Cynthia's blend

This scenario is for illustration purposes only.

For financial intermediary use only.

Cynthia's blend 2025

This scenario is for illustration purposes only.

For financial intermediary use only.

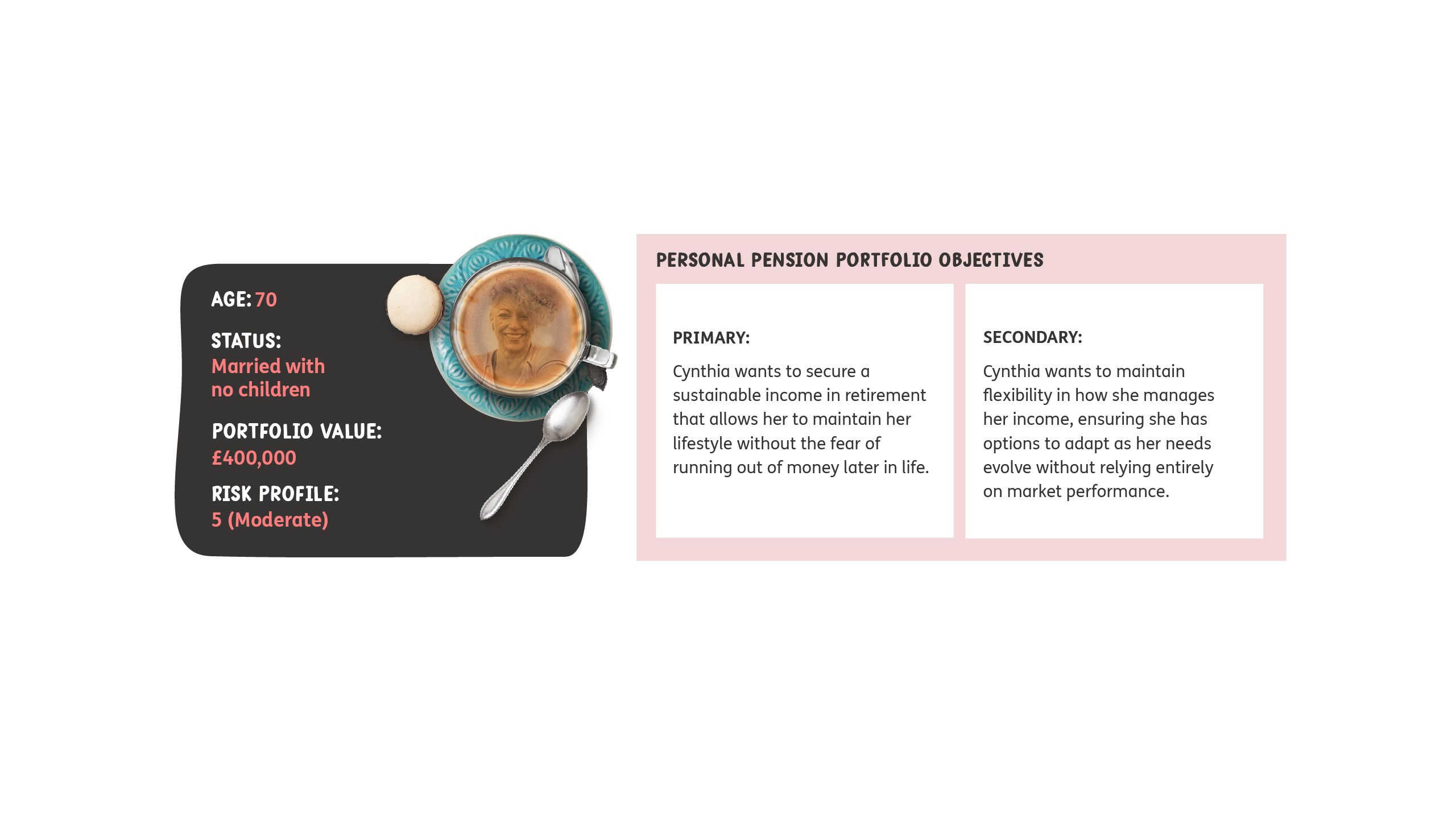

Cynthia, a 70-year-old retired administrator, always believed she had planned well for retirement. At age 65, she had a pension pot of £400,000 and began drawing £16,000 per year, escalating at 2% per annum. Her initial projections suggested that her strategy was ambitious but sustainable. She felt confident in her plan. However, five years later, she had less money than expected.

At her annual financial review, Cynthia was shocked to learn that her pension pot had fallen to £300,000—a significant drop. A combination of market downturns, rising living costs, and increased withdrawals had left her in a difficult position.

Cynthia, a 70-year-old retired administrator, always believed she had planned well for retirement. At age 65, she had a pension pot of £400,000 and began drawing £16,000 per year, escalating at 2% per annum. Her initial projections suggested that her strategy was ambitious but sustainable. She felt confident in her plan. However, five years later, she had less money than expected.

At her annual financial review, Cynthia was shocked to learn that her pension pot had fallen to £300,000—a significant drop. A combination of market downturns, rising living costs, and increased withdrawals had left her in a difficult position.

Now, Cynthia faces a choice:

Not sure which blend is right for your client?

Speak to the Just team today.

How secure lifetime income helps

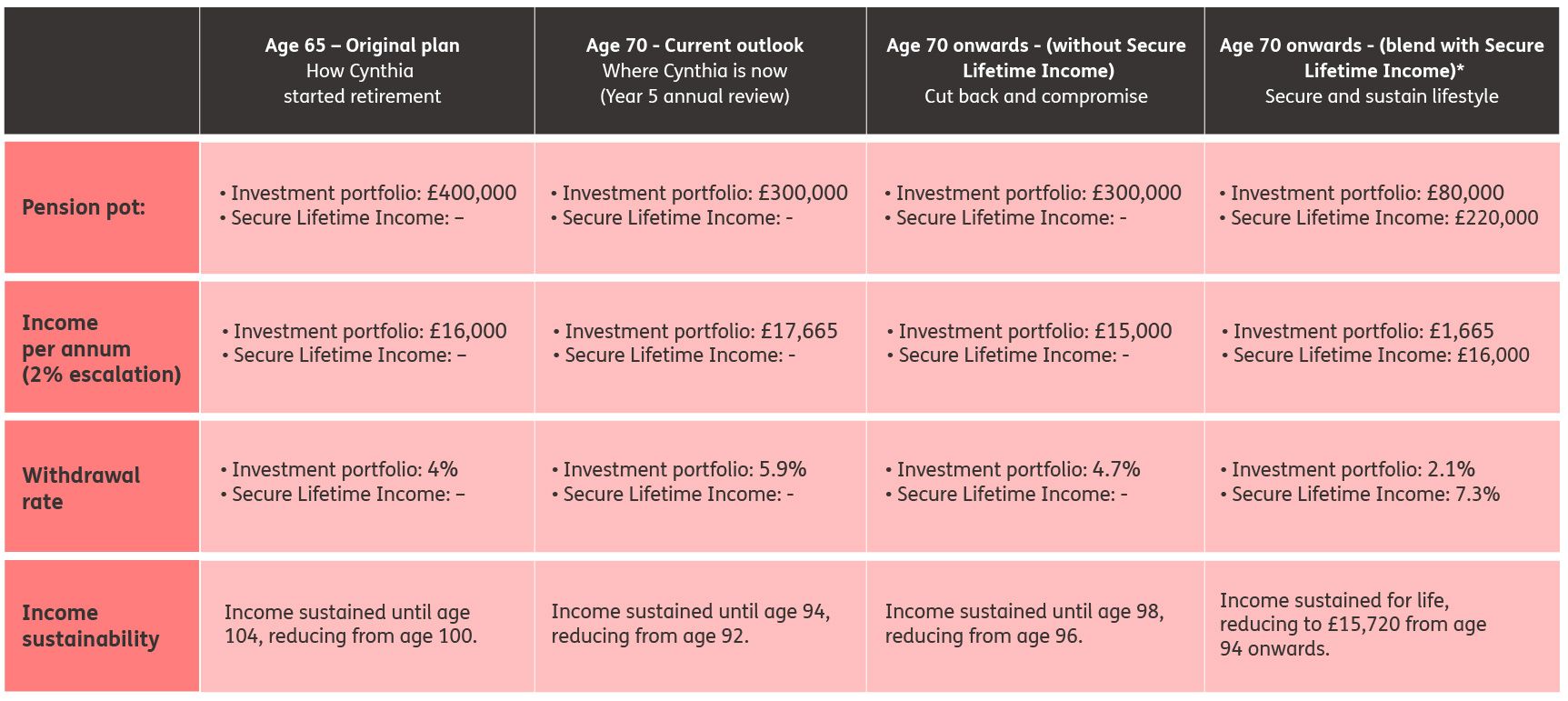

Cynthia’s adviser introduced Secure Lifetime Income as a way to preserve her spending power while improving her financial security. By using approximately £220,000 to purchase Secure Lifetime Income while keeping £80,000 invested, she could:

- Secure a guaranteed income that covers her £16,000 annual withdrawals, helping to remove pressure from her remaining investments.

- Reduce the need for large portfolio withdrawals, allowing her other assets to remain invested and potentially recover over time.

- Avoid drastic lifestyle cutbacks, helping to give her financial stability and peace of mind.

Now, Cynthia feels more in control. With Secure Lifetime Income providing a stable income baseline, she no longer feels forced to reduce her spending. She’s also feeling confident that her portfolio is more likely to last throughout her lifetime.

Adviser talking points

“Cynthia, maintaining your current withdrawals increases the risk of depleting your savings later in life. By blending a portion of your assets into a guaranteed income stream, we can help you sustain your lifestyle without unnecessary financial stress.”

“By incorporating Secure Lifetime Income, you don’t have to make drastic spending cuts—you can keep your income stable while helping to ensure your pension pot lasts longer.”

“Secure Lifetime Income allows you to lower your withdrawal rate from your investments, helping to preserve your savings for longer and reducing your reliance on market fluctuations. If your circumstances change, you have the flexibility to adjust how much you withdraw from your pension.”

Validation

Retirement planning isn’t just about how much you’ve saved—it’s about ensuring your money works for you efficiently, sustaining your lifestyle while minimising financial risks. Cynthia’s case shows how integrating Secure Lifetime Income could help prevent the risks of market volatility and premature depletion, creating a more sustainable retirement plan. The following data illustrates the impact of Secure Lifetime Income on Cynthia’s financial security.

Cynthia’s financial review was a wake-up call. She’d followed her plan, but despite careful withdrawals, her savings had declined more than expected. The thought of cutting her income felt restrictive, but ignoring the problem wasn’t an option either. Her adviser laid out the numbers—she had three clear choices, each with different consequences for her future.

Cynthia's Retirement situation

* The allocation to Secure Lifetime Income should be adapted to meet the client’s needs.

Cynthia's Retirement income options

For Cynthia, this isn’t just about percentages and projections—it’s about keeping her independence and not having to second-guess every expense. By integrating Secure Lifetime Income, she could maintain the lifestyle she envisioned while knowing her portfolio has the resilience to help support her long-term future. Instead of worrying about ‘what if,’ she can focus on ‘what’s next’.

Cynthia's Retirement situation

* The allocation to Secure Lifetime Income should be adapted to meet the client’s needs.

Cynthia's Retirement income options

(Click to find out more)

For Cynthia, this isn’t just about percentages and projections—it’s about keeping her independence and not having to second-guess every expense. By integrating Secure Lifetime Income, she could maintain the lifestyle she envisioned while knowing her portfolio has the resilience to help support her long-term future. Instead of worrying about ‘what if,’ she can focus on ‘what’s next’.

key benefits of the new blended solution for Cynthia

Cynthia’s retirement plan is now more secure. By allocating part of her pension to Secure Lifetime Income, she can maintain her current lifestyle without the fear of running out of money in later life—even if markets remain volatile.

Secure Lifetime Income provides Cynthia with a reliable income stream that covers her essential needs. This allows her to reduce reliance on her drawdown pot, lowering the risk of premature depletion and giving her confidence to keep spending without unnecessary cutbacks.

By integrating Secure Lifetime Income, Cynthia gains income certainty today and protection for tomorrow. Her adviser has helped her strike a balance between flexibility and security—supporting a more sustainable plan with less stress and more freedom.

Notes:

Scenario numbers are illustrative only, and correct as at 24 March 2025, to show how Secure Lifetime Income can be included alongside equities and bond assets in a drawdown personal pension portfolio.

Projections shown are hypothetical and based on assumptions, not indicative of future performance and shouldn’t be the sole basis for investment decisions. Investment returns can fluctuate.

Example based on a 65- and 70-year-old female, in good health, non-smoker, with a total portfolio value of £400,000 at age 65 and £300,000 at age 70. The traditional drawdown personal pension portfolio scenario assumes a 60% equity / 40% fixed income asset allocation. The new blended drawdown personal pension portfolio scenario includes a £220,000 Secure Lifetime Income purchase, resulting in a blended model of 74% Secure Lifetime Income / 22% equities / 5% fixed income, total fees of 1.75%. This structure is designed to generate an initial income of £16,000 per year, increasing by 2% annually, (£17,665 by age 70). The blended portfolio is risk optimised taking advantage of the lower volatility of the Secure Lifetime Income allocation. The State Pension figures used are for the 2024/2025 tax year, escalating at 2% per annum.

Figures are generated using our internal modeller, with capital market assumptions provided by Milliman.