GEOFF's blend

This scenario is for illustration purposes only.

For financial intermediary use only.

Geoff's blend 2025

This scenario is for illustration purposes only.

For financial intermediary use only.

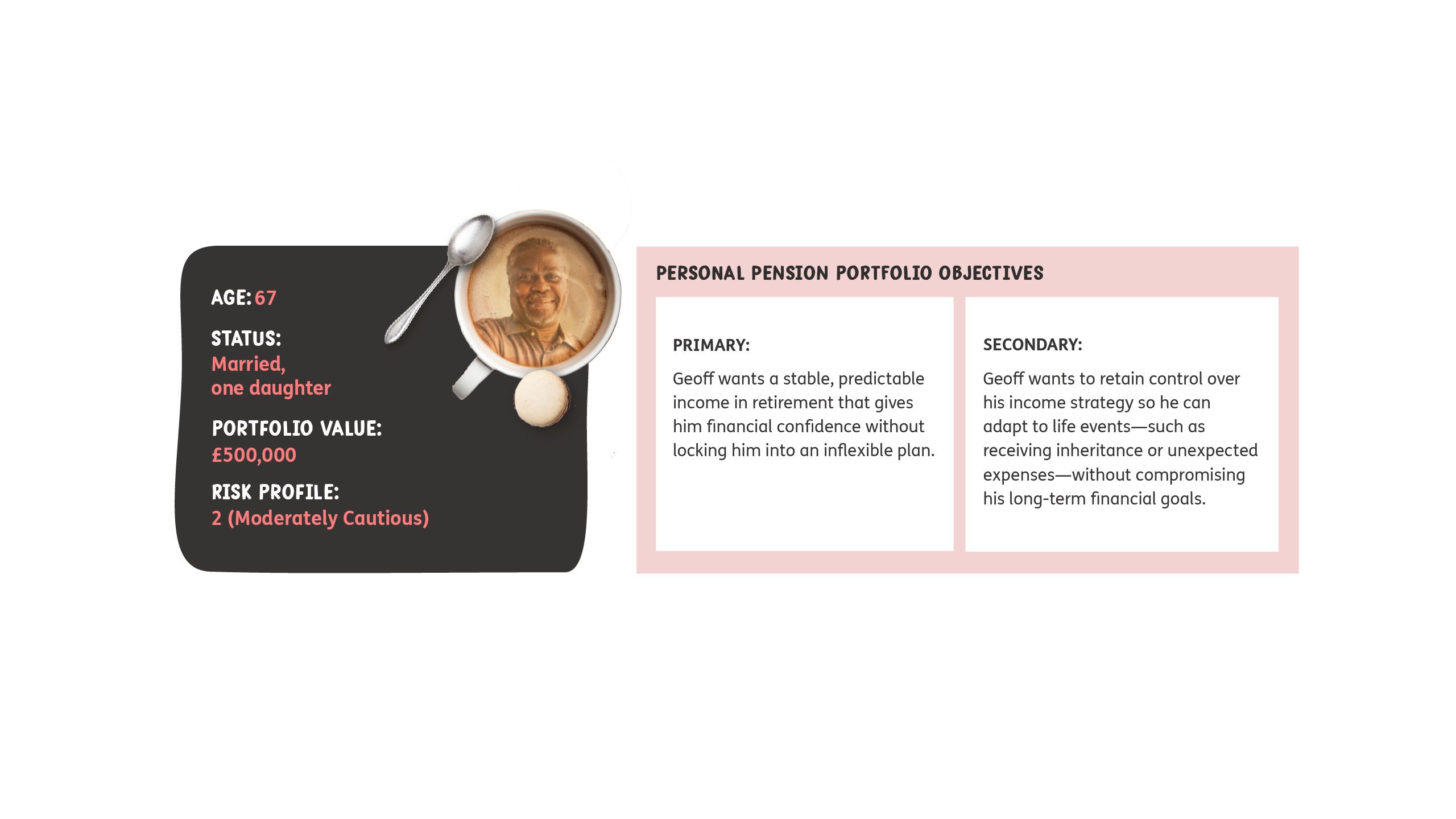

Geoff, 67, recently retired from a long career in operations. He built his life on structure—steady income, disciplined saving, and predictable routines. Now in retirement, he wants that same sense of stability from his finances.

He likes the idea of a regular, guaranteed income. It feels familiar. But Geoff isn’t ready to give up control. He knows life won’t stand still—he may want to help his daughter with a house deposit, cover medical bills, or reduce withdrawals if his wife receives an inheritance. He doesn’t want to be locked into something inflexible.

What Geoff needs is a way to recreate the reliability of a monthly salary, while keeping the ability to adapt when life changes. To help bridge that gap between security and flexibility, he turns to his adviser.

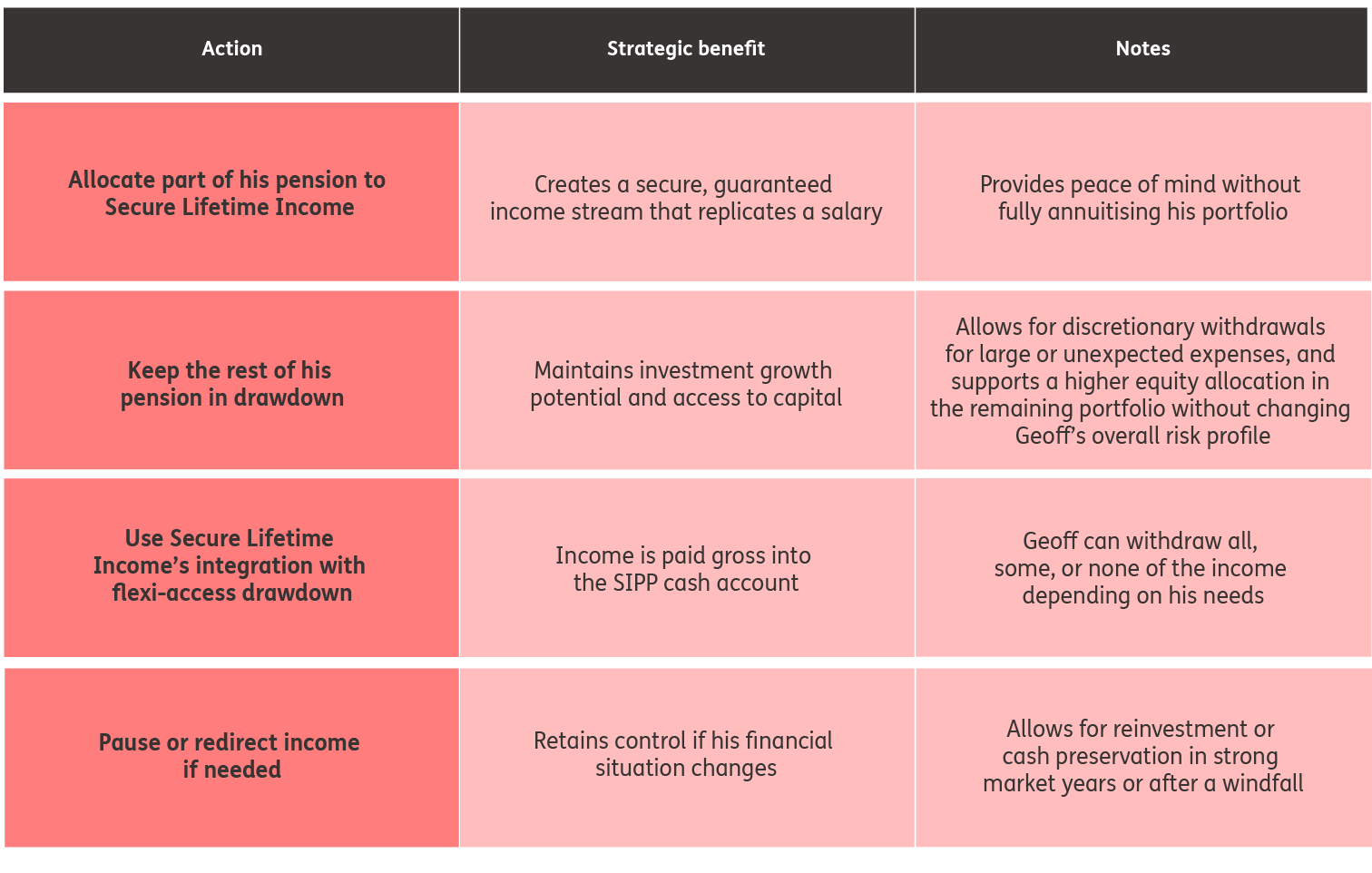

Geoff’s Financial Planning Strategy

With the help of his adviser, Geoff explores a solution that balances his desire for income certainty with flexibility. The strategy includes:

This approach gives Geoff a retirement income structure that feels familiar and safe—without giving up flexibility.

Not sure which blend is right for your client?

Speak to the Just team today.

How secure lifetime income helps

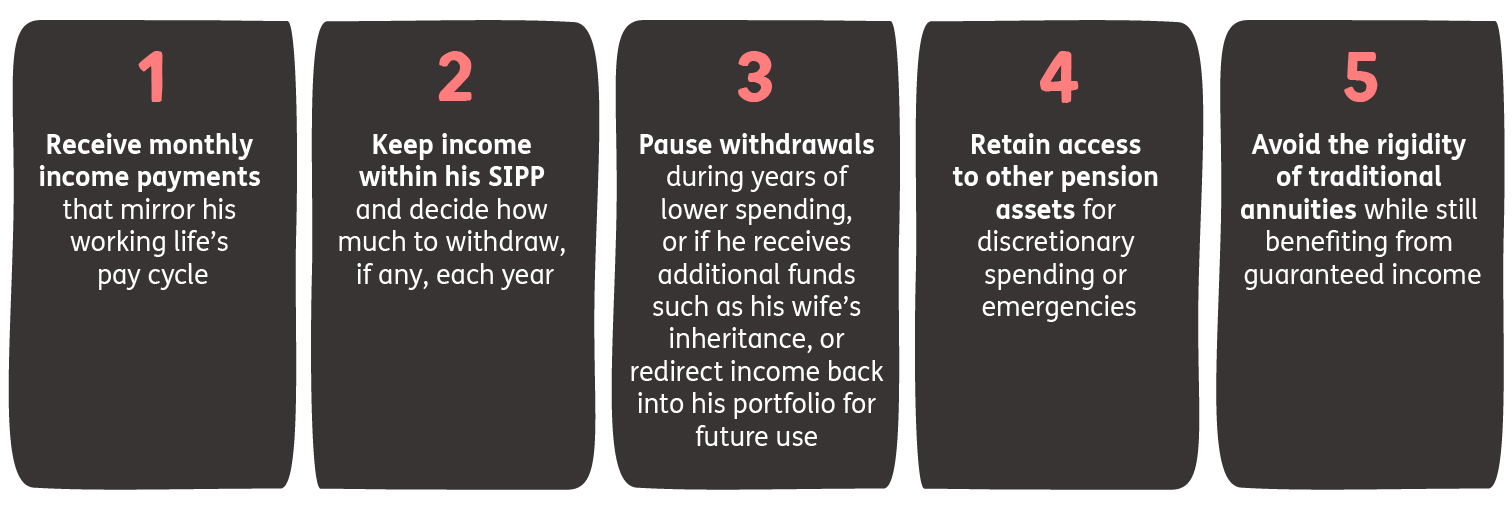

Secure Lifetime Income gives Geoff the emotional comfort of a regular income with the practical control of a drawdown product. By allocating a portion of his pension to Secure Lifetime Income within his SIPP, Geoff can:

Secure Lifetime Income fits seamlessly into Geoff’s desire for structure, without locking him into a one-size-fits-all income model.

Adviser talking points

- “Geoff, what if you could have a regular monthly income acts like a salary—but still keep control of how and when you spend it?”

- “With Secure Lifetime Income, your income is paid into your pension’s cash account. You decide whether to withdraw it or leave it invested.”

- “This gives you the peace of mind of guaranteed income—without the inflexibility of a traditional annuity.”

Validation

For someone like Geoff—who values financial structure but doesn’t want to sacrifice flexibility—Secure Lifetime Income provides a tailored foundation to build a retirement strategy that could adapt over time.

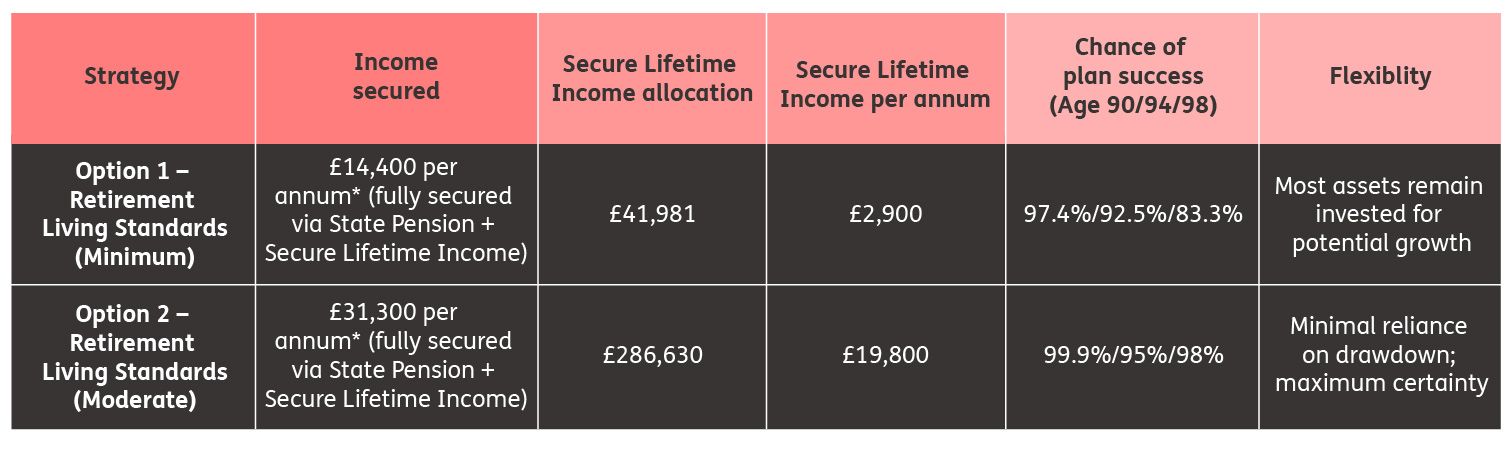

Rather than living on assumptions and market expectations alone, Geoff’s adviser helped him secure a base income that’s stable, predictable, and guaranteed for life. Drawing on the Retirement Living Standards (RLS), the adviser framed two income strategies to suit Geoff’s needs and preferences:

Two Paths to Income Security

*Retirement Living Standards (RLS) figures based on 2024 for a single person

In both scenarios, Geoff retains full control. In year two, following a family inheritance, he reinvests his Secure Lifetime Income income for five years—delaying withdrawals from his portfolio. This adaptability is only possible because Secure Lifetime Income is paid gross into his pension cash account, giving Geoff the flexibility to pause, draw, or redirect income as needed.

Option 1 – Retirement Living Standards (RLS) minimum:

Shows how a modest Secure Lifetime Income allocation secures basic needs, while maintaining portfolio flexibility.

By securing a portion of Geoff’s income through Secure Lifetime Income, the overall portfolio becomes less reliant on investment returns. This reduces downside risk, allowing the adviser to confidently shift from a Moderately Cautious to a Moderate risk profile—without exceeding Geoff’s overall tolerance. The result is increased long-term growth potential without compromising security.

Option 2 – Retirement Living Standards (RLS) moderate:

Demonstrates how securing all income with Secure Lifetime Income and State Pension dramatically reduces reliance on market returns—and creates near-zero failure risk

Secure Lifetime Income provides a stable income floor, giving the adviser more risk budget to work with. While staying within Geoff’s agreed risk tolerance, the portfolio is reallocated to a Moderately Adventurous position—enhancing growth potential while maintaining a strong foundation of guaranteed income.

These scenarios demonstrate that Secure Lifetime Income isn’t just about guarantees—it’s about enabling control, clarity, and long-term success in a retirement plan built to flex with life.

The result? A flexible, future-ready retirement plan that mirrors Geoff’s working life—and evolves with it.

Option 1 – Retirement Living Standards (RLS) minimum:

Shows how a modest Secure Lifetime Income allocation secures basic needs, while maintaining portfolio flexibility.

(Click to find out more)

By securing a portion of Geoff’s income through Secure Lifetime Income, the overall portfolio becomes less reliant on investment returns. This reduces downside risk, allowing the adviser to confidently shift from a Moderately Cautious to a Moderate risk profile—without exceeding Geoff’s overall tolerance. The result is increased long-term growth potential without compromising security.

Option 2 – Retirement Living Standards (RLS) moderate:

(Click to find out more)

Demonstrates how securing all income with Secure Lifetime Income and State Pension dramatically reduces reliance on market returns—and creates near-zero failure risk

Secure Lifetime Income provides a stable income floor, giving the adviser more risk budget to work with. While staying within Geoff’s agreed risk tolerance, the portfolio is reallocated to a Moderately Adventurous position—enhancing growth potential while maintaining a strong foundation of guaranteed income.

These scenarios demonstrate that Secure Lifetime Income isn’t just about guarantees—it’s about enabling control, clarity, and long-term success in a retirement plan built to flex with life.

The result? A flexible, future-ready retirement plan that mirrors Geoff’s working life—and evolves with it.

key benefits of the new blended solution for GEOFF

Geoff’s strategy now gives him the best of both worlds—peace of mind and control. By incorporating Secure Lifetime Income, Geoff can replicate the certainty of a salary in retirement, while keeping the rest of his pot invested and flexible.

This approach means a portion of Geoff’s essential spending is now backed by guaranteed income, shielding him from market dips and giving him confidence to spend without second-guessing every decision.

Secure Lifetime Income helps reduce the pressure on his drawdown portfolio, improves the overall sustainability of his plan, and gives him freedom to adapt—whether that’s helping his daughter, responding to unexpected events, or simply enjoying life on his terms.

Notes:

Scenario numbers are illustrative only and correct as at 25 March 2025 to show how a guaranteed income producing asset can be included alongside equities and bond assets within a drawdown personal pension portfolio. The State Pension figures used are for the 2024/2025 tax year, escalating at 2% per annum.

The Retirement Living Standards (RLS) figures used are based on 2024 for a single person.

Projections shown are hypothetical and based on modelled assumptions. They are not a reliable indicator of future performance and should not form the sole basis for investment decisions. Investment returns may vary.

The example is based on a 67-year old male, in good health, non-smoker, with a total portfolio value of £500,000, The desired income is £20,000 per annum escalating by 2% annually. Two blended drawdown personal pension portfolio scenarios are shown:

Option 1 is based on a £41,981 Secure Lifetime Income purchase generating £2,900 per year. The remaining portfolio is allocated 60% to equities and 40% to fixed income.

Option 2 is based on a £286,630 Secure Lifetime Income purchase generating £19,800 per year. The remaining portfolio is allocated 80% to equities and 20% to fixed income.

Both scenarios assume a total fee of 1.75%

Figures are generated using our internal modeller, with capital market assumptions provided by Milliman.