Financing the

energy transition

Financing the

energy transition

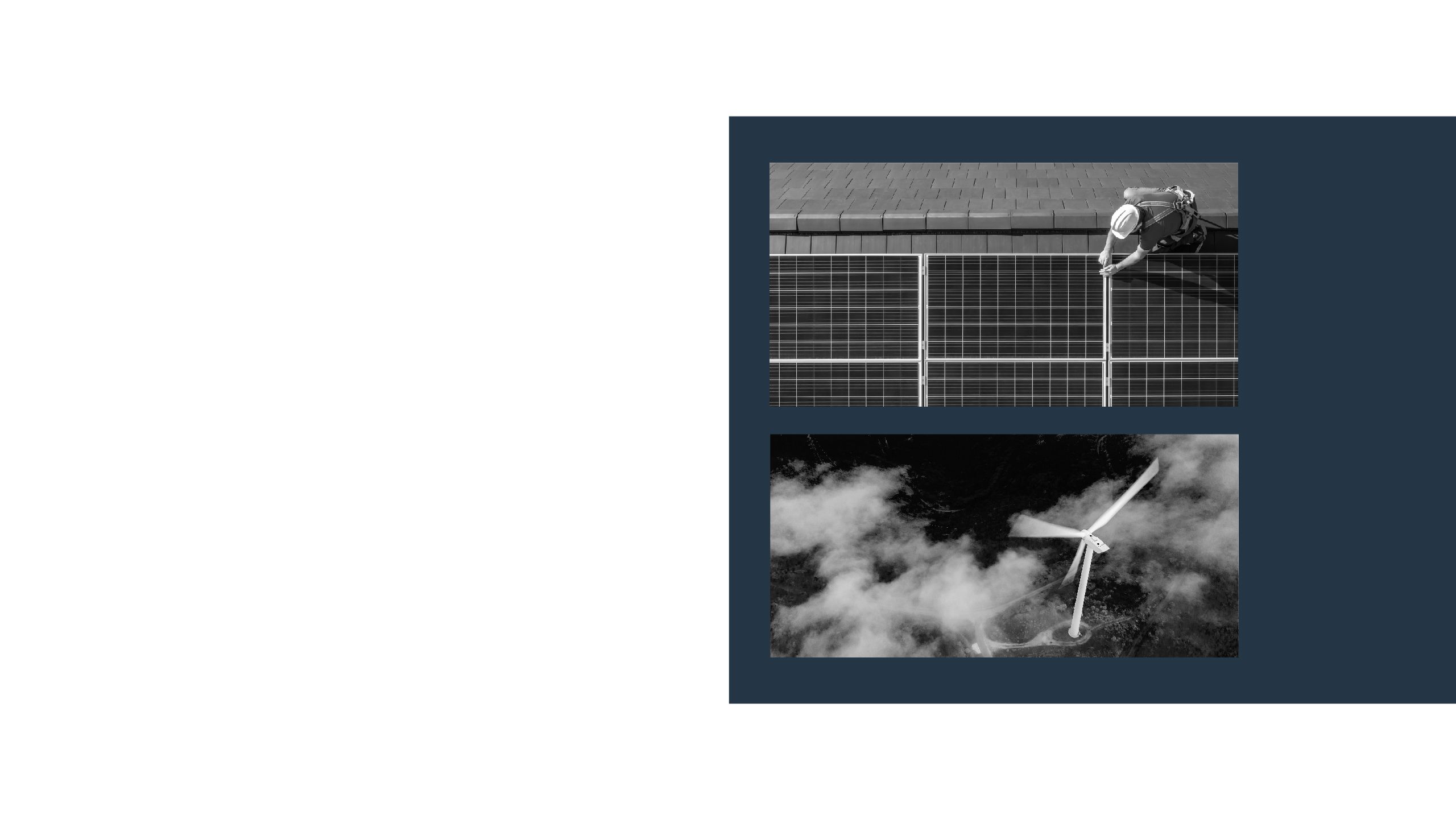

The global energy transition has moved well beyond its initial focus on decarbonizing our electricity systems by significantly reducing our reliance on legacy fossil fuel resources, adding renewable energy sources to the grid and accelerating rail and passenger car electrification to take advantage of the lower carbon footprint in the energy mix. Importantly, we are beginning to embrace the challenges of reducing emissions in “hard to abate” sectors such as heavy road transport, maritime, aviation and heavy industry. Indeed, the energy transition now encompasses the full spectrum of solutions that seek to:

Importantly, ESG factors and considerations also are playing an increasingly important role in this space. In particular, stakeholders recognize that ESG considerations such as focusing on sustainable product development and risk management issues (e.g., avoiding greenwashing and developing processes to support substantiation of sustainability claims); developing credible and consistent ESG-related reporting and disclosures and compliance procedures; and embedding ESG factors in investment, lending, corporate governance and regulatory oversight of governance processes and procedures will be critical as the energy transition continues across all sectors of the global economy. These issues will be of particular importance as regulators increasingly look at developing and deploying integrated disclosure requirements as well as enforcement tools to ensure compliance with such requirements.

This very broad spectrum of energy transition solutions has different capital and financing requirements and different risk profiles. There is no “one size fits all” approach to developing and scaling a solution, and we expect that most stakeholders will implement energy transition strategies that involve a combination of available solutions, depending on geography, sector requirements and stakeholder-specific facts and circumstances.

Importantly, ESG factors and considerations also are playing an increasingly important role in this space. In particular, stakeholders recognize that ESG considerations such as focusing on sustainable product development and risk management issues (e.g., avoiding greenwashing and developing processes to support substantiation of sustainability claims); developing credible and consistent ESG-related reporting and disclosures and compliance procedures; and embedding ESG factors in investment, lending, corporate governance and regulatory oversight governance processes and procedures will be critical as the energy transition continues across all sectors of the global economy. These issues will be of particular importance as regulators increasingly look at developing and deploying integrated disclosure requirements as well as enforcement tools to ensure compliance with such requirements.

This very broad spectrum of energy transition solutions has different capital and financing requirements and different risk profiles. There is no “one size fits all” approach to developing and scaling a solution, and we expect that most stakeholders will implement energy transition strategies that involve a combination of available solutions, depending on geography, sector requirements and stakeholder-specific facts and circumstances.

We therefore expect all of the financing solutions below to

play a significant role in delivering the energy transition:

Bank project finance or limited recourse finance, which has been a dominant form of financing for the sector and will continue to play a critical role, particularly for assets with well-understood construction risks and long-term cost and revenue certainty.

Bond capital markets, which have played a key role in financing (or refinancing) projects with stable, operational, lower-risk profiles (or greenfield construction assets that have been structured to replicate an operational risk profile due to the presence of government support providing protection for cost overruns and/or construction delay or failure) and innovative delayed-draw structures have evolved to offer project bond solutions for more construction projects.

Common debt platforms, which will continue to be attractive for projects with very large financing requirements and the need or desire to pre-wire their ability to continue to access further finance over time from a mix of the bank, private placement and public bond markets.

Green, sustainable or impact finance (including green bonds, green loans and sustainability-linked loans), using any of the above lending structures, but which are specifically targeted at lending to qualifying energy transition or ESG projects, businesses or activities or are designed to incentivize a broader sustainability or decarbonization agenda.

Development finance institutions (DFI) and export credit agencies (ECA), which will remain key to mobilizing additional commercial capital, reducing the overall cost of capital, promoting the export of domestic supply chain solutions and/or bringing additional rigor to project due diligence and debt terms and conditions, particularly for projects in emerging sectors or with new technology risk.

Sovereign infrastructure banks, loan guarantees and other blended-finance solutions, which provide support for innovative technologies, critical infrastructure and demonstration projects that are not yet served by commercial lenders.

“HoldCo” or fund financings, which provide indirect funding solutions or funding projects on a portfolio basis.

Streaming or royalty financings, which attract a different and complimentary category of financier and enable companies to monetize their assets with greater flexibility than traditional debt terms (and which may play an even greater role as carbon credits develop).

Private credit and institutional direct lending, which we expect to play an increasingly significant role in financing the transition as it may be able to offer more attractive financing solutions for energy transition projects with, for example, higher technology, construction, cost overrun, revenue or political/regulatory risks.

Special situations lending, which may be well suited to projects or businesses in, or close to, distress and looking at rescue or restructuring options.

In addition, many energy transition projects, solutions and businesses will continue to rely on balance sheet and/or traditional corporate financing, with energy, automotive, industry and technology majors alongside investment funds, likely to play a pivotal role in driving the sector forward.

In addition, many energy transition projects, solutions and businesses will continue to rely on balance sheet and/or traditional corporate financing, with energy, automotive, industry and technology majors alongside investment funds, likely to play a pivotal role in driving the sector forward.

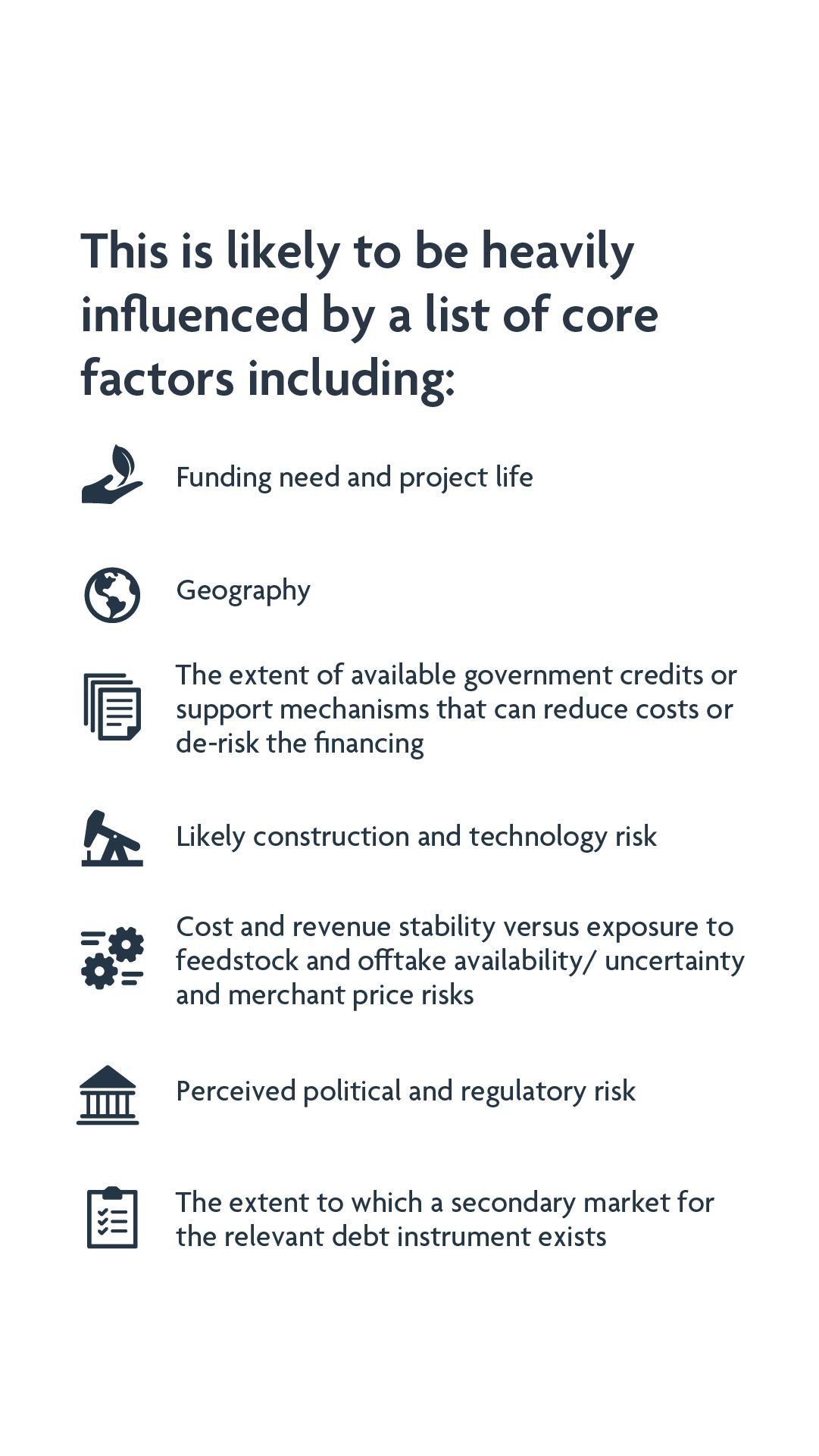

This is likely to be heavily influenced by a list of core factors including:

Authors

Ike Emehelu

Partner

Alex Harrison

Partner

Amy Kennedy

Partner

Shaun Lascelles

Partner

shaun.lascelles@akingump.com

London

T+44 20.7012.9839

F+44 20.7012.9601

v-card

Charles Edward Smith

Consultant

Daniel Giemajner

Partner

daniel.giemajner@akingump.com

London

T+44 20.7661.5521

F+44 20.7012.9601

v-card

Paul Greening

Partner

paul.greening@akingump.com

Singapore

T+65 6579.9070

F+65 6579.9009

v-card

Matt Kapinos

Partner

mkapinos@akingump.com

Houston

T+1 713.250.2117

F+1 713.236.0822

v-card