John's blend

This scenario is for illustration purposes only.

For financial intermediary use only.

John's blend 2025

This scenario is for illustration purposes only.

For financial intermediary use only.

John, a 65-year-old retired engineer, spent decades building his career, ensuring he and his partner had financial stability. He prided himself on careful planning and assumed his diversified investments—his workplace pension, some ISAs, and a private pension—would be enough to secure his retirement. But as time passed, he became increasingly anxious. Watching his investments fluctuate with the markets left him feeling vulnerable. When an unexpected home repair required a large withdrawal, he realised how quickly things could spiral.

John, a 65-year-old retired engineer, spent decades building his career, ensuring he and his partner had financial stability. He prided himself on careful planning and assumed his diversified investments—his workplace pension, some ISAs, and a private pension—would be enough to secure his retirement. But as time passed, he became increasingly anxious. Watching his investments fluctuate with the markets left him feeling vulnerable. When an unexpected home repair required a large withdrawal, he realised how quickly things could spiral.

Not sure which blend is right for your client?

Speak to the Just team today.

How secure lifetime income helps

Jane introduced John to Secure Lifetime Income, explaining how it could provide a stable foundation while keeping the rest of his assets invested for potential growth. By shifting a portion of his portfolio into a guaranteed income stream, John could help ensure he maintains his minimum lifestyle comfortably. Now, he no longer checks the markets obsessively—his base income is secure, and he can use his other assets as needed for discretionary spending.

Adviser talking points:

“John, would you feel more comfortable knowing that a portion of your income is guaranteed, no matter what the market does?”

“By using Secure Lifetime Income, you can help keep your investments growing while ensuring your essential needs are covered.”

Validation

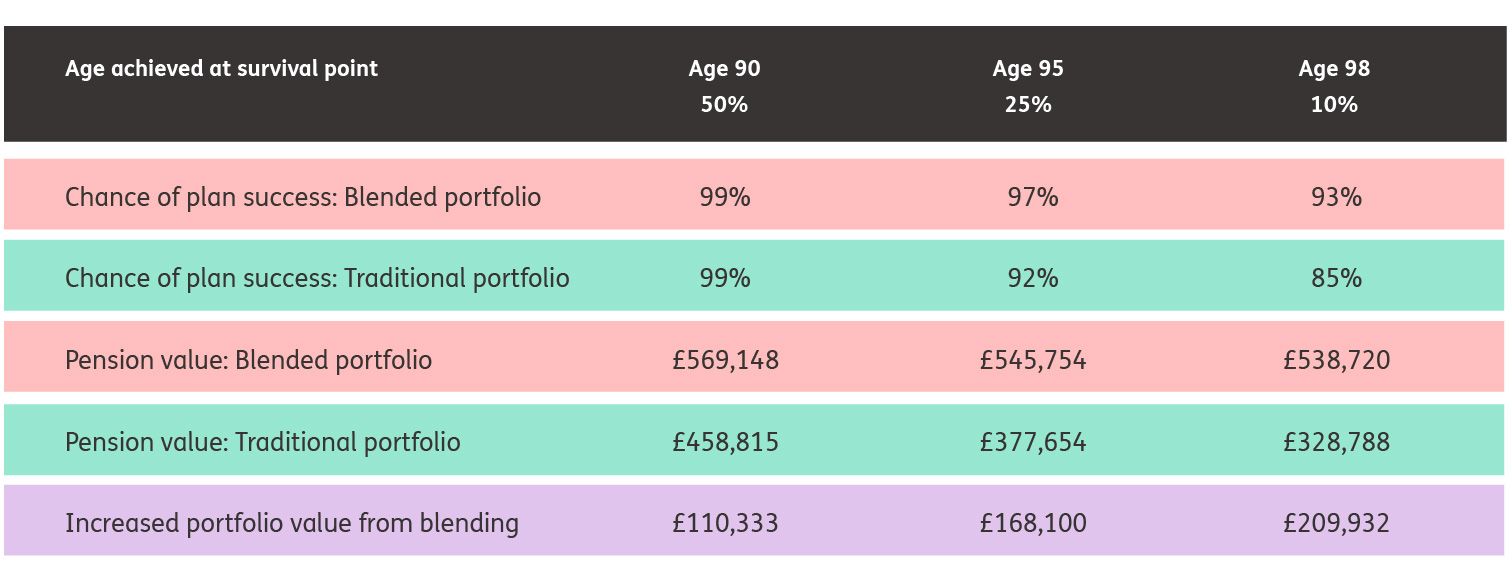

A retirement isn’t lived on a chart or spreadsheet however in addition to providing greater psychological benefits and spending freedom a portfolio blended with Secure Lifetime Income can increase John’s probability of success and enhances his portfolio values.

Figures are based on median projected future portfolio value

Just as you diversify investments to manage market risk, it’s equally important to diversify income sources to mitigate retirement risk. By incorporating Secure Lifetime Income alongside a traditional portfolio, John’s portfolio withdrawal rate reduces from 5% to 4.56%, strengthening the sustainability of his retirement income.

Diversification of Retirement Income through a Blended Portfolio

Figures are based on median projected future portfolio value

Just as you diversify investments to manage market risk, it’s equally important to diversify income sources to mitigate retirement risk. By incorporating Secure Lifetime Income alongside a traditional portfolio, John’s portfolio withdrawal rate reduces from 5% to 4.56%, strengthening the sustainability of his retirement income.

Diversification of Retirement Income through a Blended Portfolio

(Click to find out more)

key benefits of the new blended solution for John

For John, this means greater confidence in his financial future—knowing that a portion of his income is secure while still allowing growth potential in his remaining investments. With a lower withdrawal rate, his assets are more likely to last, reducing the stress of market fluctuations and giving him the flexibility to enjoy his retirement.

By integrating Secure Lifetime Income, advisers can help clients like John reduce withdrawal pressure, preserve long-term financial security, and balance stability with growth potential—a key component in modern retirement planning.

key benefits

of the new blended

solution for John

For John, this means greater confidence in his financial future—knowing that a portion of his income is secure while still allowing growth potential in his remaining investments. With a lower withdrawal rate, his assets are more likely to last, reducing the stress of market fluctuations and giving him the flexibility to enjoy his retirement.

By integrating Secure Lifetime Income, advisers can help clients like John reduce withdrawal pressure, preserve long-term financial security, and balance stability with growth—a key component in modern retirement planning.

Notes:

Scenario numbers are illustrative only, and correct as at 6 February 2025 to show how a guaranteed income producing asset can be included alongside equities and bond assets in a drawdown personal pension portfolio.

Projections shown are hypothetical and are based on assumptions, not indicative of future performance and should not be the sole basis for investment decisions. Investment returns can fluctuate.

Example based on a 65-year old, male, in good health, non-smoker, with a £500,000 total portfolio value. In two years, when John is 67, he’ll receive State Pension of £11,500*. His desired income is £25,000 per annum, escalating by 2%. Traditional drawdown personal pension portfolio scenario is based on 40% equities / 60% fixed income asset allocation. Secure Lifetime Income allocation, £100,000 generating £6,780 per annum and the remaining portfolio allocation consists of 60% equities / 40% fixed income. Total blended portfolio allocation is based on 20% Secure Lifetime Income / 48% equities/ 32% fixed income, total fees of 1.75%. The blended portfolio is risk optimised, taking advantage of the lower volatility of the Secure Lifetime Income allocation.

Figures are generated using our internal modeller, with capital market assumptions provided by Milliman.

* The State Pension figures used are for the 2024/2025 tax year, escalating at 2% per annum.