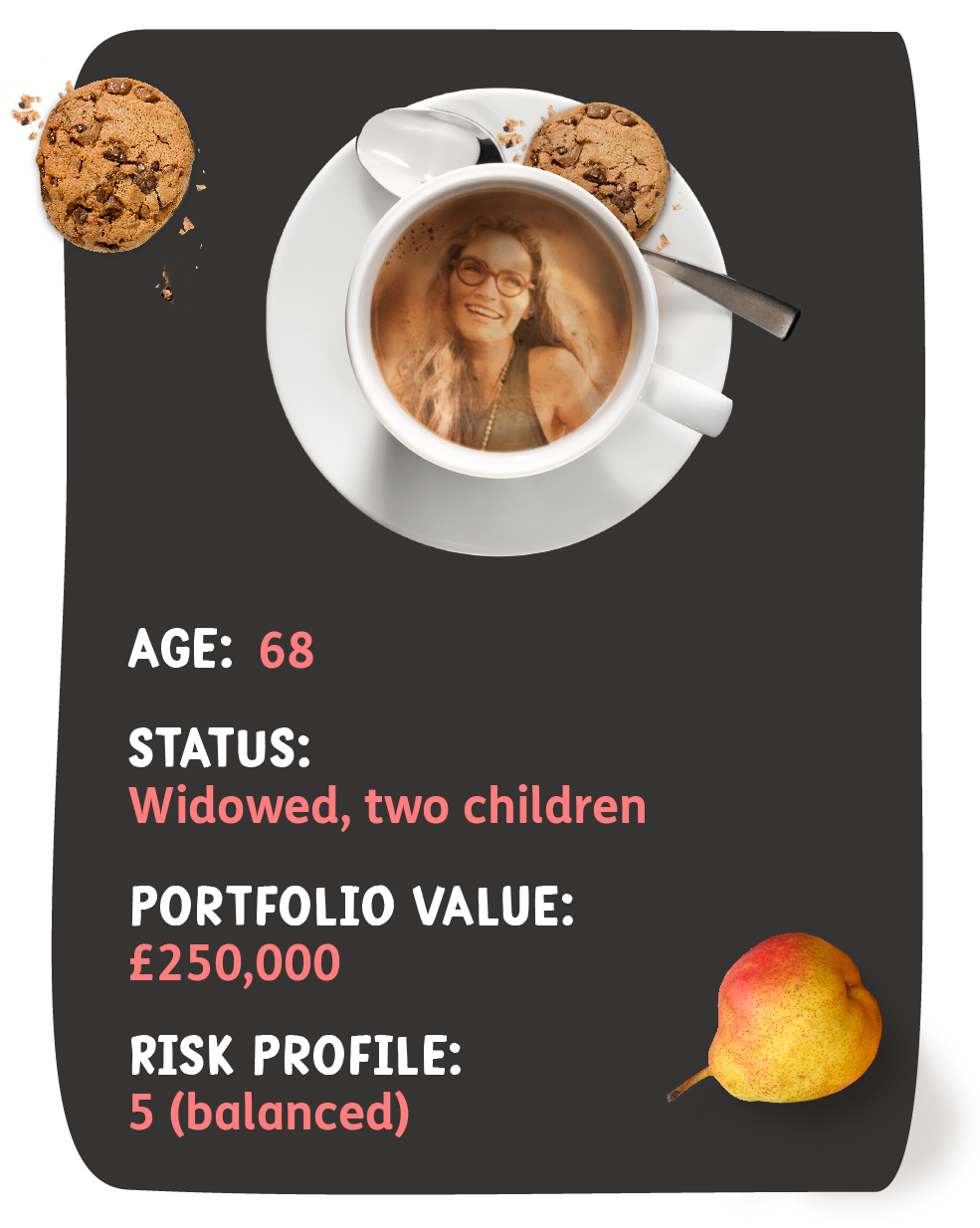

- Annabel is 68 and currently in good health.

- She lost her husband, Bob, ten years ago and has two children who are financially stable.

- Together with her ‘balanced’ attitude to risk, Annabel has a low capacity for loss.

- Her investment portfolio is currently worth £250,000.

- Apart from receiving a full State Pension, Annabel has no other sources of income.

- Guarantees are very important to her as she needs an additional stable and sustainable £10,000 pa adjusted for inflation.

Find a better blend for your client.

talk to us today

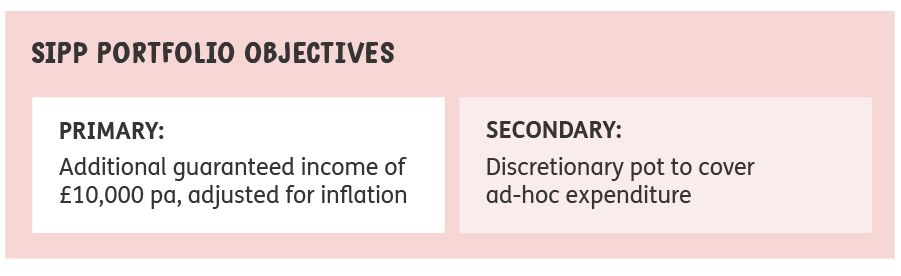

Annabel's options

In a planning exercise with her adviser, Annabel discussed the fact that she has no other source of income other than from her State Pension and that guarantees are of paramount importance. Any additional income generated needs to be adjusted for inflation. She likes the idea of leaving some funds to help with ad-hoc expenditure.

In this case, her adviser believes that a guaranteed income producing asset is not the best solution because Annabel has a low capacity for loss and her primary need is guaranteed income, not flexibility or legacy. Also, to meet this need, it requires nearly 57% of her SIPP assets.

With her adviser’s guidance, Annabel considered many of the features an off-platform annuity can offer. She wants a guaranteed income that’s adjusted for inflation and leaving some funds to help with ad-hoc expenditure.

Below are some of the annuity examples she considered:

The top four options were considered too binary and didn’t fulfil her needs. The last option allows Annabel to use £201,124 from her retirement portfolio to purchase a £10,000 guaranteed income which increases 2% each year with a 25-year guarantee period. This meets her objective of £10,000 additional income. It also means that £201,124 investment in the annuity will guarantee to pay at least £320,301 over a 25-year period.

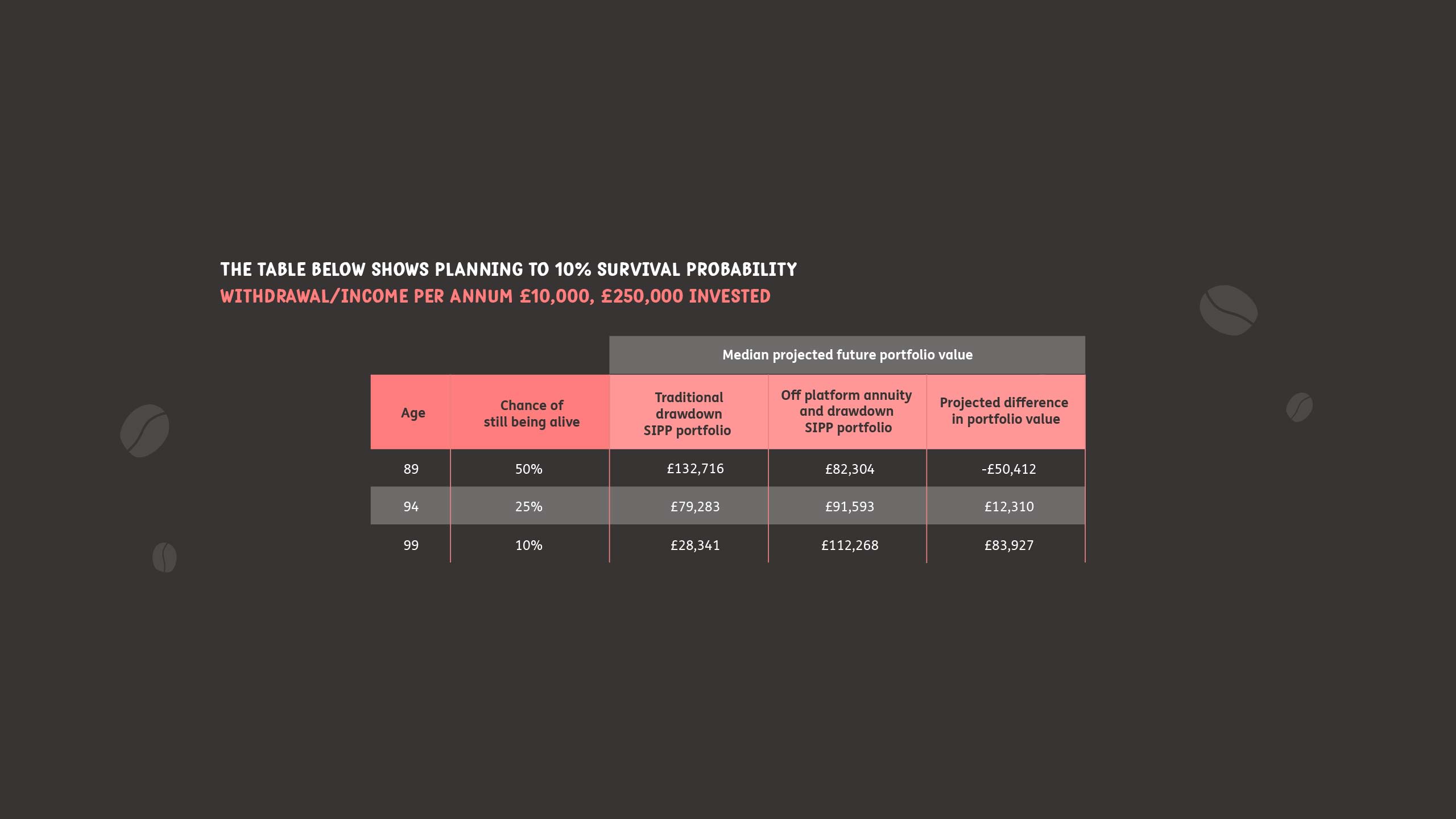

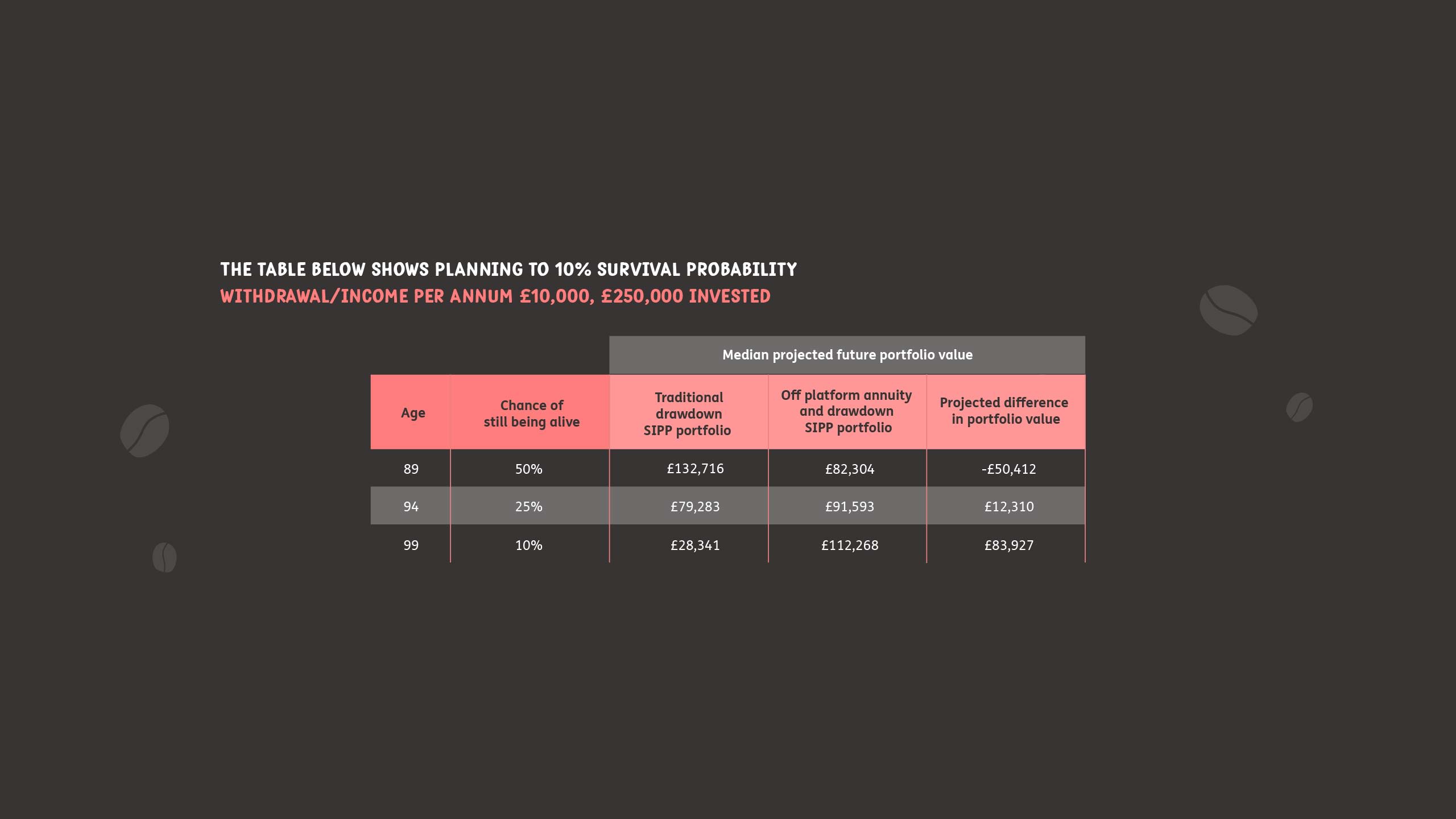

The balance of £48,876 is left in Annabel’s drawdown SIPP portfolio to be invested to match her risk appetite. This would allow her to draw from the portfolio to cover any ongoing needs in retirement as shown in the chart below:

It shows the portfolio value when planning to 10% survival probability in isolation.

Below are some of the annuity examples she considered:

The top four options were considered too binary and didn’t fulfil her needs. The last option allows Annabel to use £201,124 from her retirement portfolio to purchase a £10,000 guaranteed income which increases 2% each year with a 25-year guarantee period. This meets her objective of £10,000 additional income. It also means that £201,124 investment in the annuity will guarantee to pay at least £320,301 over a 25-year period.

The balance of £48,876 is left in Annabel’s drawdown SIPP portfolio to be invested to match her risk appetite. This would allow her to draw from the portfolio to cover any ongoing needs in retirement as shown in the chart below:

It shows the portfolio value when planning to 10% survival probability in isolation.

Death benefits

Annabel chose an annuity with a 25-year guarantee. This means if she dies during the guaranteed 25-year period, her beneficiaries will receive ongoing payments for the remainder of that period. The chart below shows the value of her drawdown SIPP portfolio, investment and guaranteed income at 2% escalation if she dies aged 73.

The difference between the payments Annabel’s beneficiaries will receive upon her death at various ages if she chose the blended option compared to drawdown alone is shown in the chart below. The orange column represents the balance of her guaranteed payments plus the value of her investments.

If she dies at the age of 73, her beneficiaries would receive a total of £324,374 which is made up of the balance of her guaranteed income payment (£268,261) and the investment value (£56,113).

Ongoing value on death at various ages (£)

This solution fulfils Annabel’s objective of generating an additional income of £10,000 pa adjusted for inflation.

Death benefits

Annabel chose an annuity with a 25-year guarantee. This means if she dies during the guaranteed 25-year period, her beneficiaries will receive ongoing payments for the remainder of that period. The chart below shows the value of her drawdown SIPP portfolio, investment and guaranteed income at 2% escalation if she dies aged 73.

The difference between the payments Annabel’s beneficiaries will receive upon her death at various ages if she chose the blended option compared to drawdown alone is shown in the chart below. The orange column represents the balance of her guaranteed payments plus the value of her investments.

If she dies at the age of 73, her beneficiaries would receive a total of £324,374 which is made up of the balance of her guaranteed income payment (£268,261) and the investment value (£56,113).

Ongoing value on death at various ages (£)

This solution fulfils Annabel’s objective of generating an additional income of £10,000 pa adjusted for inflation.

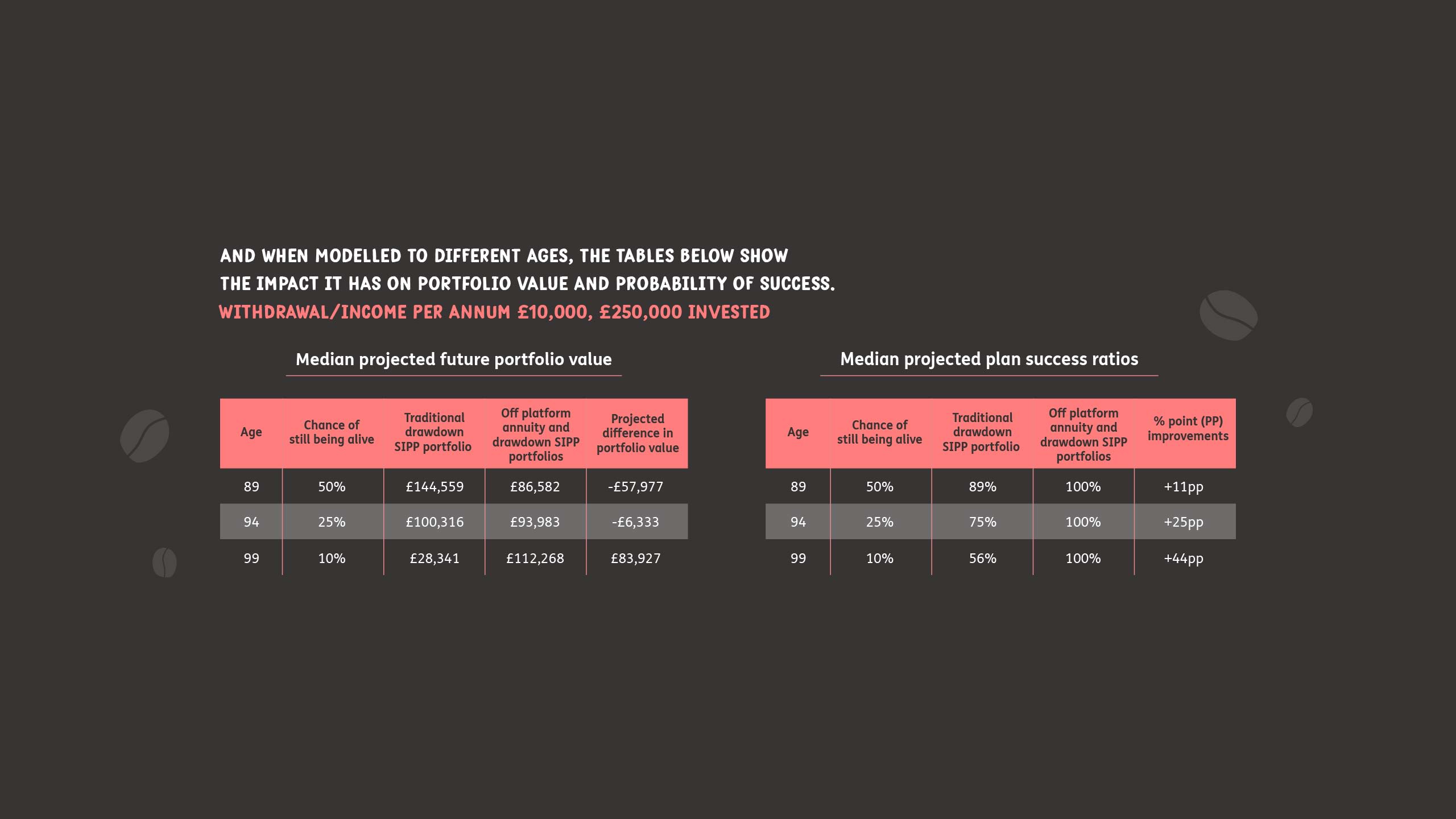

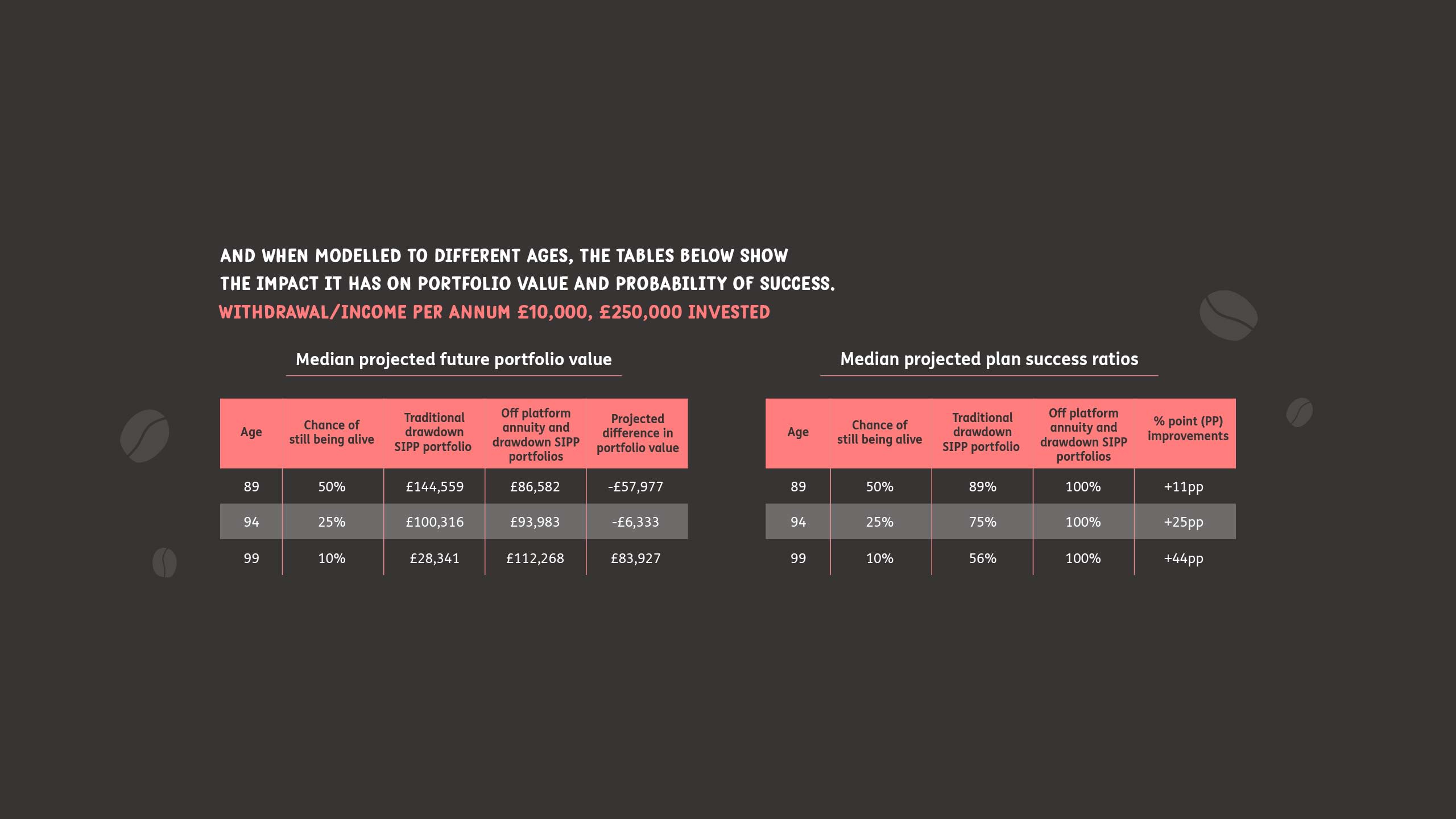

Key benefits of the new portfolio solution for Annabel

The new portfolio solution could achieve a better outcome for Annabel, as well as reducing overall risk.

Annabel’s income objective has been achieved. This plan takes all the strain from the long-term portfolio. Also, it enables higher projected long-term portfolio values to help achieve Annabel’s secondary objective of having a discretionary pot to help cover any future ad-hoc expenditure and spikes in inflation.

Key benefits

of the new portfolio

solution for Annabel

The new portfolio solution could achieve a better outcome for Annabel, as well as reducing overall risk.

Annabel’s income objective has been achieved. This plan takes all the strain from the long-term portfolio. Also, it enables higher projected long-term portfolio values to help achieve Annabel’s secondary objective of having a discretionary pot to help cover any future ad-hoc expenditure and spikes in inflation.

Notes:

Scenario numbers are illustrative only and correct as at 11 March 2024.

Projections shown are hypothetical and are based on assumptions, not indicative of future performance and should not be the sole basis for investment decisions. Investment returns can fluctuate.

Example based on a 68 year old female, in good health, non-smoker, with a £250,000 total portfolio value. Traditional drawdown SIPP portfolio scenario is based on 50% mature equity / 50% investment grade bond asset allocation. New blended drawdown SIPP portfolio scenario is based on £201,124 annuity purchase / 50% mature equity / 50% investment grade bonds asset allocation, total fees of 1.75%.

Portfolio figures are generated via Timeline, with rates supplied by Just using median return from 912 scenarios from 109 years of historic data. The annuity rates are Just annuity rates. The £10,000 income has been set to increase by 2% (government target inflation).