Introduction

The entrepreneurial spirit in the UK is alive and well, despite the unprecedented challenges of the pandemic and the acute lack of certainty that has prevailed across so many facets of daily life since early 2020. As well as the human cost, the pandemic and associated government response prompted the deepest recession in history across the global economy. In the UK, close to 400,000 firms closed in 2020, according to the ONS.

Despite the crisis, though, and perhaps even because of it, more businesses are being launched than ever. 2020 saw a record 407,510 new businesses formed1. The same burst of business creativity was true in the US and elsewhere2, and 2021 saw another record year, with over 770,000 businesses formed3– an increase of 3.5% year-on-year.

The pandemic will leave its mark. A period of homeworking and a year marked by protests have brought work-life balances and broader social and environmental issues to the fore. The entrepreneurial heart is beating stronger than ever. But post-Covid-19, will it yearn for the same things?

In this latest Heart of the Deal survey, we sought to find out by talking to the entrepreneurs themselves. We surveyed 351 business owners with businesses valued between £10m and £200m. Across the consumer goods, business and financial services, manufacturing, media, technology, and healthcare sectors, we asked business owners about the impact of Covid-19 and its influence on their motivations, perspectives on business ownership, hopes, concerns and plans for the future.

As the UK starts to “build back better”, we hope that Heart of the Deal offers a valuable insight into how the extraordinary events of the last 18 months have influenced the businessmen and women laying the foundations of our future economic success and prosperity.

The entrepreneurial spirit in the UK is alive and well, despite the unprecedented challenges of the pandemic and the acute lack of certainty that has prevailed across so many facets of daily life since early 2020. As well as the human cost, the pandemic and associated government response prompted the deepest recession in history across the global economy. In the UK, close to 400,000 firms closed in 2020, according to the ONS.

Despite the crisis, though, and perhaps even because of it, more businesses are being launched than ever. 2020 saw a record 407,510 new businesses formed1. The same burst of business creativity was true in the US and elsewhere2, and 2021 saw another record year, with over 770,000 businesses formed3– an increase of 3.5% year-on-year.

The pandemic will leave its mark. A period of homeworking and a year marked by protests have brought work-life balances and broader social and environmental issues to the fore. The entrepreneurial heart is beating stronger than ever. But post-Covid-19, will it yearn for the same things?

In this latest Heart of the Deal survey, we sought to find out by talking to the entrepreneurs themselves. We surveyed 351 business owners with businesses valued between £10m and £200m in June 2021. Across the consumer goods, business and financial services, manufacturing, media, technology, and healthcare sectors, we asked business owners about the impact of Covid-19 and its influence on their motivations, perspectives on business ownership, hopes, concerns and plans for the future.

As the UK starts to “build back better”, we hope that Heart of the Deal offers a valuable insight into how the extraordinary events of the last 18 months have influenced the businessmen and women laying the foundations of our future economic success and prosperity.

Covid-19: A mixed legacy

Covid-19: A

mixed legacy

Even where businesses and entrepreneurs survived – and even thrived – during the pandemic, few business owners have come through the experience unscathed. The crisis has been a source of huge uncertainty and a multitude of concerns for entrepreneurs.

Key worries revealed by our survey included the challenges of operating remotely, mentioned by 45%, the inability to plan for the future (43%), the wellbeing of staff (41%) – and potential job losses (38%). Inevitably, supply chain disruption, cashflow concerns and lost revenue also weighed heavily, each being a top-three concern for about a third of those surveyed.

In over a third of cases, business owners are considering exiting their businesses – at least partly – as a result of Covid-19.

Over a third (34%) say, while they previously hadn’t planned to sell prior to Covid-19, the pandemic has led them to reconsider and half of those plan to sell as soon as possible. Nor is it just older owners bringing forward an exit: these survey findings were similar across ages.

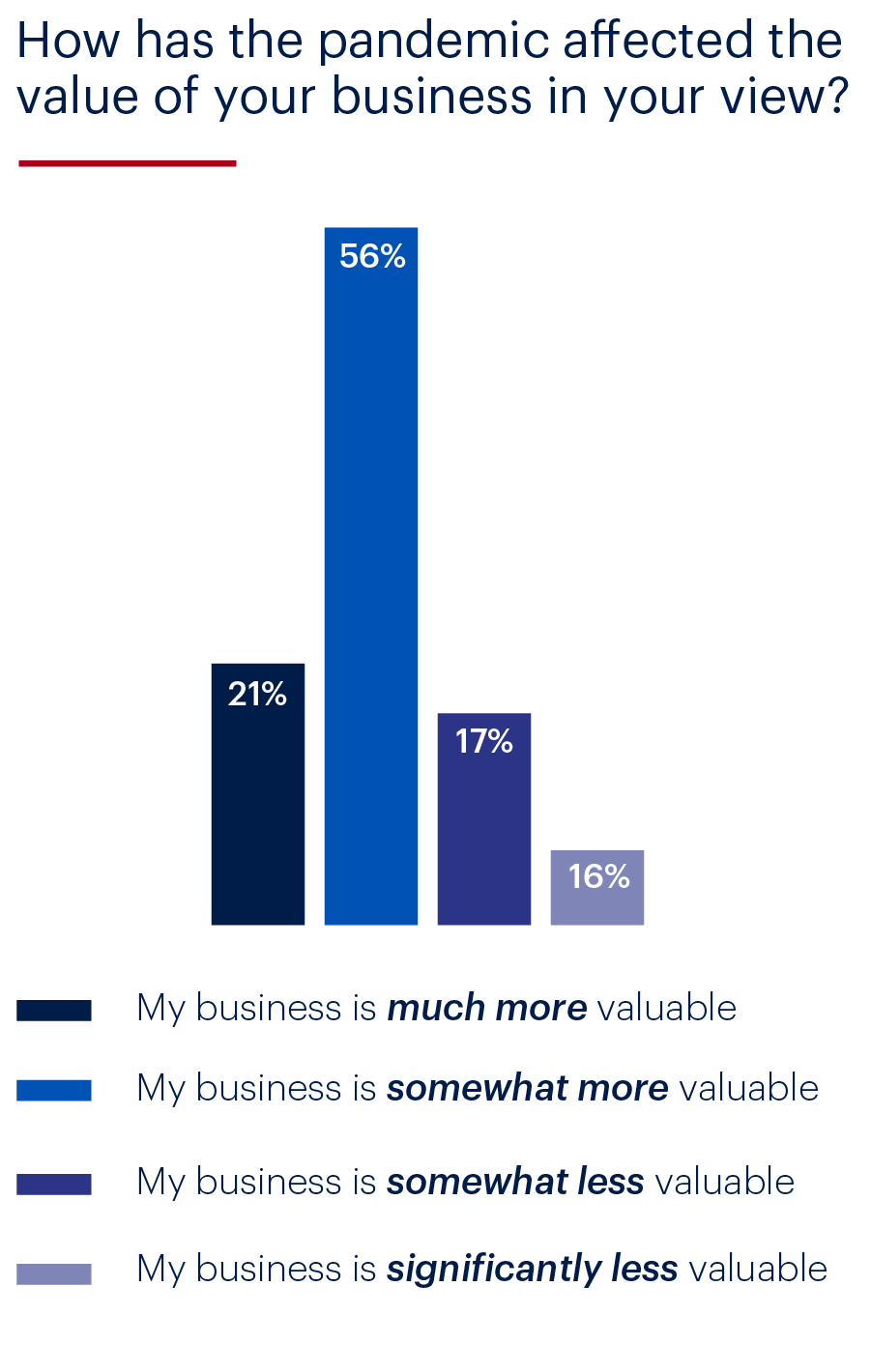

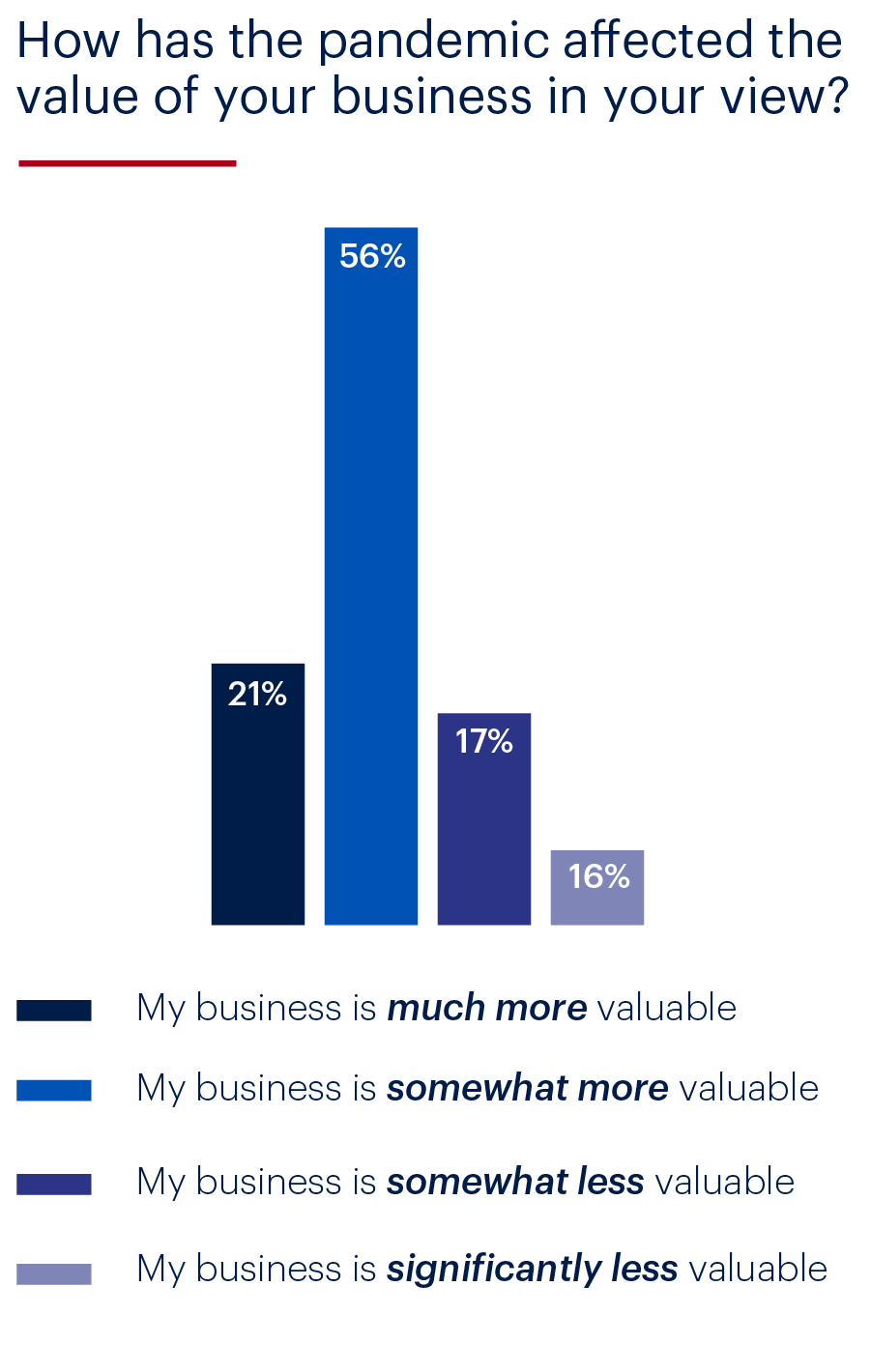

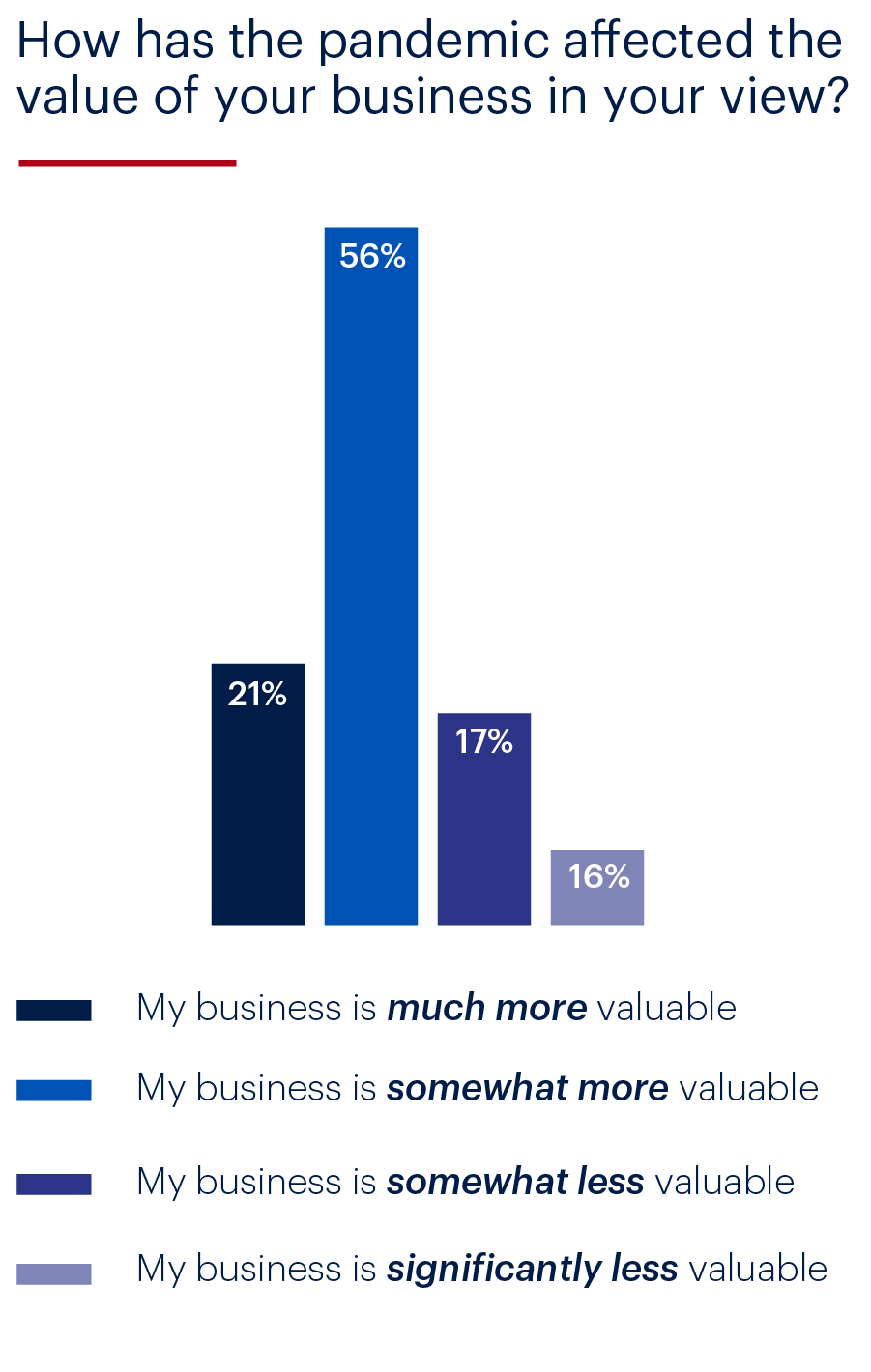

For all that, however, the most striking finding is that business owners remain remarkably bullish about the prospects for their businesses. There is a clear sense among owners that, having survived the crucible of Covid-19, their businesses are stronger than ever.

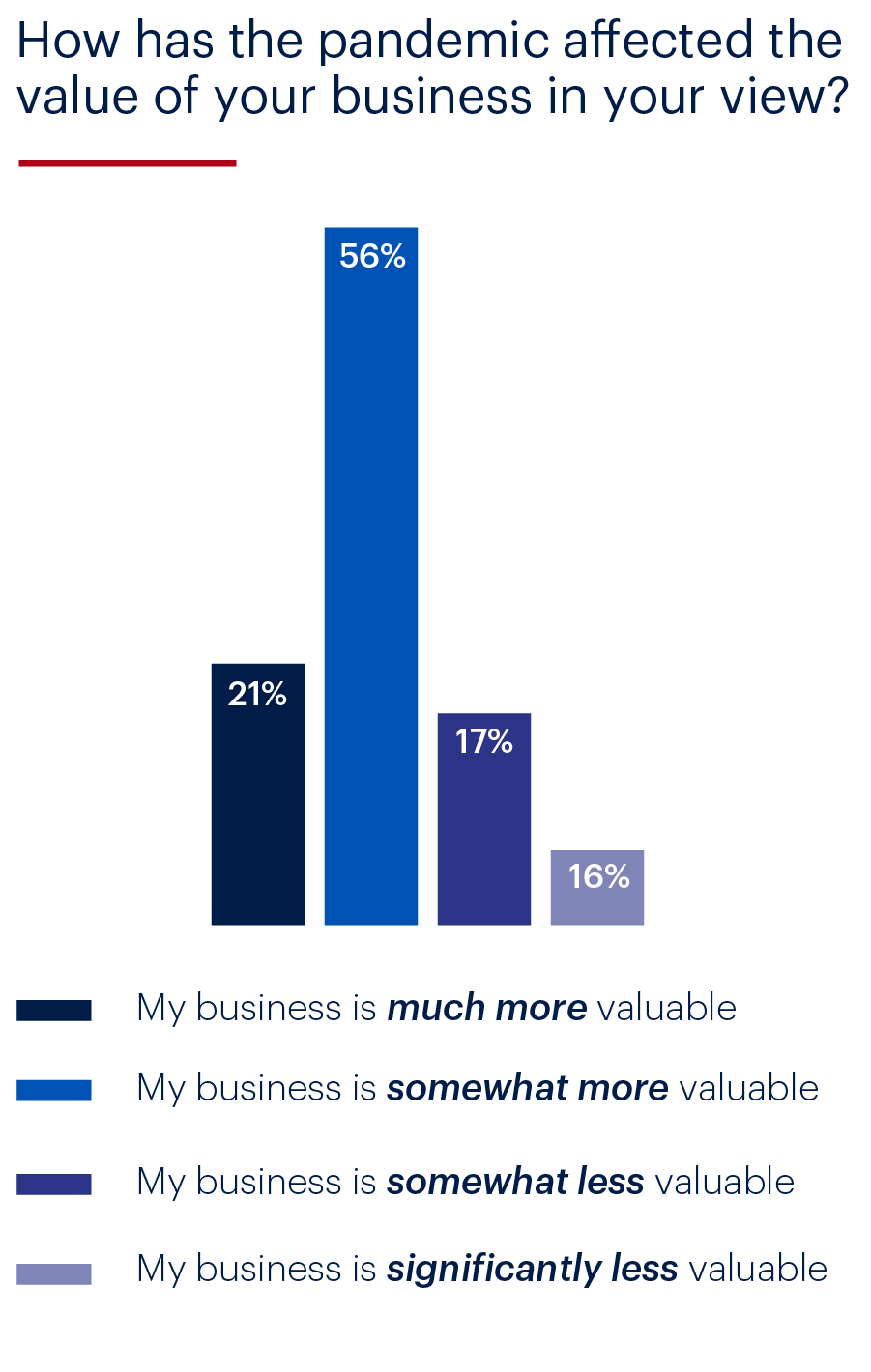

This has led more than three quarters to say they believe their businesses are more valuable than before the pandemic, with more than a fifth believing it has made them significantly more valuable.

The findings are perhaps not surprising in the healthcare sector, which led the way with a third thinking that their businesses were now much more valuable (and just over half somewhat more valuable). But all sectors saw solid majorities upbeat about their prospects when it comes to an exit. Financial services were weakest but even there, 62% say their businesses have added value over the crisis.

In over a third of cases, business owners are considering exiting their businesses – at least partly – as a result of Covid-19:

Over a third (34%) say, while they previously hadn’t planned to sell prior to Covid-19, the pandemic has led them to reconsider; and half of those plan to sell as soon as possible. Nor is it just older owners bringing forward an exit: these survey findings were similar across ages.

For all that, however, the most striking finding is that business owners remain remarkably bullish about the prospects for their businesses. There is a clear sense among owners that, having survived the crucible of Covid-19, their businesses are stronger than ever.

This has led more than three quarters to say they believe their businesses are more valuable than before the pandemic, with more than a fifth believing it has made them significantly more valuable.

The findings are perhaps not surprising in the healthcare sector, which led the way with a third thinking that their businesses were now much more valuable (and just over half somewhat more valuable). But all sectors saw solid majorities upbeat about their prospects when it comes to an exit. Financial services were weakest but, even there, 62% say their businesses haves added value over the crisis.

Hearts and heads

There is a fundamental tension many entrepreneurs and business owners wrestle with. On the one hand, the motivations for starting and building a business are not simply or even mainly financial. The most common motivator stated by respondents for starting a business is to create jobs or a legacy or give something back to the community, agreed by almost a quarter (24%), in stark contrast to just 1% of business owners who said the same in our 2018 Heart of the Deal survey.

Even if this is retrospective reasoning, it’s just one of many motivations. Perhaps surprisingly, only in a minority of cases is the key driver to create wealth (17%) or earn a living (14%). This is almost 10 percentage points lower than in 2018, where 23% of entrepreneurs started their company to earn a living.

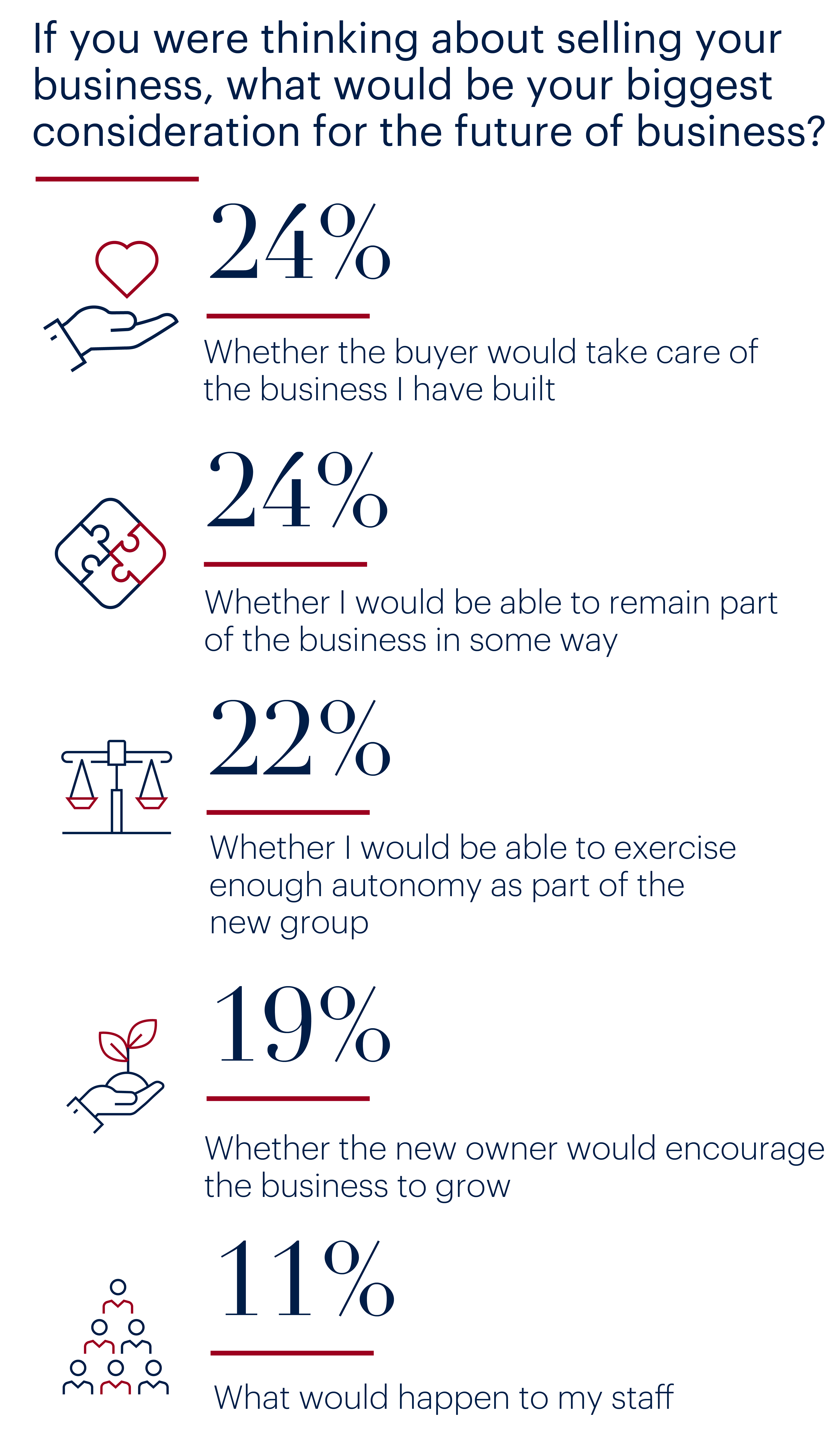

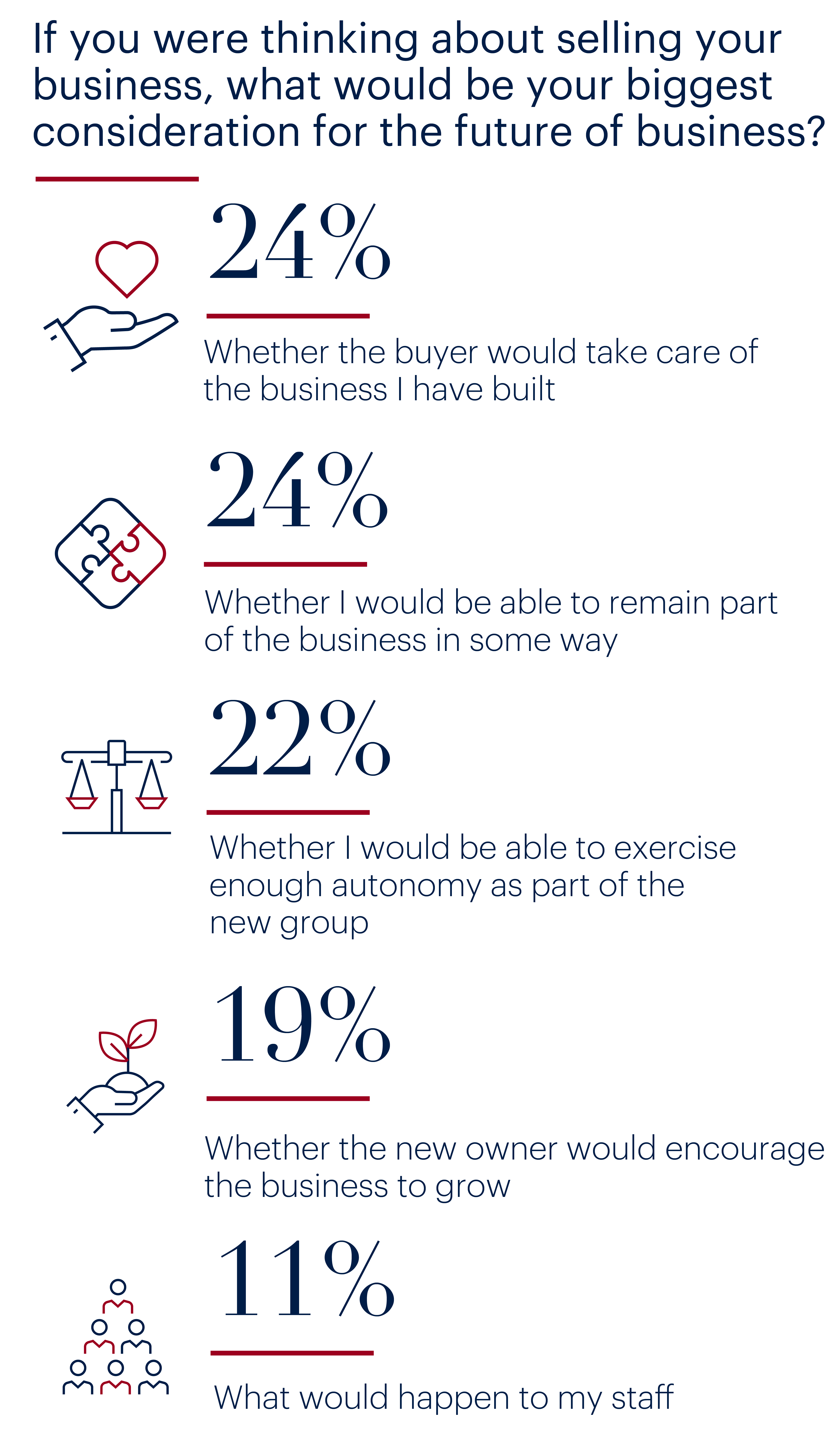

We see the same when it comes to decisions to sell a business. The most significant considerations for vendors are whether a new owner will take care of the business and if they can remain part of it (24% for each). Whether the new owners would encourage the business to grow is also a key consideration (19%).

We see the same when it comes to decisions to sell a business. The most significant considerations for vendors are whether a new owner will take care of the business and if they can remain part of it (24% for each). Whether the new owners would encourage the business to grow is also a key consideration (19%).

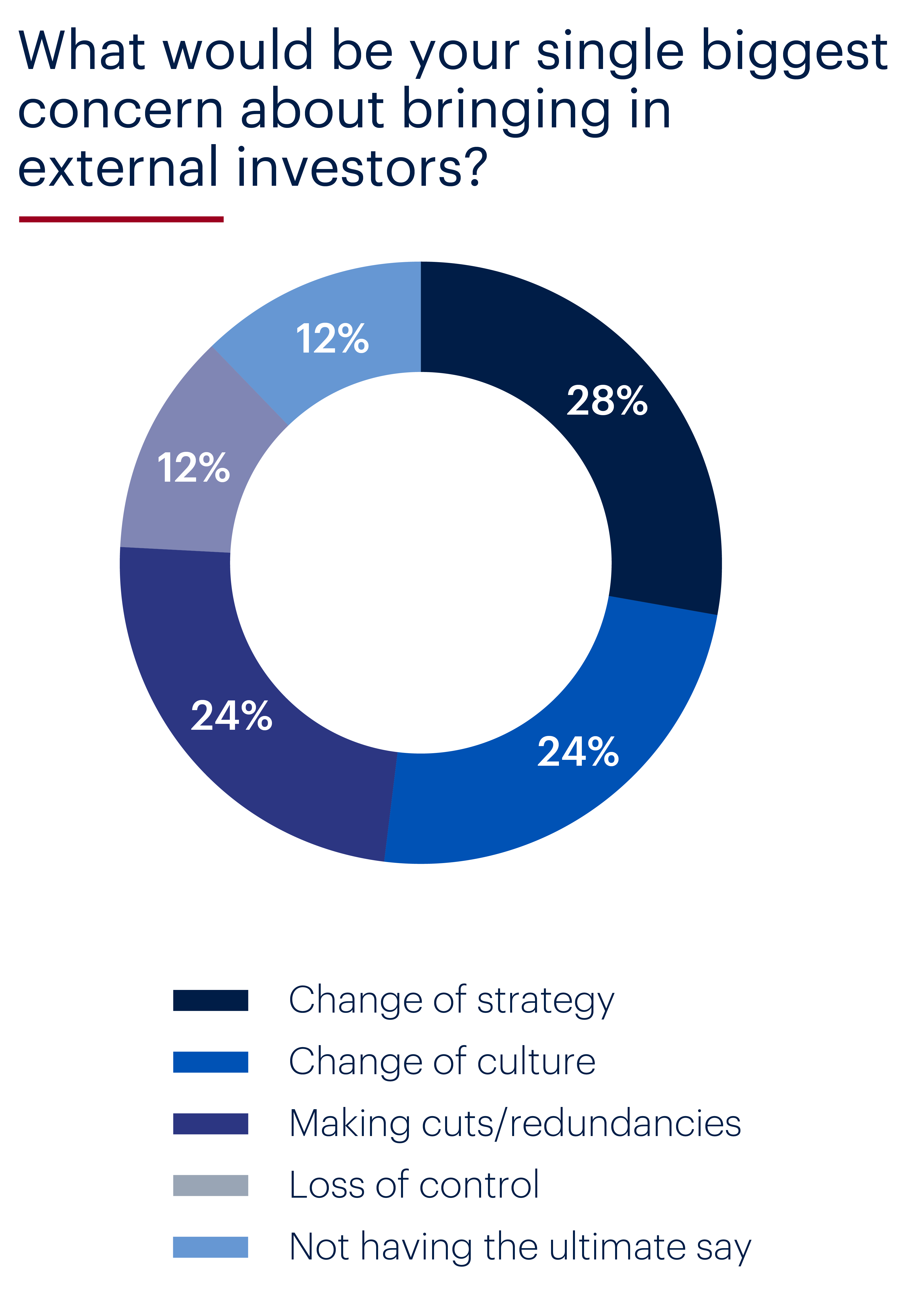

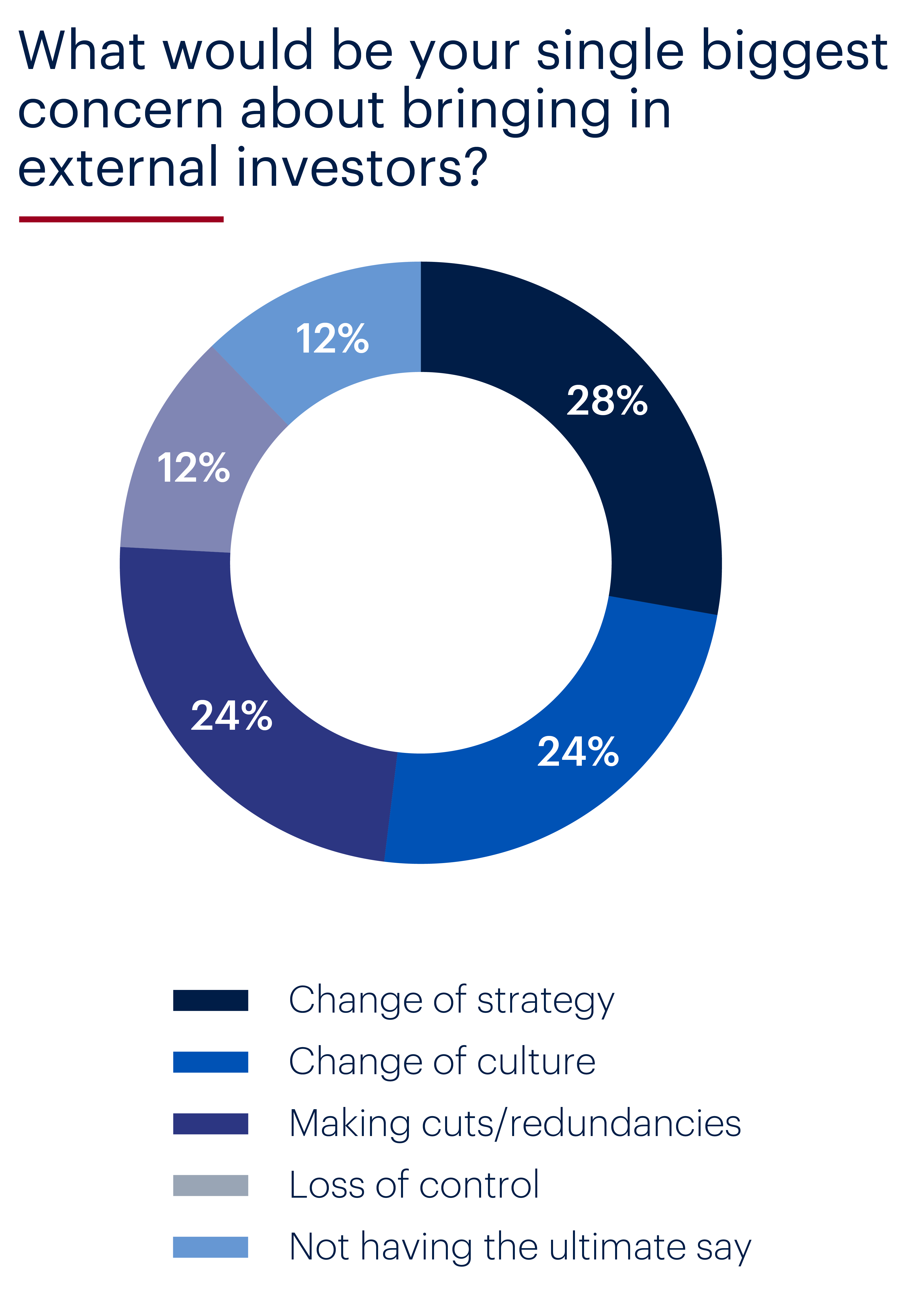

Most owners are heavily committed to the ongoing success of their businesses, beyond the direct impact on their own financial position. This is partly why it can be challenging for owners to bring in outside investors, as some of the concerns revealed by our survey show.

The primary worry is not so much a simple loss of control but the impact that this loss will have on the strategy and culture of the company that the owner has created – as well as on the jobs of their valued employees. When owners are prepared to step away from the business or bring in investors, it’s usually as much because they feel they have taken it as far as they can on their own, as a desire to cash in.

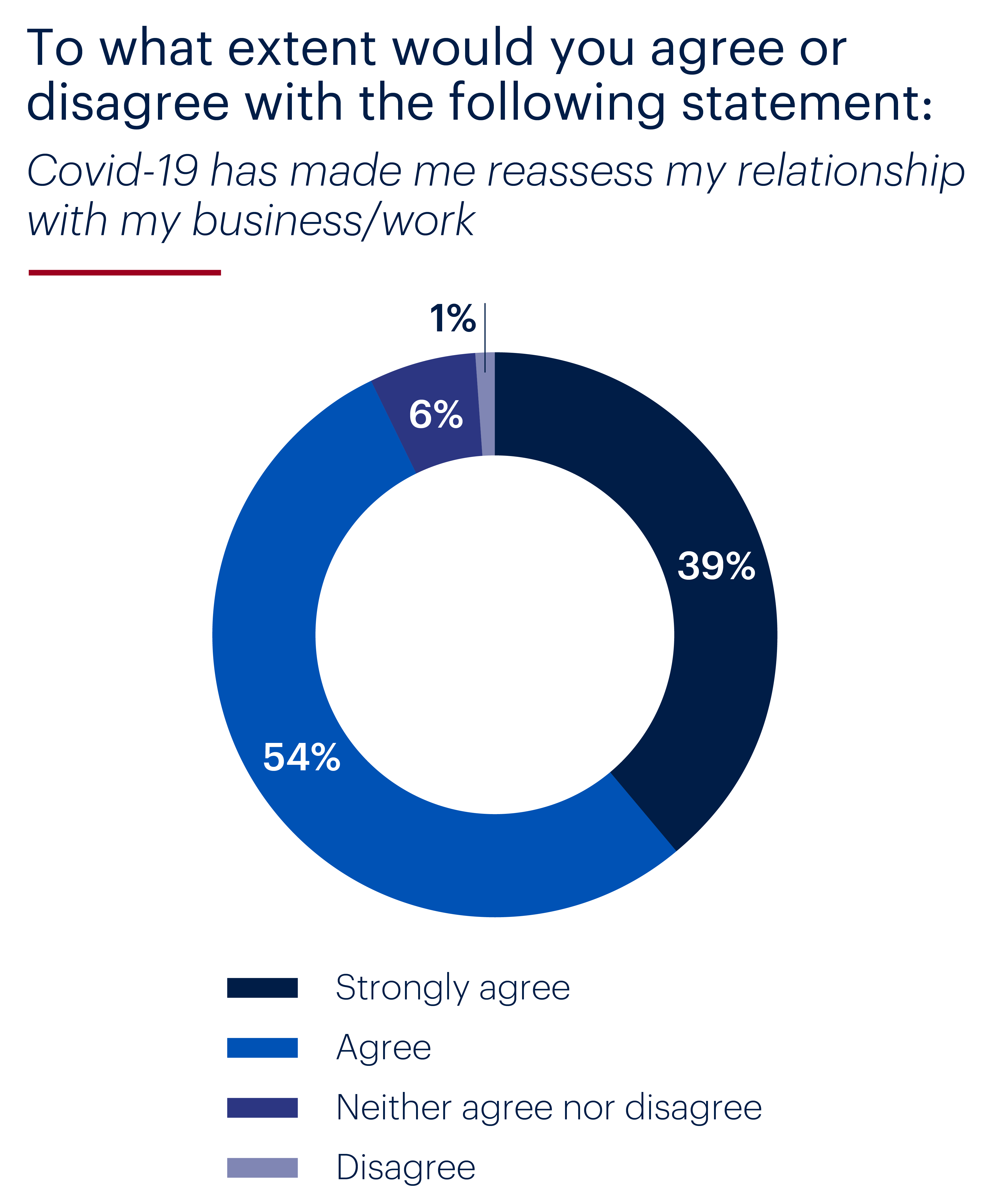

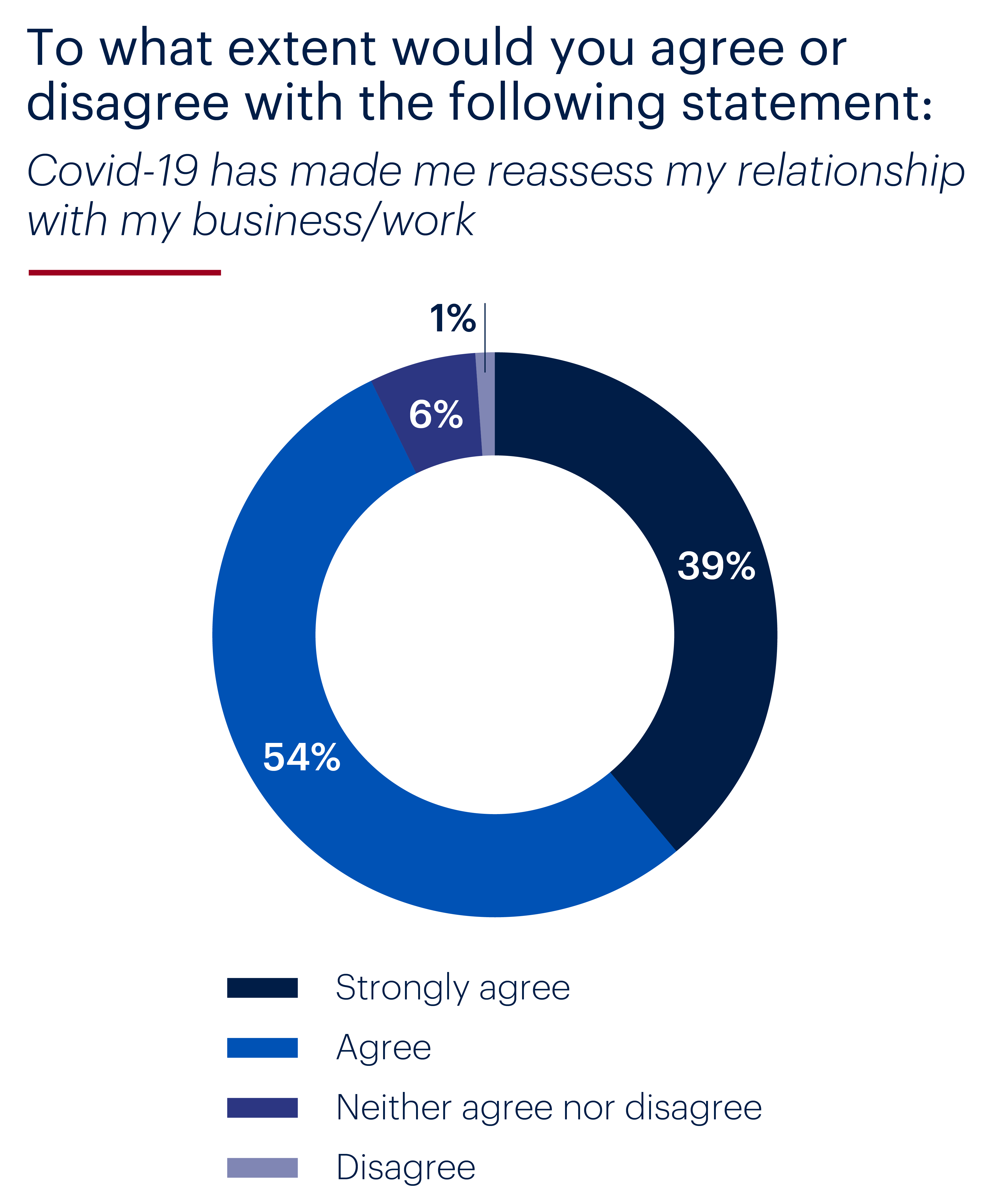

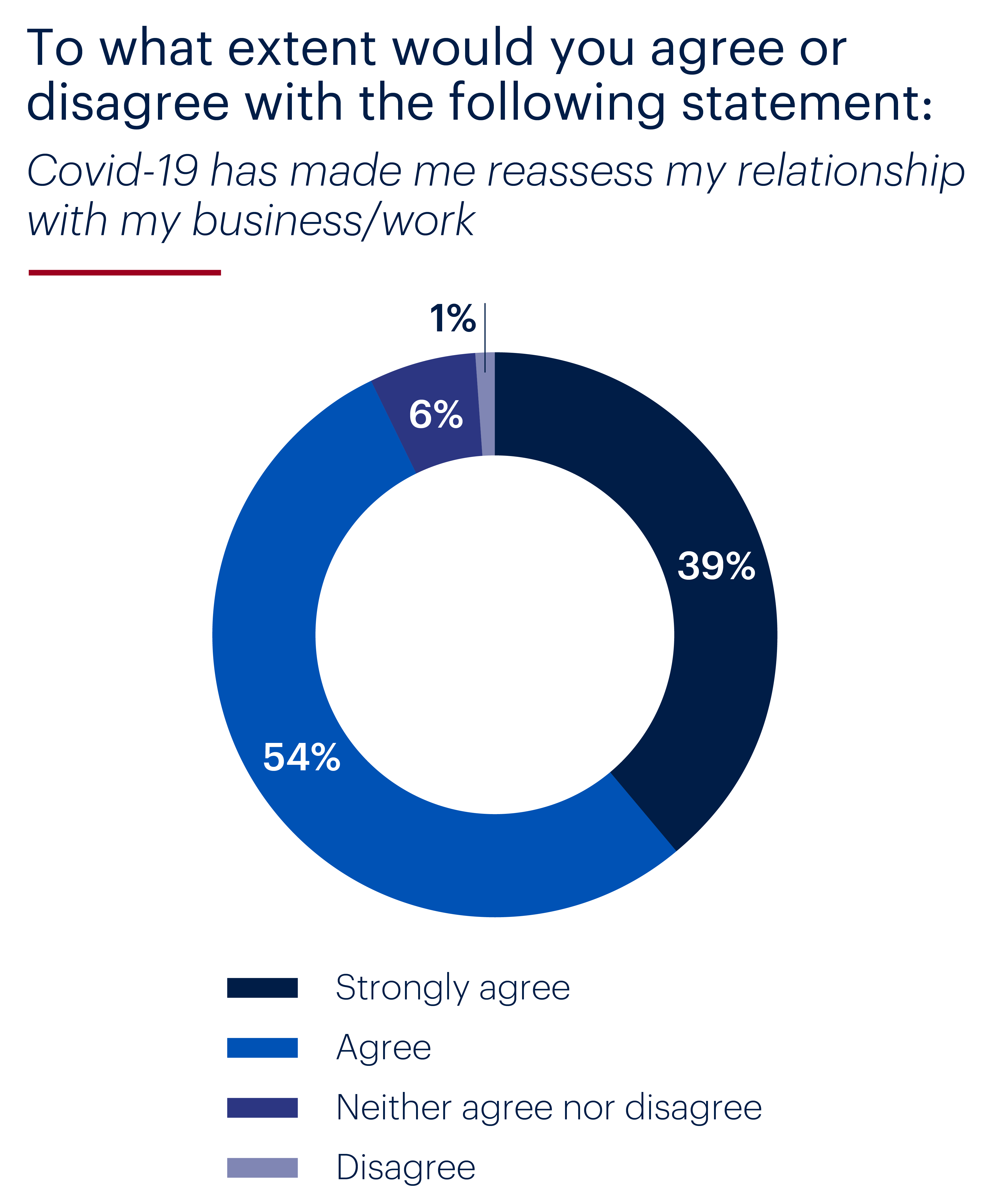

Of course, the last 18 months have had a profound effect on owners: more than nine out of ten (93%) say Covid-19 has made them reassess their relationship with their enterprises. There’s little sign from the other responses, however, that it has left them less emotionally invested in the businesses they create.

Most owners are heavily committed to the ongoing success of their businesses, beyond the direct impact on their own financial position. This is partly why it can be challenging for owners to bring in outside investors, as some of the concerns revealed by our survey show.

The primary worry is not so much a simple loss of control but the impact that this loss will have on the strategy and culture of the company that the owner has created – as well as on the jobs of their valued employees. When owners are prepared to step away from the business or bring in investors, it’s usually as much because they feel they have taken it as far as they can on their own, as a desire to cash in.

Of course, the last 18 months have had a profound effect on owners: more than nine out of ten (93%) say Covid-19 has made them reassess their relationship with their enterprises. There’s little sign from the other responses, however, that it has left them less emotionally invested in the businesses they create.

Capital gains tax uncertainty: The tail wags the dog

A more immediate concern for many UK business owners, though, has been more prosaic – higher capital gains tax.

Until March 2020, under the “entrepreneurs’ relief” regime, those selling their companies could benefit from highly favourable tax treatment: a reduced rate of 10% capital gains tax (CGT) on up to £10 million in gains over their lifetime.

The lifetime limit was reduced significantly in the 2020 Spring Budget to £1 million of gains, and the relief re-branded (perhaps tellingly) as “business asset disposal relief”. However, the favourable reduced 10% rate was left in place.

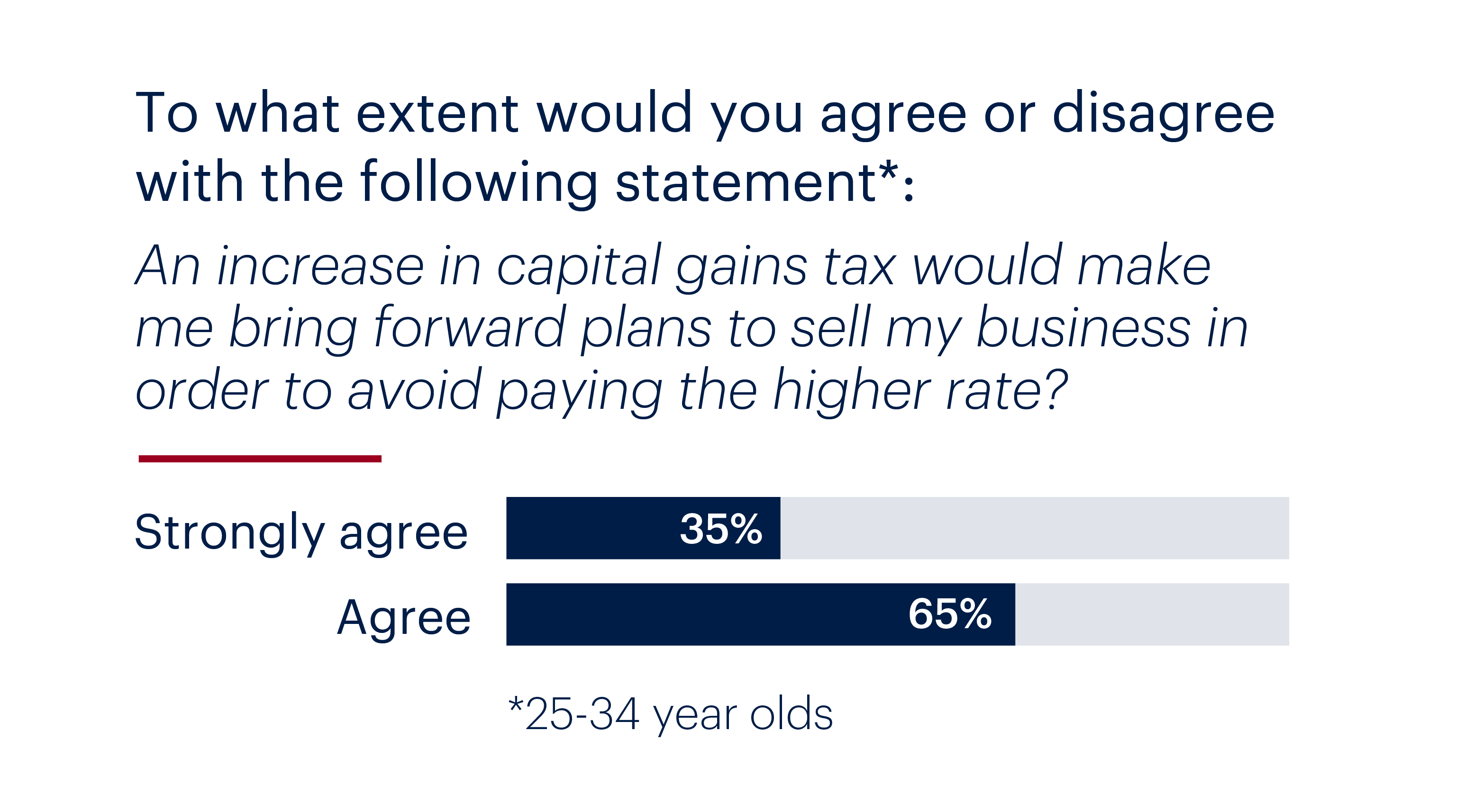

After Chancellor Rishi Sunak wrote to the Office of Tax Simplification in July 2020 asking for a review of the CGT system, much of the period since has been spent anticipating a further revision. A widespread concern has persisted that it may even be eliminated with rates normalised with income tax – up to 45% for higher rate taxpayers, which would include many business owners.

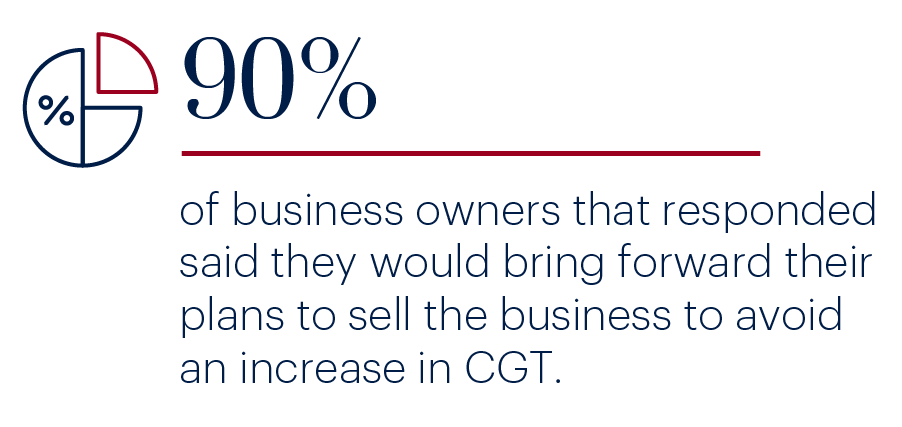

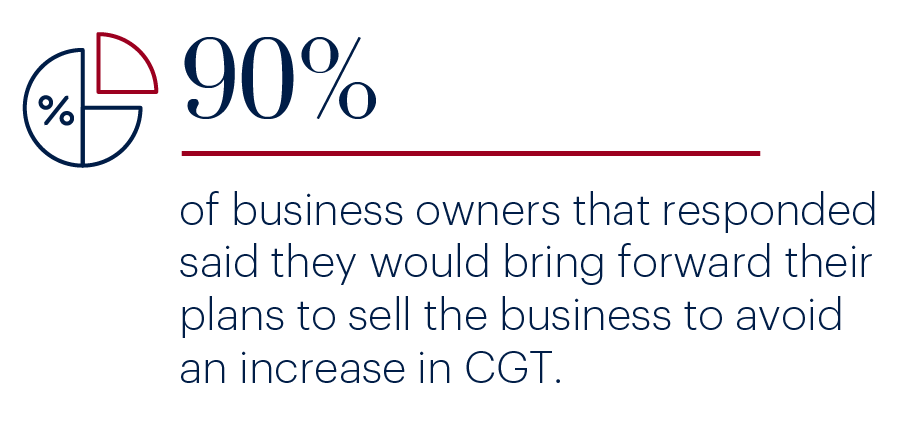

Even without any changes, that uncertainty has fuelled transaction activity. First, the run-up to the 2020 Autumn Statement and then the approach to the Spring Budget in March 2021 and most recently the Autumn Budget in October 2021, resulting in notable surges of business owners exploring a sale in expectation of a change.

Although the Government announced at the end of 2021 that its review of CGT had been completed and no changes recommended, it remains to be seen if this eliminates business owners’ anxiety. If any uncertainty prevails, it is likely to remain a recurring factor.

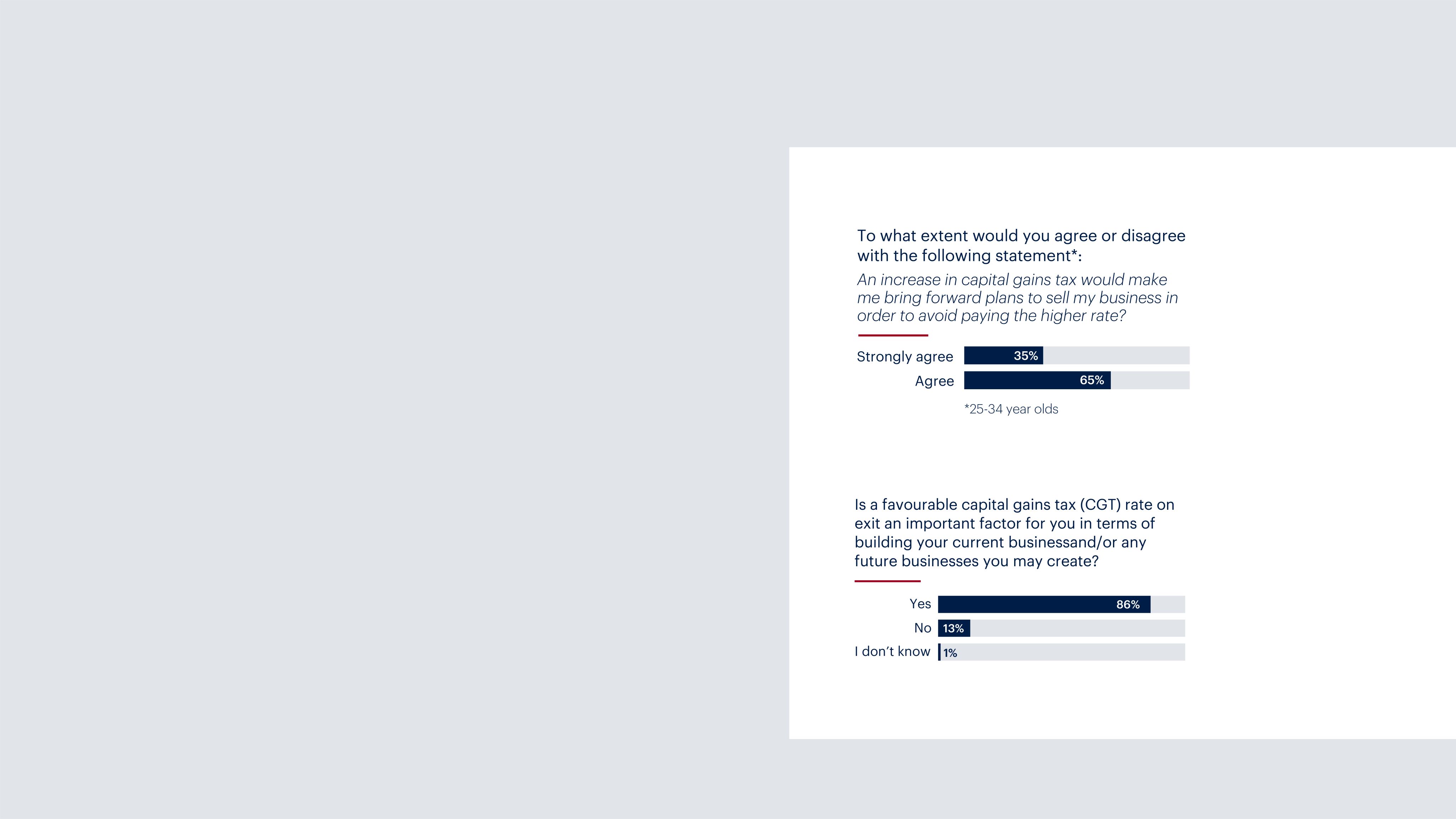

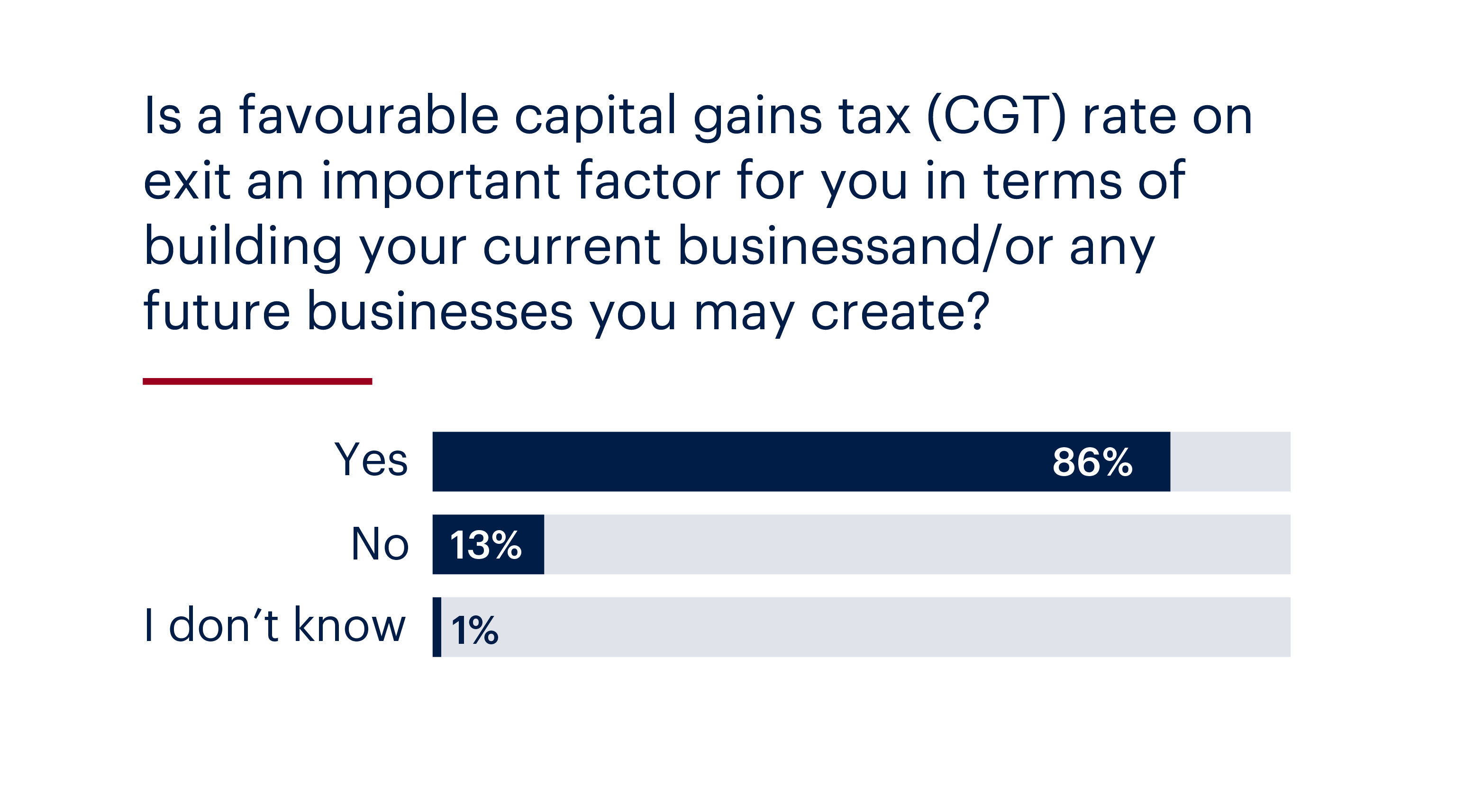

Nor is the danger simply that tax rates rather than business needs or prospects (and by proxy those of the economy) determine private company exit timings. A favourable CGT treatment is a significant motivator for entrepreneurs when it comes to building the business or starting new ones: 86% say it is an important factor.

No responsibly managed economy can afford to deter wealth creators from building tomorrow’s business successes and our survey would seem to suggest that the pervading sense of uncertainty around the longer-term benefits of building a UK business as a vehicle for personal financial security may be acting as such.

Business owners are a vital part of the UK Government’s plans to build back better4 post pandemic. This and future governments need to be careful that any reform to CGT does not undermine that broader aim.

A more immediate concern for many UK business owners, though, has been more prosaic – higher capital gains tax.

Until March 2020, under the “entrepreneurs’ relief” regime, those selling their companies could benefit from highly favourable tax treatment: a reduced rate of 10% capital gains tax (CGT) on up to £10 million in gains over their lifetime.

The lifetime limit was reduced significantly in the 2020 Spring Budget to £1 million of gains, and the relief re-branded (perhaps tellingly) as “business asset disposal relief”. However, the favourable reduced 10% rate was left in place.

After Chancellor Rishi Sunak wrote to the Office of Tax Simplification in July 2020 asking for a review of the CGT system, much of the period since has been spent anticipating a further revision. A widespread concern has persisted that it may even be eliminated with rates normalised with income tax – up to 45% for higher rate taxpayers, which would include many business owners.

Even without any changes, that uncertainty has fuelled transaction activity. First, the run-up to the 2020 Autumn Statement and then the approach to the Spring Budget in March 2021 and most recently the Autumn Budget in October 2021, resulting in notable surges of business owners exploring a sale in expectation of a change.

Although the Government announced at the end of 2021 that its review of CGT had been completed and no changes recommended, it remains to be seen if this eliminates business owners’ anxiety. If any uncertainty prevails, it is likely to remain a recurring factor.

Nor is the danger simply that tax rates rather than business needs or prospects (and by proxy those of the economy) determine private company exit timings. A favourable CGT treatment is a significant motivator for entrepreneurs when it comes to building the business or starting new ones: 86% say it is an important factor.

No responsibly managed economy can afford to deter wealth creators from building tomorrow’s business successes and our survey would seem to suggest that the recent uncertainty around the tax-driven advantages of building a substantial business as a vehicle for an entrepreneur’s personal financial security may have prompted some to exit sooner than they might otherwise have.

Business owners are a vital part of the UK Government’s plans to build back better4 post pandemic. This and future governments need to be careful that any reform to CGT does not undermine that broader aim.

Political pressures

Political

pressures

Business owners face significant challenges and uncertainty ahead beyond Covid-19 and the recovery. Two stand out.

First are the difficulties related directly and indirectly to Brexit. On the one hand, almost all of our survey respondents agreed anything is preferable to the transition period’s acute uncertainty when even a deal with the EU was in doubt. More than nine out of ten owners (92%) that responded believe it has been easier (Covid-19 aside) to manage and grow their business since the end of the Brexit transition concluded at the end of 2019.

On the other hand, the outcome has been far from ideal for some businesses. Post-Brexit export challenges are the top concern for a third of businesses overall and 46% of those in the technology sector.

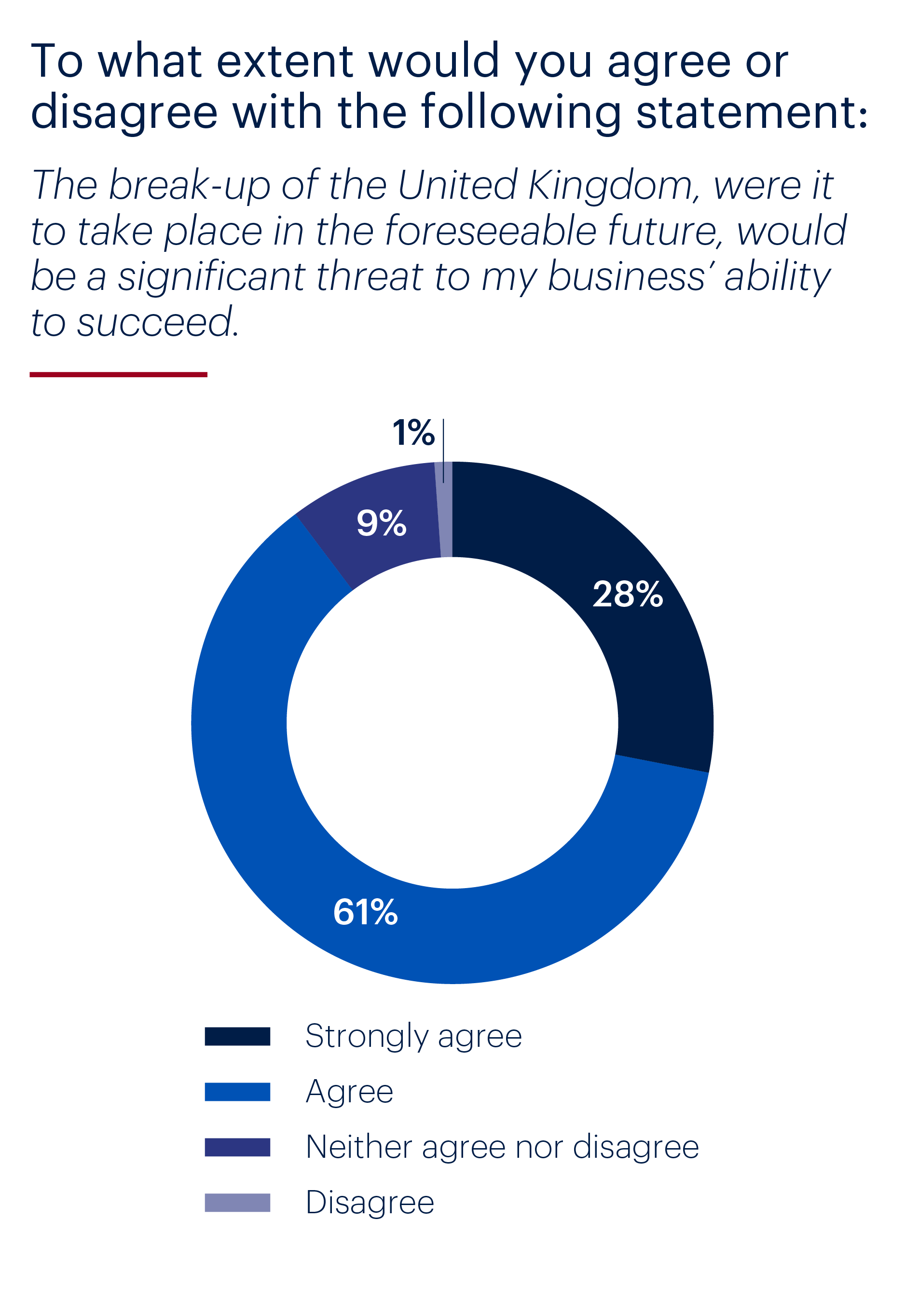

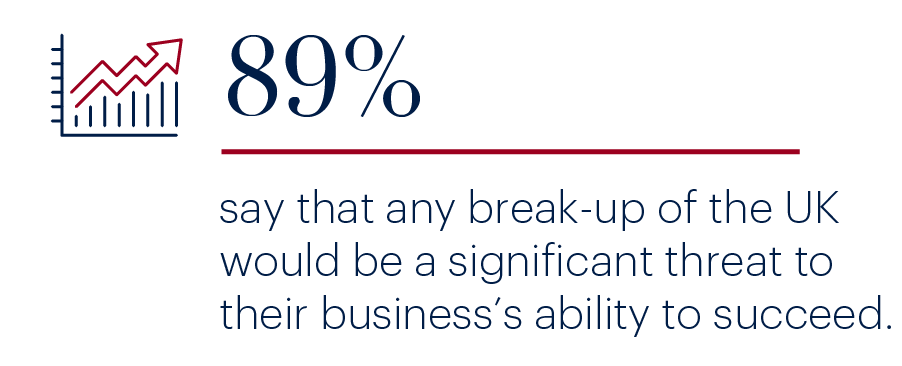

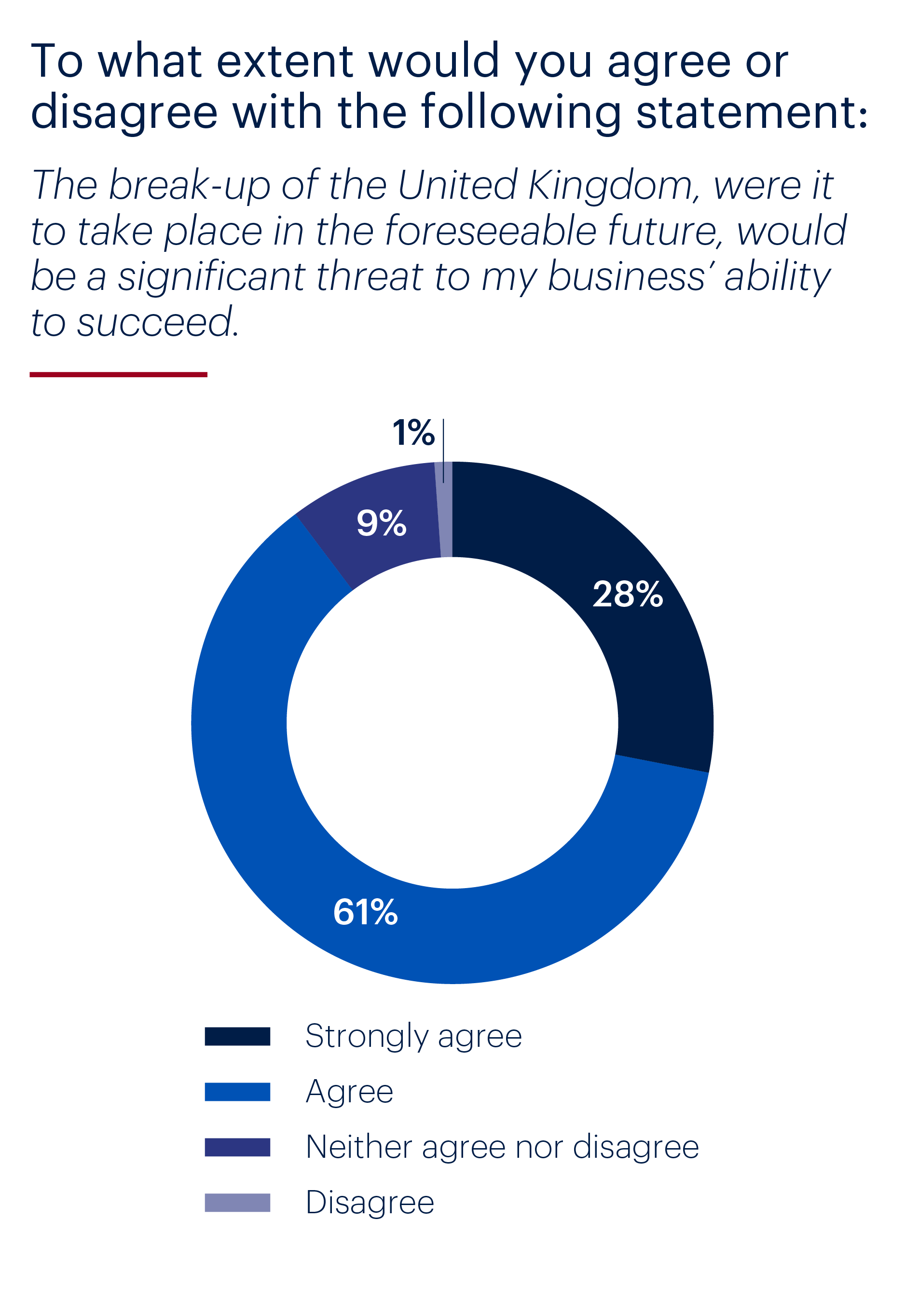

Moreover, many fear the broader consequences of the exit from the EU may still yet be felt. To the extent that Brexit has fuelled the separatist sentiment in the constituent parts of the United Kingdom, and most notably in Scotland, it continues to pose a risk factor for a large majority of business owners.

Retirement planning:

A healthy balance?

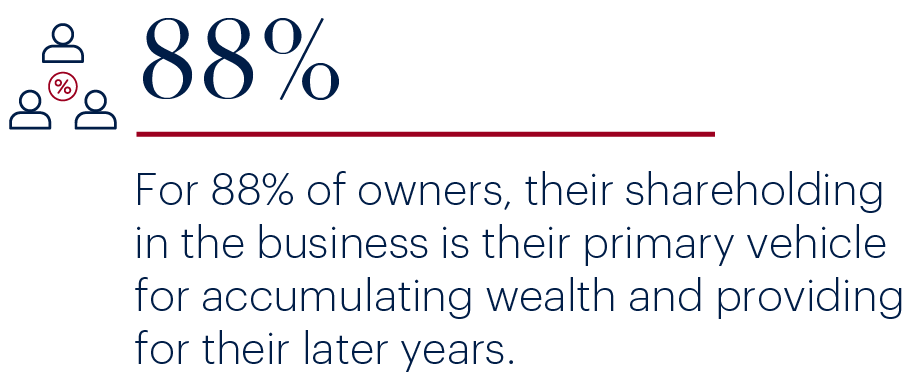

For all this, though, most entrepreneurs cannot escape that they are financially as well as personally invested in their businesses.

That’s particularly true for younger owners: of those aged 25 to 34, 93% agree and 44% strongly – against 82% and 35% for the over 55s.

That should probably not be a surprise, given that the main alternative sources of wealth are heavily skewed towards older age groups. For example, an estimated three-quarters of the over 65s own their homes outright5 according to the Office of National Statistics. People in their mid-thirties, meanwhile, are three times more likely to rent than 20 years ago. Older generations who have worked elsewhere before starting a business are also much more likely to have some final salary pension provision.

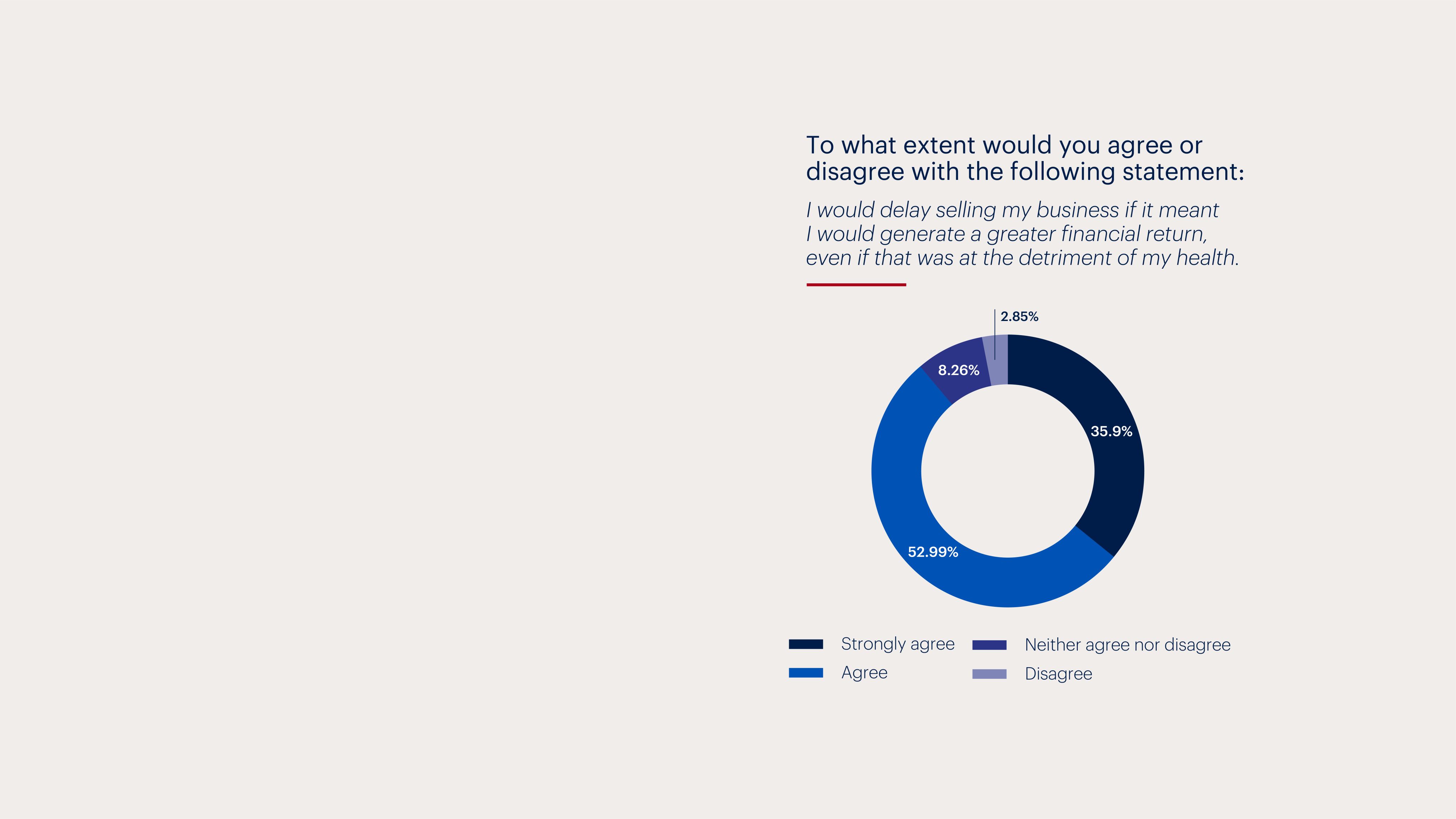

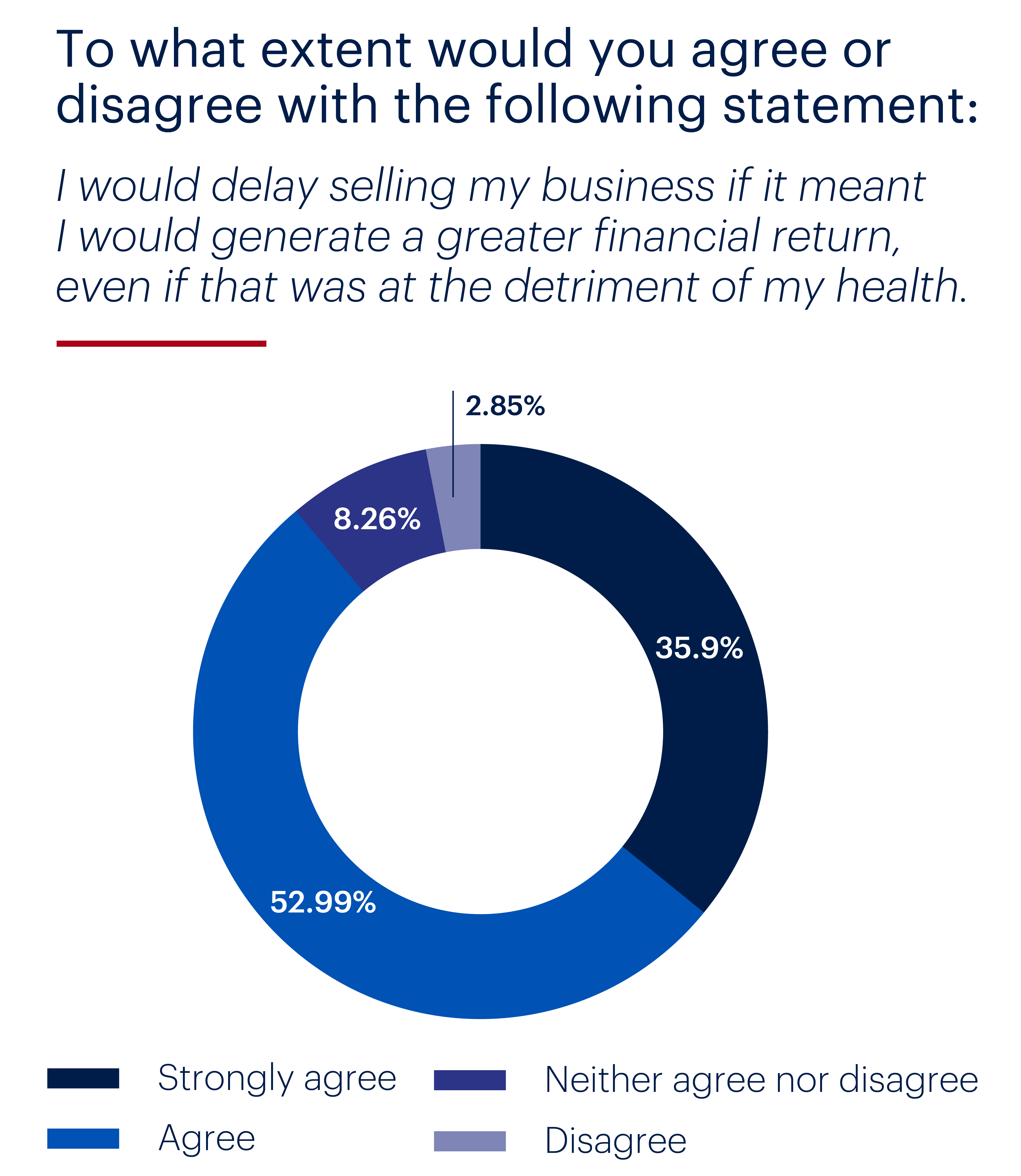

If it is not surprising, though, neither is it healthy – quite literally. A dependence on their businesses as the primary source of wealth inevitably means owners’ decisions in relation to their businesses can be heavily swayed by considerations of their personal financial wellbeing.

In practice, the surge of interest in selling in fear of capital gains tax changes suggests that owners’ financial interests can come to dominate. The reliance on a business for financial security and as a substitute for a pension makes it inevitable. That doesn’t just mean decisions that are not necessarily best for the enterprise, and therefore the economy. It can mean owners making difficult decisions, balancing what’s best for their business with what’s best for them personally.

That should probably not be a surprise, given that the main alternative sources of wealth are heavily skewed towards older age groups. For example, an estimated three-quarters of the over 65s own their homes outright5 according to the Office of National Statistics. People in their mid-thirties, meanwhile, are three times more likely to rent than 20 years ago. Older generations who have worked elsewhere before starting a business are also much more likely to have some final salary pension provision.

If it is not surprising, though, neither is it healthy – quite literally. A dependence on their businesses as the primary source of wealth inevitably means owners’ decisions in relation to their businesses can be heavily swayed by considerations of their personal financial wellbeing.

In practice, the surge of interest in selling in fear of capital gains tax changes suggests that owners’ financial interests can come to dominate. The reliance on a business for financial security and as a substitute for a pension makes it inevitable. That doesn’t just mean decisions that are not necessarily best for the enterprise, and therefore the economy. It can mean owners making difficult decisions, balancing what’s best for their business with what’s best for them personally.

Tipping the scales: The personal and political

There are two ways of mitigating the risks that financial pressures lead to poor outcomes personally and for the business.

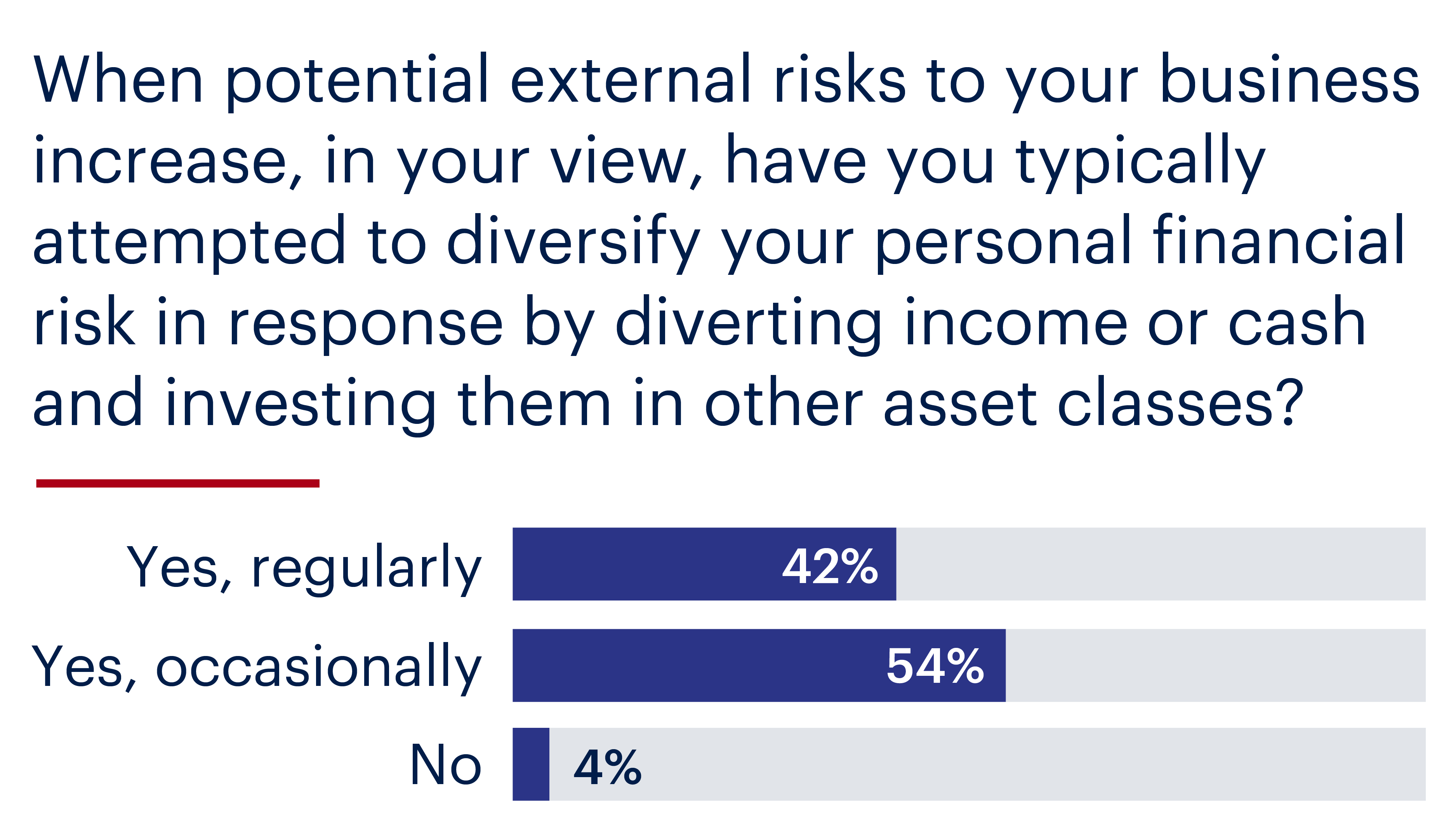

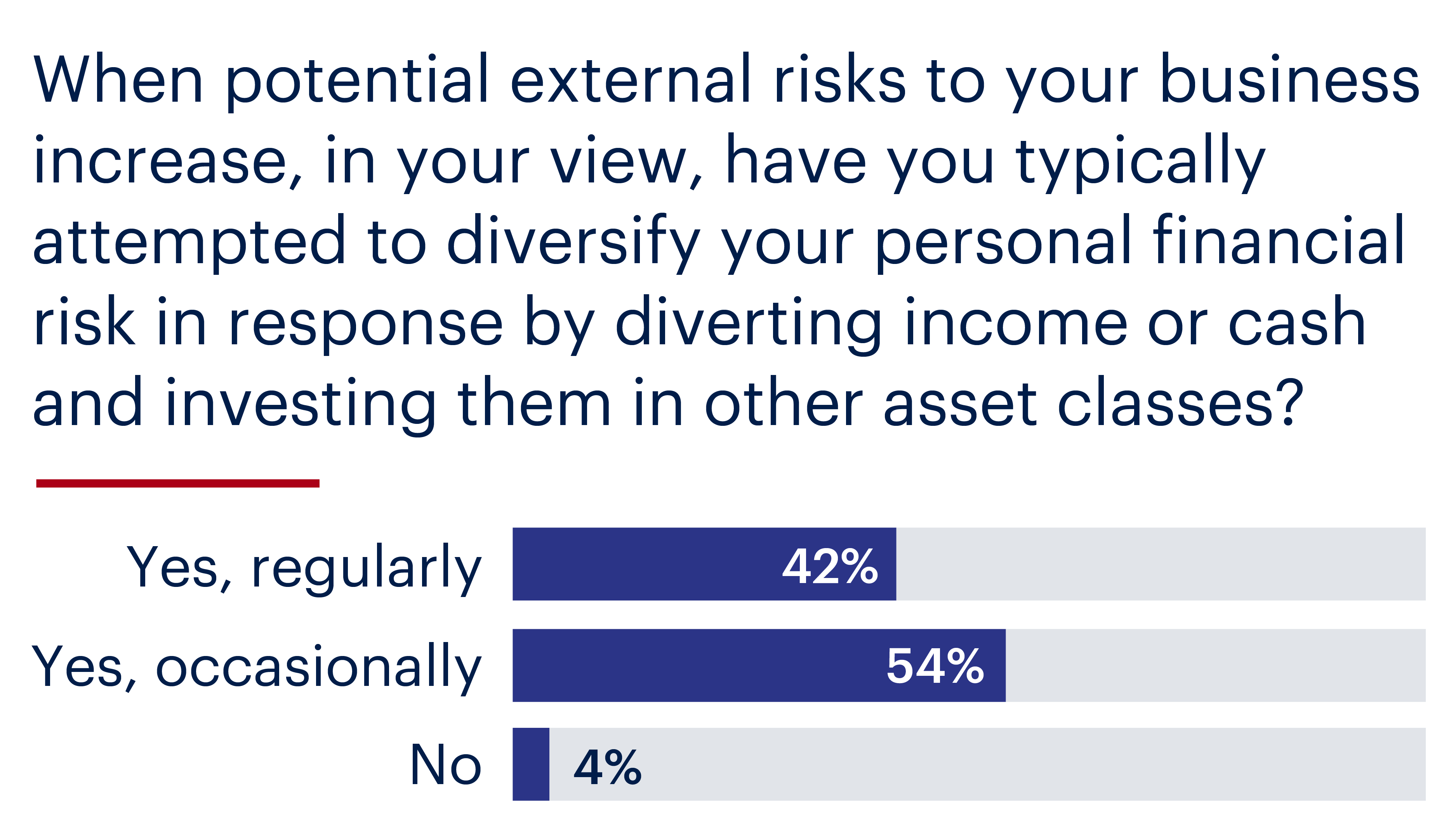

The first relies upon owners themselves diversifying their assets and weaken the dependency on the value of their business for their financial security. There’s encouraging evidence that many owners are doing just that – at least when uncertainty around the company grows.

Almost all owners (96%) say that when external risks to the business have increased, they have attempted to divert income or cash to invest outside the business in other asset classes – and 42% do so as a matter of course. The willingness among owners to mitigate risk by diversifying their wealth alongside their business makes perfect sense, although many owners continue to rely heavily upon their businesses to secure their future financial security.

Policymakers must also share some of the responsibility, however. The willingness of entrepreneurs to take risks depends on their confidence in reaping the rewards. In their decisions to start new businesses and grow existing ones, it is perhaps unrealistic and unhelpful to expect them to act against their own interests. Any economy that wants to foster the entrepreneurial community must keep in mind the people at its heart.

There are two ways of mitigating the risks that financial pressures lead to poor outcomes personally and for the business.

The first relies upon owners themselves diversifying their assets and weaken the dependency on the value of their business for their financial security. There’s encouraging evidence that many owners are doing just that – at least when uncertainty around the company grows.

Almost all owners (96%) say that when external risks to the business have increased, they have attempted to divert income or cash to invest outside the business in other asset classes – and 42% do so as a matter of course. The willingness among owners to mitigate risk by diversifying their wealth alongside their business makes perfect sense, although many owners continue to rely heavily upon their businesses to secure their future financial security.

Policymakers must also share some of the responsibility, however. The willingness of entrepreneurs to take risks depends on their confidence in reaping the rewards. In their decisions to start new businesses and grow existing ones, it is perhaps unrealistic and unhelpful to expect them to act against their own interests. Any economy that wants to foster the entrepreneurial community must keep in mind the people at its heart.

Jeremy Furniss

Managing Director

jeremy.furniss@rothschildandco.com

T +44 20 7484 4703

M +44 7711 078462

Download vCard

Rosemarie Lamanno

Marketing Director

rosemarie.lamanno@rothschildandco.com

T +44 20 7484 4729

M +44 7557 126435

Download vCard

https://www.arrowpointadvisory.com/

Arrowpoint Advisory is the dedicated mid-market team of Rothschild & Co in the UK. We provide expert M&A, Debt and Special Situations advice to publicly-listed, private and family companies, entrepreneurs, sponsor-backed businesses and management teams, investors and lenders.

To get your own copy of the latest Arrowpoint Advisory Heart of the Deal report, please enter your details below, and one of the team will be in touch.