Across the UK, many people are experiencing health and financial challenges like never before. Increased demand for NHS services coupled with the financial pressures triggered by the cost of living crisis are causing uncertainty not seen in the UK for many decades. This in turn raises concerns about our future health and financial wellbeing.

To gain a deeper knowledge of the challenges facing UK households, we surveyed 2,000 employed and 2,000 self-employed adults to understand their health and financial fears during a time of record NHS waiting times and increased living costs.

We also wanted to understand consumers’ views on insurance (income protection, health insurance, life insurance and cash plans). Are more people now turning to insurance products to better prepare themselves for the unknown? If not, what's preventing them from buying cover?

Our research highlights a range of concerns. From being able to access healthcare and fears about further cost of living increases, to being able to save for the future, these are challenging times. We also reveal what’s important to consumers when considering insurance, and the needs we must meet as an industry to make products more accessible and appealing to more people.

Across the UK, many people are experiencing health and financial challenges like never before. Increased demand for NHS services coupled with the financial pressures triggered by the cost of living crisis are causing uncertainty not seen in the UK for many decades. This in turn raises concerns about our future health and financial wellbeing.

To gain a deeper knowledge of the challenges facing UK households, we surveyed 2,000 employed and 2,000 self-employed adults to understand their health and financial fears during a time of record NHS waiting times and increased living costs.

We also wanted to understand consumers’ views on insurance (income protection, health insurance, life insurance and cash plans). Are more people now turning to insurance products to better prepare themselves for the unknown? If not, what's preventing them from buying cover?

Our research highlights a range of concerns. From being able to access healthcare and fears about further cost of living increases, to being able to save for the future, these are challenging times. We also reveal what’s important to consumers when considering insurance, and the needs we must meet as an industry to make products more accessible and appealing to more people.

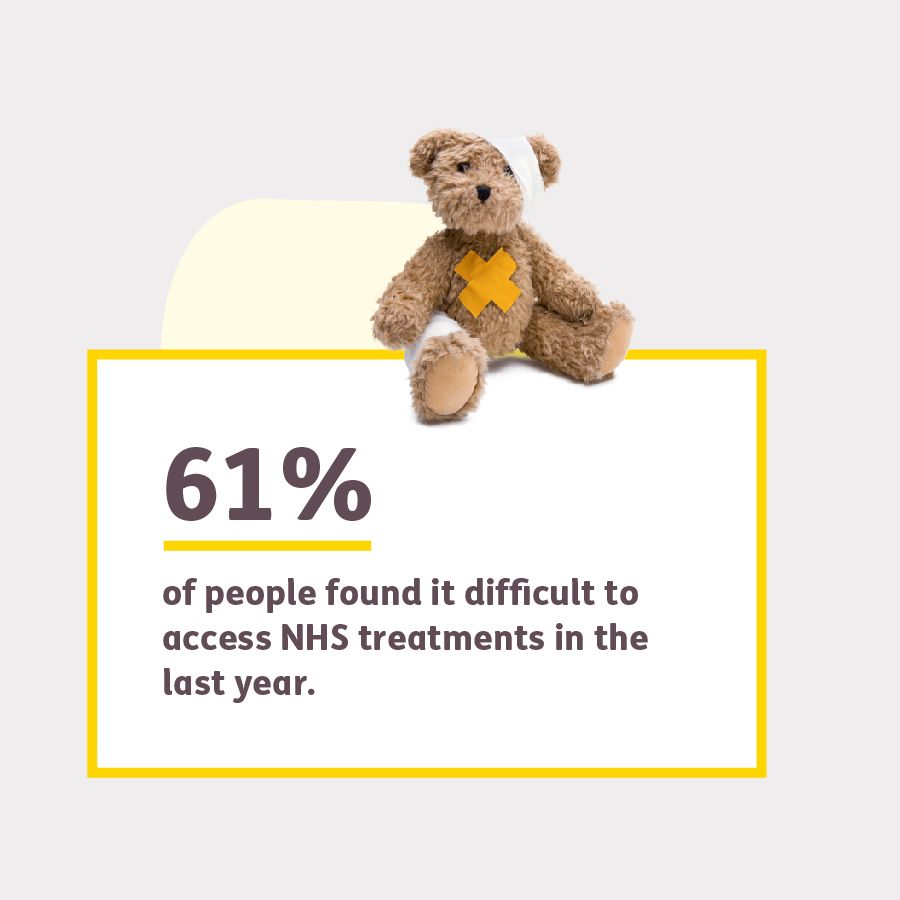

Many of the health fears facing UK working adults stem from delays in accessing timely treatment. 61% of people – the equivalent to 18 million adults in the UK said they found it difficult to access NHS treatments or encountered delays in being given a GP appointment in the last year.

Almost half (49%) are concerned about getting a same-day GP appointment or seeing a GP face-to-face. Contacting a GP by telephone is also a concern for 46% while increasing waiting times for NHS treatments and operations is a worry for 39%.

These fears highlight the pressures placed on the NHS and the demand it faces for its services. But despite concerns about accessing timely healthcare, 74% are confident about the level of care they would receive from the NHS.

Over half (52%) of working adults reported an adverse impact on their mental health because of the financial challenges we face. More women (59%) than men (46%) reported this to be a problem, with those aged 18-34 effected the most.

Many of the health fears facing UK working adults stem from delays in accessing timely treatment. 61% of people – the equivalent to 18 million adults in the UK said they found it difficult to access NHS treatments or encountered delays in being given a GP appointment in the last year.

Almost half (49%) are concerned about getting a same-day GP appointment or seeing a GP face-to-face. Contacting a GP by telephone is also a concern for 46% while increasing waiting times for NHS treatments and operations is a worry for 39%.

These fears highlight the pressures placed on the NHS and the demand it faces for its services. But despite concerns about accessing timely healthcare, 74% are confident about the level of care they would receive from the NHS.

Over half (52%) of working adults reported an adverse impact on their mental health because of the financial challenges we face. More women (59%) than men (46%) reported this to be a problem, with those aged 18-34 effected the most.

Seeking an alternative?

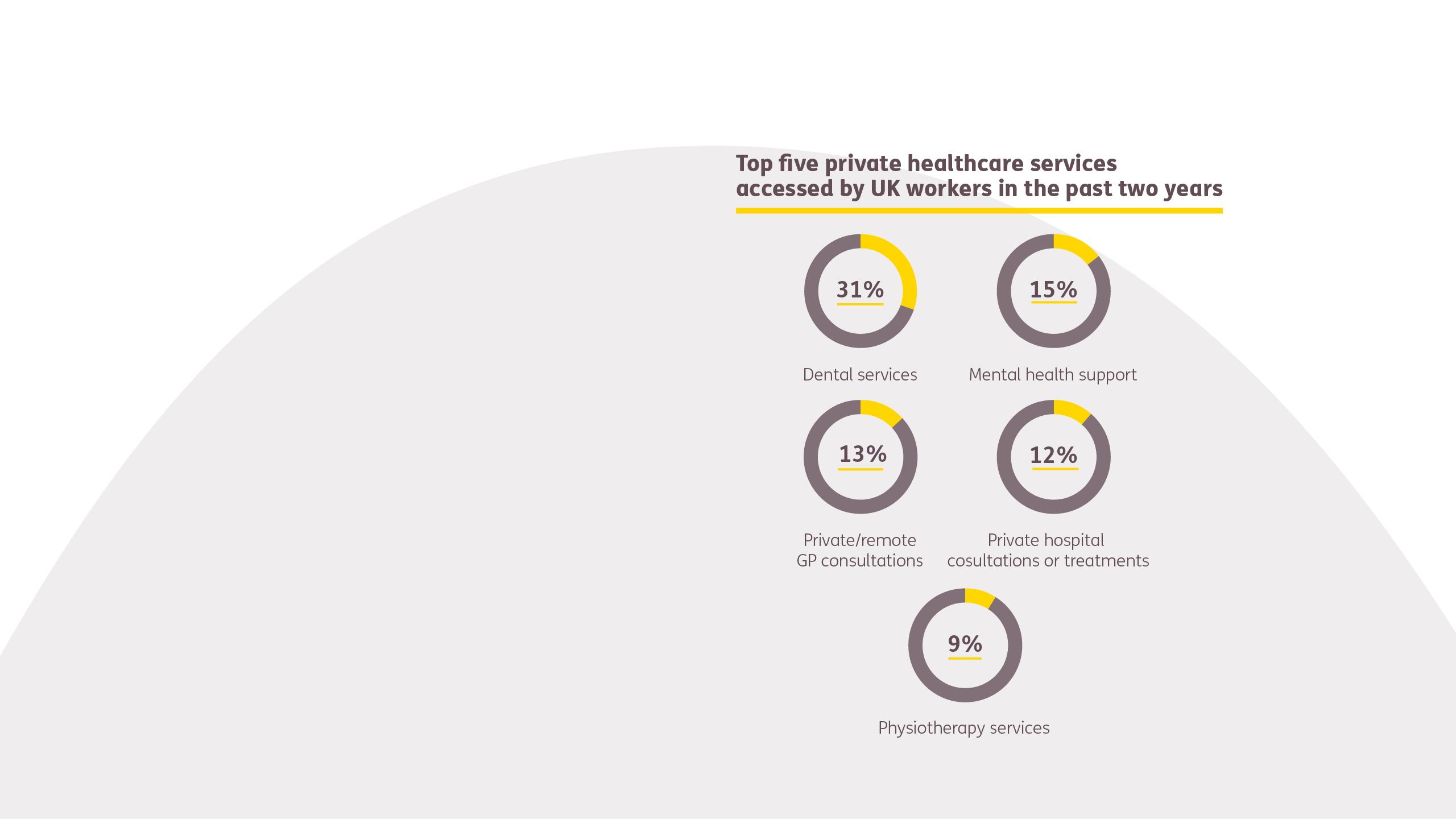

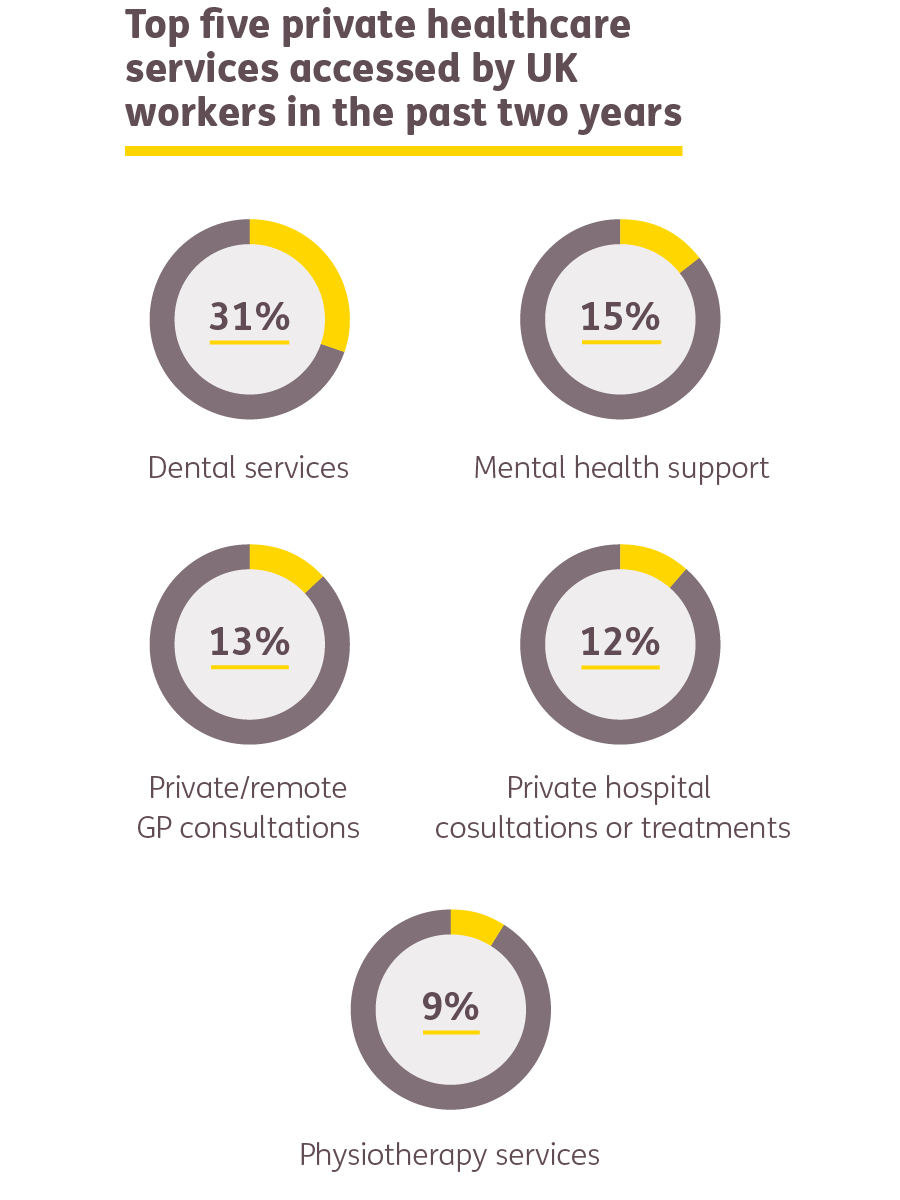

Although NHS delays cause significant disruption, few adults are using private alternatives other than private dental care.

Just 13% have used private GP services. This is despite many patients facing difficulties when making an NHS appointment and where private services can offer same-day appointments.

Whilst the use of private services remains low, the range of support accessed highlights an opportunity for affordable private healthcare to support the NHS in meeting the population’s health needs.

There are many areas where private healthcare can provide access to timely support, helping individuals to proactively manage conditions. These include mental health or musculoskeletal conditions, where immediate intervention or treatment may not be available on the NHS.

Seeking an alternative?

Although NHS delays cause significant disruption, few adults are using private alternatives other than private dental care.

Just 13% have used private GP services. This is despite many patients facing difficulties when making an NHS appointment and where private services can offer same-day appointments.

Whilst the use of private services remains low, the range of support accessed highlights an opportunity for affordable private healthcare to support the NHS in meeting the population’s health needs.

There are many areas where private healthcare can provide access to timely support, helping individuals to proactively manage conditions. These include mental health or musculoskeletal conditions, where immediate intervention or treatment may not be available on the NHS.

“Ten years ago, most people could book an appointment with an NHS GP without even thinking. After the pandemic, it’s no longer that simple and the best efforts of the NHS alone may not be enough to ensure speedy service for all.

As more and more customers struggle to access normal day to day services, advisers and lenders must collaborate to raise awareness of the private healthcare products which could alleviate some of these concerns. Improving consumer education, so everyone at all stages of life can benefit, is key.”

"Ten years ago, most people could book an appointment with an NHS GP without even thinking. After the pandemic, it’s no longer that simple and the best efforts of the NHS alone may not be enough to ensure speedy service for all.

As more and more customers struggle to access normal day to day services, advisers and lenders must collaborate to raise awareness of the private healthcare products which could alleviate some of these concerns. Improving consumer education, so everyone at all stages of life can benefit, is key."

The cost of living increases sweeping across the UK have seen financial precarity among consumers reach dangerous levels.

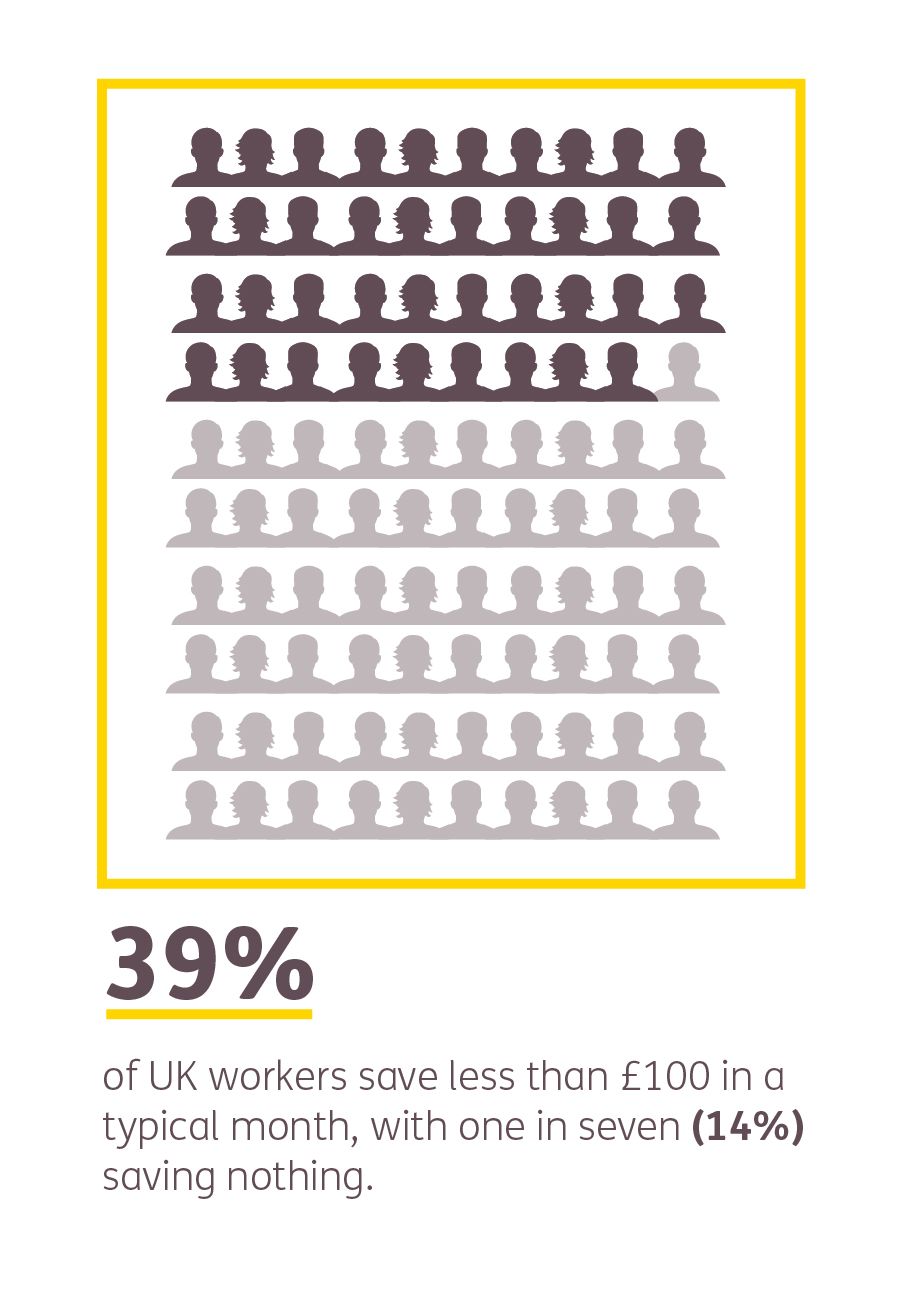

Our research showed that 39% of working adults over 18 years old in the UK save less than £100 in a typical month, with one in seven (14%) saving nothing. Almost one in five (19%) 45–64 year-olds save nothing in a typical month, raising concern over their future financial security in retirement.

Of those who do save, respondents in London are most likely to put away more than £100 a month, with only 20% saving less. But this varies by region. Almost half of those in Yorkshire (47%) and the East of England (45%) save less than £100 a month.

The ability to save is a source of sleepless nights for many, with 65% not saving as much as they would like. Being able to save could be considered a luxury, especially for those worried about covering the cost of necessities. 52% of people are concerned about being able to pay for food or utility bills and 44% are worried about keeping up with rent or mortgage repayments.

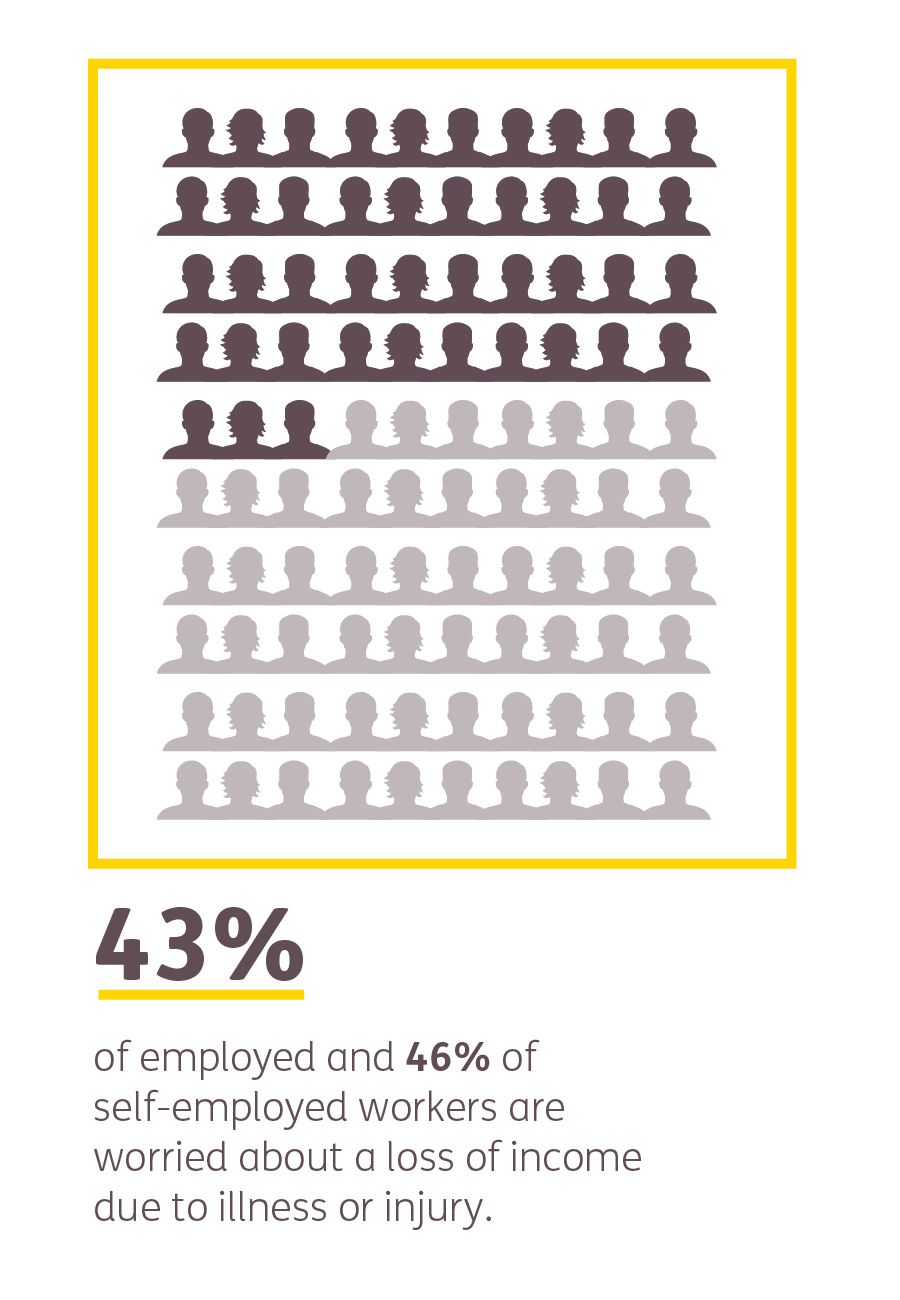

Financial concerns resulting from a loss of income caused by personal illness or injury are a worry for 43% of working-age adults. The self-employed also share this worry, more so now than before the pandemic (46% compared to 34% in 20191).

Faced with these challenges, job security remains top of mind for almost half of people at this current time, with 43% concerned about job loss or a reduction in working hours and 41% concerned about changes to welfare payments.

Of the various age groups in the UK, younger generations (18-24) are less concerned about the rising cost of living compared to the national average (67% compared to 79%). They are also not as worried as the national average about having less disposable income each month (59% compared to 69%).

However, it's concerning that almost 40% of this demographic are also less worried about not saving as much as they would like in current accounts, investments, or their pension. This could have consequences for them in the years ahead, whether it’s getting on to the property ladder or saving for retirement.

The cost of living increases sweeping across the UK have seen financial precarity among consumers reach dangerous levels.

Our research showed that 39% of working adults over 18 years old in the UK save less than £100 in a typical month, with one in seven (14%) saving nothing. Almost one in five (19%) 45–64 year-olds save nothing in a typical month, raising concern over their future financial security in retirement.

Of those who do save, respondents in London are most likely to put away more than £100 a month, with only 20% saving less. But this varies by region. Almost half of those in Yorkshire (47%) and the East of England (45%) save less than £100 a month.

The ability to save is a source of sleepless nights for many, with 65% not saving as much as they would like. Being able to save could be considered a luxury, especially for those worried about covering the cost of necessities. 52% of people are concerned about being able to pay for food or utility bills and 44% are worried about keeping up with rent or mortgage repayments.

Financial concerns resulting from a loss of income caused by personal illness or injury are a worry for 43% of working-age adults. The self-employed also share this worry, more so now than before the pandemic (46% compared to 34% in 20191).

Faced with these challenges, job security remains top of mind for almost half of people at this current time, with 43% concerned about job loss or a reduction in working hours and 41% concerned about changes to welfare payments.

Of the various age groups in the UK, younger generations (18-24) are less concerned about the rising cost of living compared to the national average (67% compared to 79%). They are also not as worried as the national average about having less disposable income each month (59% compared to 69%).

However, it's concerning that almost 40% of this demographic are also less worried about not saving as much as they would like in current accounts, investments, or their pension. This could have consequences for them in the years ahead, whether it’s getting on to the property ladder or saving for retirement.

Cutting back

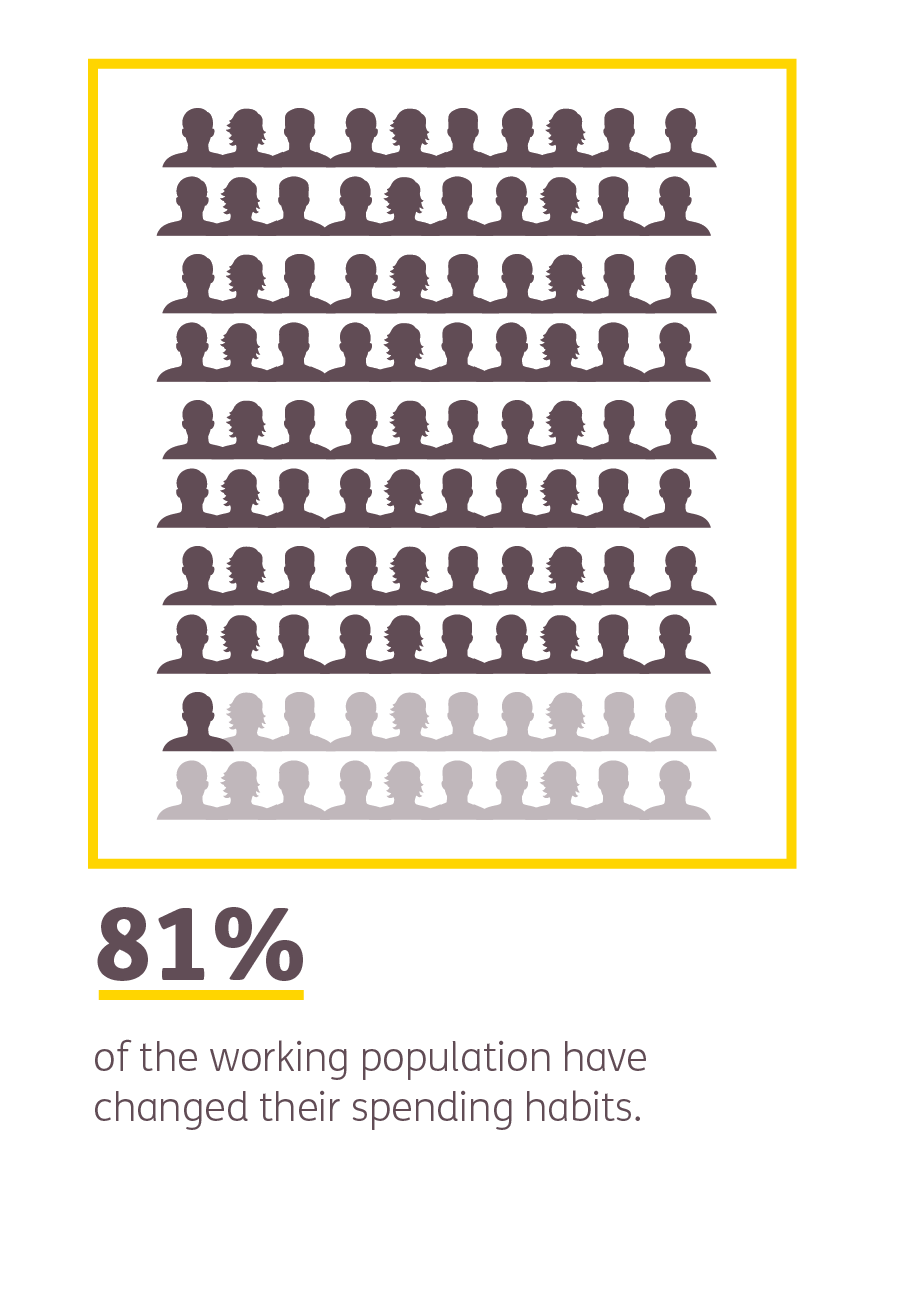

The rising cost of living is forcing many people to cut back on spending. Our research found that 81% of the working population have changed their spending habits because of increases in energy prices, inflation, and National Insurance.

Almost half (49%) said they now spend less on their weekly shopping by buying fewer or cheaper options, while 44% have reduced their utility usage, and 41% are spending less on leisure and entertainment.

But it’s not just day-to-day expenditure that is reducing. People are also cutting back in areas which may impact their future finances. Not only are people saving less than they used to, 4% have cancelled insurance products or reduced pension contributions to free up money.

When it comes to cutting back on such expenses, the self-employed are most financially exposed. Almost twice the number of self-employed people in the UK compared to those in traditional employment said they had reduced pension contributions in light of the current cost of living increases (7% compared to 4%). 6% had also cancelled insurance products (compared to 4%).

This is despite not having access to employer sick pay arrangements, pension contributions, or wider employer benefit packages to fall back on.

The fears of working adults and the cutbacks they are making are a sign of the financial challenges individuals face. Should anything prevent people from working – or if they face an unexpected health bill – not only will they not have their desired savings to fall back on, but they may also be unable to afford basic necessities. This is where insurance can help to provide invaluable support.

Cutting back

The rising cost of living is forcing many people to cut back on spending. Our research found that 81% of the working population have changed their spending habits because of increases in energy prices, inflation, and National Insurance.

Almost half (49%) said they now spend less on their weekly shopping by buying fewer or cheaper options, while 44% have reduced their utility usage, and 41% are spending less on leisure and entertainment.

But it’s not just day-to-day expenditure that is reducing. People are also cutting back in areas which may impact their future finances. Not only are people saving less than they used to, 4% have cancelled insurance products or reduced pension contributions to free up money.

When it comes to cutting back on such expenses, the self-employed are most financially exposed. Almost twice the number of self-employed people in the UK compared to those in traditional employment said they had reduced pension contributions in light of the current cost of living increases (7% compared to 4%). 6% had also cancelled insurance products (compared to 4%).

This is despite not having access to employer sick pay arrangements, pension contributions, or wider employer benefit packages to fall back on.

The fears of working adults and the cutbacks they are making are a sign of the financial challenges individuals face. Should anything prevent people from working – or if they face an unexpected health bill – not only will they not have their desired savings to fall back on, but they may also be unable to afford basic necessities. This is where insurance can help to provide invaluable support.

"This data makes clear how the cost of living crisis is hitting people in the UK. The impact of this in the protection industry is more people cancelling their policies as a result of higher living costs.

Raising awareness of the benefits of protection is so vital for advisers, brokers and providers, and we clearly have a duty of care to ensure that all demographics who could benefit from protection understand the risks they face and how they can mitigate them through insurance. The FCA Duty of Care has set this in stone, but providers and the Government also have a role to play."

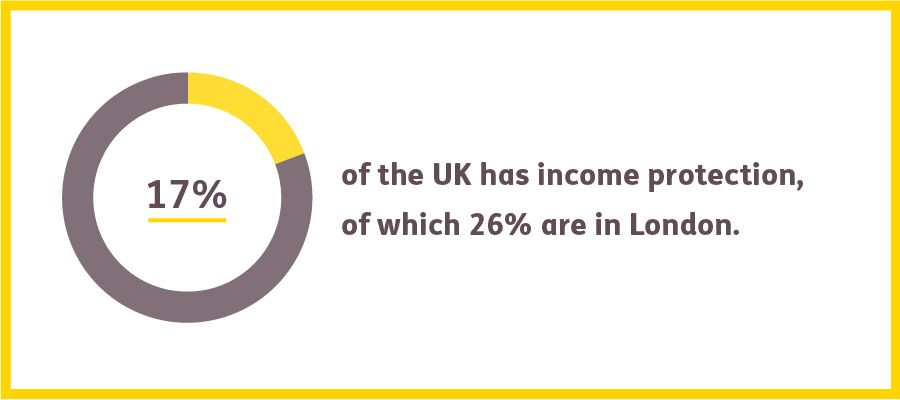

Protection and health insurance policies can provide peace of mind and a safety net that protect a person's quality of life. Yet our research found that despite their health and financial fears, working adults remain under-protected:

- 17% have an income protection policy

- 31% have life cover

- 18% have private health insurance

- 8% have a cash plan

Take up of insurance among the self-employed also remains low, with 46% not having an income protection, health insurance, life cover or cash plan product in place.

Interestingly, those aged 18-24 are most likely to have one of these forms of insurance, with just 39% reporting that they did not. Within this age range, 23% stated they have income protection cover and 25% said they had private health insurance.

This is hugely positive and highlights awareness of these insurances amongst younger workers. It may also explain why they are less concerned about saving and challenges common perceptions that they are less likely to purchase these types of insurance.

Where are clients most likely to already have insurance?

Our research found that in England, rates of income protection and private health insurance are highest in London (26% and 27%) and lowest in East England (11% for income protection) and the East Midlands (12% for health insurance).

Although only 17% have income protection insurance across the UK and 26% in London, workers in the capital (47%) are most worried about a loss of personal income due to illness or injury.

"Consumer education needs to go beyond just raising awareness of the advantages of protection for those that don’t have it, even those who pay for a health insurance policy often aren’t fully aware of the benefits they can access. If they don’t know how to make full use of their policy, such as mental health support or remote GP services, how can we ensure they see the most value?

The challenge is twofold – the industry must work harder to educate people who have never bought a private health care product, whilst also ensuring those who have realise the multiple benefits at their fingertips."

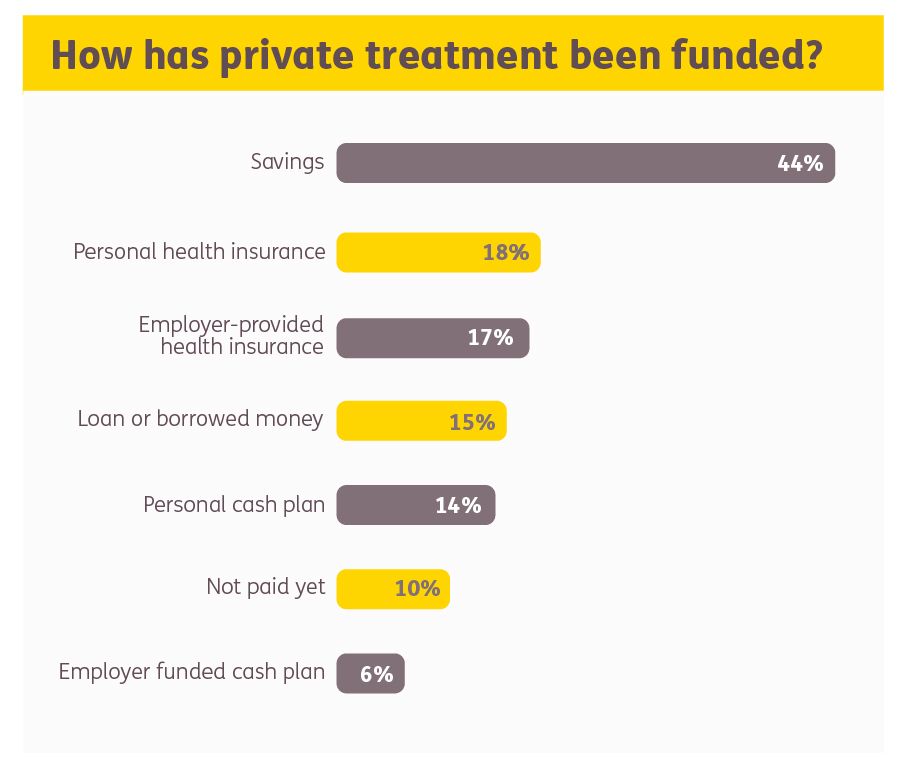

Footing the bill

Turning specifically to private healthcare, of those who used private services in the past 24 months, just 18% relied on a personal health insurance plan to cover the cost, with 17% using an employer-provided plan. 14% used a personal cash plan, and 6% used an employer-provided cash plan to help meet costs.

44% of those who accessed private services used their savings to pay for healthcare, whilst 15% took out a loan or borrowed money from family to cover the cost. Worryingly one in ten are yet to pay the bill for treatment.

These figures highlight the financial burden that paying for private healthcare can have on those without health insurance. A burden which could be worse at a time when many people are reducing their expenditure.

Barriers to purchasing an insurance product

Less than one in ten (8%) said the reason for not buying protection and health insurance was because they didn’t know what the policies were. So, if awareness of the products is high, what's stopping people from buying?

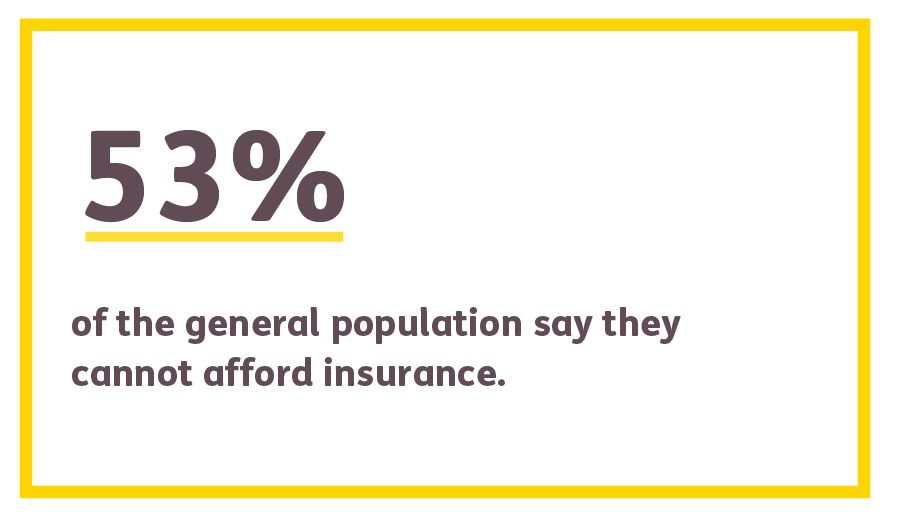

Given the impact of the last two years on the financial security of UK consumers, affordability is understandably the main reason why people do not have insurance.

Our research found that 53% of the general population say they cannot afford it. Nearly two-thirds (60%) of women stated this to be a problem, compared to 47% of men.

Interestingly, those aged 18-24 were least likely to say that affordability was the reason they did not have or were not applying for a product (42% compared to a national average of 53%). This could be a key reason behind increased take up of insurance amongst this age group.

Beyond affordability, our research has highlighted a need for wider conversations about protection and health insurance with consumers, especially given widespread awareness of the products. With 16% of people having “not got around” to applying for insurance and 9% wanting to know more but not knowing where to start, how many opportunities are we currently missing to ensure people are adequately protected?

Footing the bill

Turning specifically to private healthcare, of those who used private services in the past 24 months, just 18% relied on a personal health insurance plan to cover the cost, with 17% using an employer-provided plan. 14% used a personal cash plan, and 6% used an employer-provided cash plan to help meet costs.

44% of those who accessed private services used their savings to pay for healthcare, whilst 15% took out a loan or borrowed money from family to cover the cost. Worryingly one in ten are yet to pay the bill for treatment.

These figures highlight the financial burden that paying for private healthcare can have on those without health insurance. A burden which could be worse at a time when many people are reducing their expenditure.

Barriers to purchasing an insurance product

Less than one in ten (8%) said the reason for not buying protection and health insurance was because they didn’t know what the policies were. So, if awareness of the products is high, what's stopping people from buying?

Given the impact of the last two years on the financial security of UK consumers, affordability is understandably the main reason why people do not have insurance.

Our research found that 53% of the general population say they cannot afford it. Nearly two-thirds (60%) of women stated this to be a problem, compared to 47% of men.

Interestingly, those aged 18-24 were least likely to say that affordability was the reason they did not have or were not applying for a product (42% compared to a national average of 53%). This could be a key reason behind increased take up of insurance amongst this age group.

Beyond affordability, our research has highlighted a need for wider conversations about protection and health insurance with consumers, especially given widespread awareness of the products. With 16% of people having “not got around” to applying for insurance and 9% wanting to know more but not knowing where to start, how many opportunities are we currently missing to ensure people are adequately protected?

"Helping more people overcome these barriers to accessing protection will need a three-pronged approach.

Consumer education around the benefits, and highlighting the positive claim statistics the industry has, is essential in doing away with some of the misconceptions of protection providers. So too is a wider effort from advisers of all stripes to think about protection less as a product and more as a way to help people reach their financial goals and protect their overall lifestyle.

Lastly, providers must continue to create flexible products with features like payment holidays to accommodate a policyholder’s needs."

When it comes to making insurance more desirable, there is work to be done. Not only do we need to consider how we overcome the health and financial challenges highlighted in this research, but we also need to consider what consumers want from insurance providers when buying a product.

Price continues to be the main barrier; however, our research has found that this isn’t the only consideration.

Is there a need to consider how we position protection and health insurance products to focus on quality over cost? The quality of products available has arguably never been higher, with many having more features and greater flexibility to meet the needs of consumers.

But this is meaningless if people are not open to discussing products because of perceptions around price. We must consider what more we can do to challenge the consumer mindset to make the products a "must have".

Being easily accessible to support customers and building meaningful relationships, rather than simply offering a transactional service, can help build trust and customer loyalty.

The importance of a human touch should not be overlooked but technology is also key, with 96% in our research wanting the ability to access their records and update details online. 94% of 18–24 year-olds also expect frequent contact – higher than any other age group.

Consumers will expect more than annual updates from their insurance provider in the future when keeping them informed about their cover.

When it comes to protection and health insurance, ensuring consumers can seek advice to make the right choices is hugely important. Whilst nine in ten (91%) said buying directly from insurers was important, the complexity of health and protection insurance lends itself to the expertise offered through financial advice. The valuable role played by financial advisers is something we must continue to highlight despite a desire from consumers to buy direct.

Just over three in four (76%) said that they were confident an insurance company would pay a claim. Whilst this is positive, just 21% are “very confident”, indicating a need to do more to remove the uncertainty that still exists for consumers. If they don’t believe a policy will pay out, why would they consider buying it?

Creating diverse and inclusive working cultures has long been an important focus for many businesses.

It’s also becoming an important consideration for consumers when choosing an insurance company, with a third (33%) of those aged 18-24 considering this very important.

With diversity and inclusion set to become a greater focus in the years ahead, we need to consider whether our propositions in their current form are ready to meet rapidly changing consumer needs.

Despite high awareness of protection and health insurance products among working people in the UK, they remain hugely undersold.

During times of economic challenge, it’s understandable that affordability would remain a barrier preventing people from buying insurance products. However, cost has been a challenge for our industry for many years, even in times of economic growth. Therefore, it's important to remember that affordability isn’t the only consideration for consumers.

When it comes to insurance, people have high expectations, and rightly so. Consumer Duty will provide a continued focus on how we best serve those people who ultimately look to us for advice, guidance, and peace of mind.

To grow our market further, we must ask ourselves some challenging questions. Are our current products, systems and processes fit for purpose? Are we meeting the needs of consumers as best we can? What more can we do to ensure that we provide products and services that increase uptake, build trust, and exceed expectations? How many more people would be protected if we were having wider conversations about health and protection insurance?

At The Exeter, we are committed to ensuring this research helps build a stronger business for our existing members, intermediary partners, and their clients. We will do this by:

Despite high awareness of protection and health insurance products among working people in the UK, they remain hugely undersold.

During times of economic challenge, it’s understandable that affordability would remain a barrier preventing people from buying insurance products. However, cost has been a challenge for our industry for many years, even in times of economic growth. Therefore, it's important to remember that affordability isn’t the only consideration for consumers.

When it comes to insurance, people have high expectations, and rightly so. Consumer Duty will provide a continued focus on how we best serve those people who ultimately look to us for advice, guidance, and peace of mind.

To grow our market further, we must ask ourselves some challenging questions. Are our current products, systems and processes fit for purpose? Are we meeting the needs of consumers as best we can? What more can we do to ensure that we provide products and services that increase uptake, build trust, and exceed expectations? How many more people would be protected if we were having wider conversations about health and protection insurance?

At The Exeter, we are committed to ensuring this research helps build a stronger business for our existing members, intermediary partners, and their clients. We will do this by:

Ensuring the findings inform our future customer value propositions for our core markets. This will allow us to develop propositions that make products more accessible and appealing to more people whilst offering a level of service that exceeds expectations.

Highlighting areas where we can further improve communication with consumers, members, and advisers, to better promote products and services, raise awareness and build trust.

Bringing the information within this research to life for advisers over the coming months through a range of educational content to help support them in their client conversations.

We hope this research has provided a snapshot of the concerns of working people in the UK and prompts you to think about how you can continue to meet the ever-changing needs of consumers.

Collectively, we can achieve remarkable things. But we can only drive sustainable change if we are individually accountable for our actions.

We're up for the challenge. Are you?

Thank you for reading Challenging Times: The health and financial fears of UK workers.

Click here to get your CPD…

With thanks to:

Graham Gorman

Assured Futures

Charlotte Nixon

Quilter Financial Planning

Methodology

Data in this report was gathered as part of The Exeter's Challenging Times: The Health and Financial Fears of UK Workers research, which surveyed 2,000 employed adults aged over 18 and 2,000 self-employed adults aged over 18 in the UK between the 31st May and 10th June 2022. For some charts, respondents who replied ‘Don’t know', 'None of the above' or ‘Prefer not to say’ have been removed to aid clarity, however these percentages are still factored into the final figures.

Source: Ill-prepared 2020: The self-employed financial resilience report.

The legal blurb

The Exeter is a trading name of Exeter Friendly Society Limited, which is authorised by the Prudential Requlation Authority and requlated by the Financial Conduct Authority and the Prudential Requlation Authority (Register number 205309) and is incorporated under the Friendly Societies Act 1992 RegisterNo. 91F with its registered office at Lakeside House, Emperor Way, Exeter, England EX1 3FD.

A report by The Exeter produced in partnership with Rostrum agency.

250822/2535