The International Energy Agency (IEA) projects that to reach net zero by 2050, all cars sold from 2035 must be electric vehicles (EVs). That equates to upwards of 70 million batteries a year being required, just for consumer EVs. When you factor in the wider use cases for batteries (including those required to compliment new renewable energy sources), demand for batteries will grow exponentially in the coming years.

The International Energy Agency (IEA) projects that to reach net zero by 2050, all cars sold from 2035 must be electric vehicles (EVs). That equates to upwards of 70 million batteries a year being required, just for consumer EVs. When you factor in the wider use cases for batteries (including those required to compliment new renewable energy sources), demand for batteries will grow exponentially in the coming years.

Given the scale of demand, there is ever-growing interest from governments, corporates, original equipment manufacturers (OEMs), car manufacturers and investors, all of whom see opportunity. However, there is an emerging realization that the development and optimization of these facilities is not straightforward.

In this article, we consider some of the commercial, political and legal issues that need to be navigated in order to successfully develop and finance these highly bespoke manufacturing facilities.

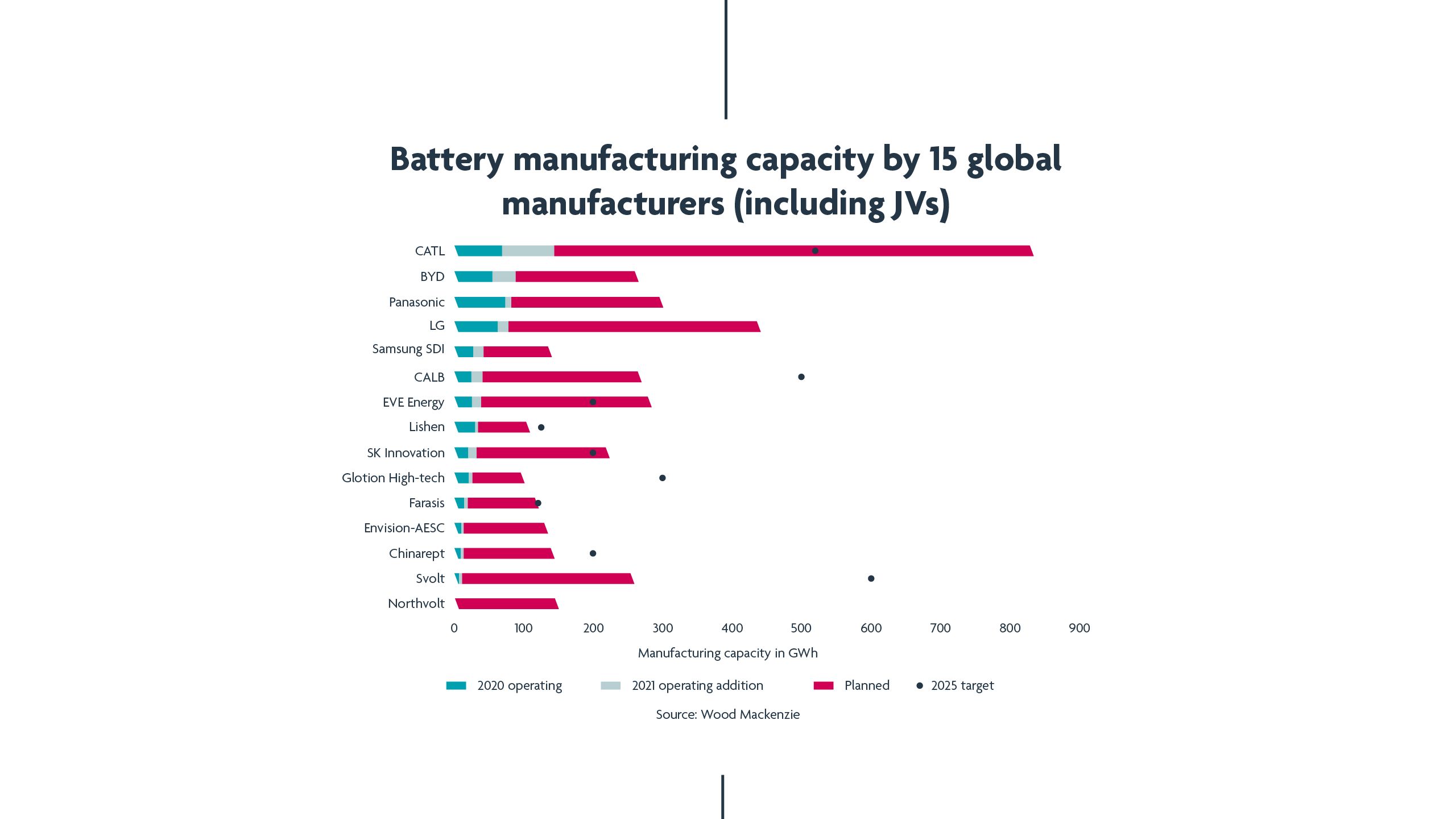

Meeting this demand will require more gigafactories to be built at scale and speed and from 2025 we need to be producing 3000 gigawatt hours per year of new battery capacity. This leap in manufacturing capacity can hardly be understated current annual global manufacturing capacity is approximately 500 gigawatt hours.

Given the scale of demand, there is ever-growing interest from governments, corporates, original equipment manufacturers (OEMs), car manufacturers and investors, all of whom see opportunity. However, there is an emerging realization that the development and optimization of these facilities is not straightforward.

In this article, we consider some of the commercial, political and legal issues that need to be navigated in order to successfully develop and finance these highly bespoke manufacturing facilities.

Given the scale of demand, there is ever-growing interest from governments, corporates, original equipment manufacturers (OEMs), car manufacturers and investors, all of whom see opportunity. However, there is an emerging realization that the development and optimization of these facilities is not straightforward.

In this article, we consider some of the commercial, political and legal issues that need to be navigated in order to successfully develop and finance these highly bespoke manufacturing facilities.

The current

gigafactory market

Driven by desires to (i) decarbonize and achieve net-zero targets, (ii) maintain independence and control over the electrification of the automotive and renewable energy industry and (iii) capture some of the very meaningful environmental, social and commercial benefits associated with the battery industry, the development of gigafactories is a critical piece of the energy transition puzzle.

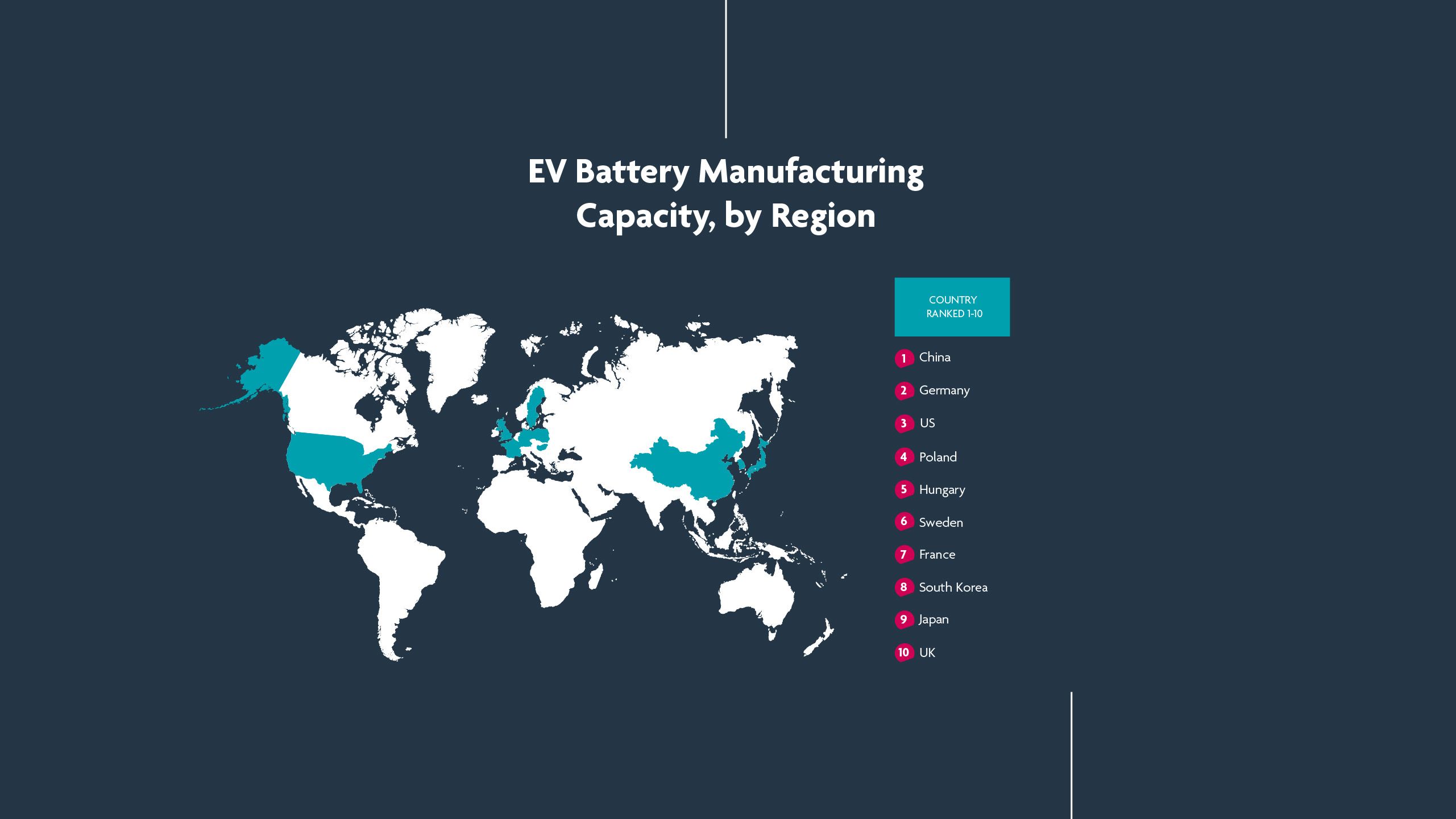

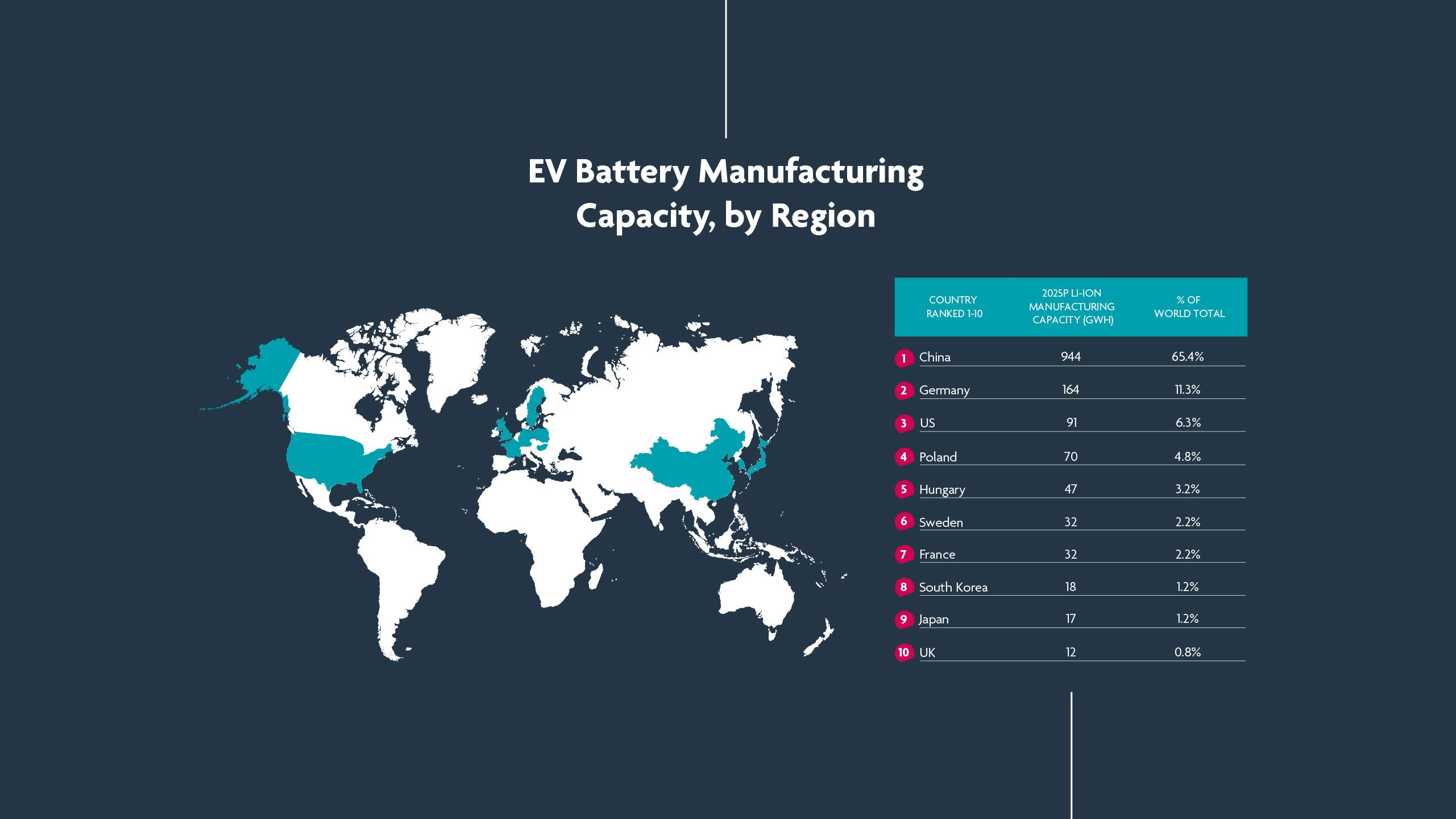

At present, China holds a dominant position in the production of battery cells. Approximately 80% of lithium-ion battery cells produced globally are made in China. This, in turn, means that the vast majority of gigafactories are currently located, or being built, in China.

The current

gigafactory market

Driven by desires to (i) decarbonize and achieve net-zero targets, (ii) maintain independence and control over the electrification of the automotive and renewable energy industry and (iii) capture some of the very meaningful environmental, social and commercial benefits associated with the battery industry, the development of gigafactories is a critical piece of the energy transition puzzle.

At present, China holds a dominant position in the production of battery cells. Approximately 80% of lithium-ion battery cells produced globally are made in China. This, in turn, means that the vast majority of gigafactories are currently located, or being built, in China.

Against this backdrop the United Kingdom (UK), European Union (EU) and United States (US) are all seeking to acquire market share and are seeking to do so quickly. There are several reasons for this global battery arms race, but they can be distilled into three broad drivers:

Economic

There is industrywide consensus that whoever manages to attract battery manufacturers to their country will also win the battle to maintain and grow a wider car-manufacturing industry. This is because there are important economic efficiencies to be achieved by assembling EVs at the same location as the battery cell manufacturing process (or at least somewhere nearby). These economic efficiencies are likely to overcome any short-term price advantage derived from sourcing cells manufactured in China, particularly given that battery cells are heavy in comparison with the internal combustion engine (ICE) and therefore costly to transport over distance. There are also good environmental reasons not to transport battery cells over long-distance if they are being produced as part of a wider decarbonization agenda.

Political

Recent events in Ukraine have further heightened calls from politicians across the globe to ensure domestic energy security. Similar concerns apply with regard to the dependency on China for the future of the battery industry and net-zero targets more generally.

Environmental

Gigafactories form a core component of global plans to move away from the ICE towards a greener and more sustainable future. In maintaining and growing domestic EV manufacturing capability, countries will drive market behavior from within by being able to offer a localized and cost-effective alternative to the ICE.

It is therefore unsurprising that there has been a meaningful uptick in gigafactories which are in construction or planning across the globe, with more than 30 planned in Europe alone.

Emerging challenges

The travails of Britishvolt have been well publicized. In the space of a few months, it has gone from being the UK government’s poster child for gigafactory development to entering administration. So, what lessons can be learned?

Emerging challenges

The travails of Britishvolt have been well publicized. In the space of a few months, it has gone from being the UK government’s poster child for gigafactory development to entering administration. So, what lessons can be learned?

These challenges are not limited to Britishvolt alone. Equally, this is not to say that Britishvolt was always destined to fail.

This requires meticulous planning, evolving technology, flexibility in terms of construction and optimization and significant financial backing. Below we have outlined how our clients are navigating these key issues.

Key issues and opportunities

Construction and optimization

The sheer size of any gigafactory would make it a considerable construction undertaking in any context (as an example, Tesla’s gigafactory in Texas may in fact be the largest building on the planet).

However, when you consider that making battery cells does not require a single type of factory, the real complexity emerges. These facilities require multiple independent specialties to be integrated in a single plant, including the roll-to-roll process, the micro-assembly process and, finally, the formation of the battery. Each of these disciplines requires different equipment, different personnel and different configuration. It also needs to be carefully considered as plants are designed, constructed and optimized. It is little wonder, then, if you look at the gigafactories that are planned or under construction globally, that there is significant variation in terms of capital expenditure (“CapEx”) cost (i.e., the investment cost per gigawatt hour). The same is true in terms of the time to bring these plants online. Some of this is due to regional variation and is therefore impacted directly by location. However, there are aspects of this cost fluctuation that can be managed and controlled, and key learnings are emerging in terms of construction and optimization:

- A number of projects have benefitted from the use of a digital twin – these are digital representations of the physical plant, its systems and production processes that are effectively indistinguishable for practical purposes, such as simulation, integration, testing, monitoring and maintenance. The use of a digital twin is critical when you are constantly seeking to optimize how many “giga” you can fit within the plant whilst balancing footprint and output.

- Against the backdrop above, the construction contractor needs to be relatively nimble. Therefore, these projects are unlikely to be well suited to a fixed-price turnkey engineering, procurement and construction (EPC) contract. A project of this nature, which brings together a number of different elements and stakeholders and contains inherent technology and technology integration risk, is unlikely to attract a single EPC contractor to underwrite the delivery of the entire project on time, on budget and to a required technical and performance specification. Instead, projects of this nature tend to be delivered on a multi-contract basis. This of course creates interface risk (time, costs and integration) between the various works and supply packages that will tend to flow back to the developer if not appropriately managed. This risk is likely to be best managed with a highly structured engineering, procurement and construction management (EPCm) contract delivery model. Whilst the EPCm contractor will not underwrite project delivery, it will instead typically be a highly skilled and competent professional consultant engineer who will manage and will be incentivized to manage (through a bespoke bonus-malus regime) all aspects of project delivery and interface risk on behalf of the supplier. The EPCm contractor will need to be incentivized to constantly optimize the plant, both during construction and in the early stages of the operating period.

- Business plans and financial models will have to take account of the wastage levels that are inherent in all of these plants. Even the most sophisticated battery cell manufacturers will have a relatively meaningful level of wastage, particularly during early periods. This will have ramifications in terms of basic costs, demand for materials and, ultimately, revenue (as well as recycling – discussed below). It may also necessitate ongoing optimization of the plant and equipment, all of which need to be considered as part of a wider construction strategy.

- It is not just the battery that needs to be green (discussed below). Construction materials (such as green steel) and construction plans need to be carefully considered and the carbon footprint of the factory and construction process needs to form part of the overall sustainability analysis in respect of the batteries.

Power

The process of producing battery cells is energy intensive and manufacturing capacity of this scale requires a significant amount of stable and reliable power.

That power must be ‘green’. Any dependency on fossil fuels or other products generating carbon emissions would undermine the role of the gigafactory in the energy transition. Put another way, if we are delivering battery cells en masse in order to reduce carbon emissions from the transport sector, then it follows that the process of producing those electric vehicles cannot itself be a net-emitter without undermining the rationale for the change.

The need to access cheap and long-term renewable energy is a key driver for the location of future gigafactories (discussed below). For example, Britishvolt chose its Blyth location partly because it is next to a power interconnector which brings in renewable energy from Norway.

At some point, a balance must be struck between the need to maximize existing green power infrastructure as opposed to a developer building its own (and potentially benefitting from other core fundamentals as a consequence). For those of us that have been developing renewable energy projects for some time, the need to co-locate the power source on site is nothing new and there are a number of models that can be deployed (whether the gigafactory wants to control its own power supply or is happy to outsource this). Equally, co-location will not always be possible, in which case a form of corporate power purchase agreement (PPA) may be required.

Site

A gigafactory will have a unique footprint.

Not only is a huge amount of land required to build a manufacturing site of this scale, but also its proximity to other key features is important. Ideally, the factory would be situated close to major transport infrastructure (such as a deep sea port or railway), a renewable energy source, a significant water resource and the remainder of the EV manufacturing plant (if this is indeed the intended use for the batteries). This is driven by the weight of the batteries making them less suitable for global transport, but also because bringing the remainder of the supply chain on-site allows the processes to be run from a single renewable energy source and away from existing car manufacturing locations abroad (many of which continue to be dependent on coal power).

If processes can be centralized, then the price of manufacture should also fall if it avoids the need for materials to move through different countries, incurring a margin and tax at each step of the process. The process of putting a contractual framework in place to ensure long-term access to all of these key features can be a thorny one, but it is essential that it is carefully considered and documented, particularly as it will form a primary part of the due diligence for any subsequent debt or equity investment that is sought.

Feedstock

As a starting point, it is important to recognize that there is no single formula for the development of a lithium-ion battery.

All lithium-ion batteries have one element in common: lithium. However, the combination of cathode materials (which are the beating heart of any battery) varies, creating a degree of flux in the market. This has a direct bearing on the feedstock which is required, and it is important to bear in mind that these are highly bespoke, highly automated production facilities, where the chemical process may need to evolve over time. Nevertheless, regardless of the ultimate composition, gigafactories will invariably need refined battery grade lithium, nickel and cobalt feedstock (or some of them) and this means having long-term arrangements in place with conversion and refining facilities and long-term feedstock agreements which can sustain manufacturing capacity. As we discussed in our previous article, much of the lithium processing capability is in China, which creates commercial and political tensions.

While new supply will emerge in Europe and North America, it is likely that there will be considerable demand for product and the gigafactories that will succeed will be those that are able to control their own feedstock needs and costs. At the very least, the development and financing of any gigafactory requires a genuine understanding of how the raw materials are sourced and processed, their provenance, their carbon footprint and the risks that abound from a commercial and environmental, social and governance (ESG) perspective. These are delicate questions that can require significant due diligence, but which will ultimately impact how sustainable and viable the gigafactory is over the medium- to long-term.

Sales strategy for the battery

To date, lots of the battery manufacturers have been producing a somewhat generic ‘off-the-shelf’ battery for the automotive industry.

That works well for small, relatively inexpensive cars where the primary differentiator will be cost rather than range or performance. However, approximately 30% of European-made vehicles are premium models (and, in fact, in the UK that figure is closer to 65%) and so, as the gigafactories open in Europe seeking to capture European market share, they will need to tailor their batteries accordingly for much heavier, higher-value models where range will be a key factor. This is going to require some careful engineering from a technical perspective but also some ability to flex the business model from time to time.

Offtake

Establishing robust offtake arrangements with an automaker or OEM is essential.

There is considerable precedent for developers entering into a ‘framework MoU’ with an automaker or OEM in the relative infancy of a gigafactory project under which the parties assume loose obligations to collaborate with one another. Though there is nothing wrong with that approach, it needs to be recognized that those arrangements will need to evolve over time and be refined into a binding commitment from the automaker or OEM, particularly if the developer is going to seek some form of debt finance.

Wider integration risk

Growing battery capacity does not necessarily equate to EV-ready supply.

There is a recognition that, in order to meaningfully develop EV supply, a number of different elements will have to come together:

- Gigafactories will need time to build and scale and this will need to happen in tandem with the development and scale of battery metal processing capability and EV manufacturing facilities. Inevitably, the interface between these facilities will need to be carefully managed.

- Cathode and anode capacity needs to increase significantly in line with the rest of the supply chain.

- The raw materials required to develop battery cells need to be extracted in unprecedented quantities.

Each of these elements creates a degree of integration or ‘project-on-project’ risk which will need to be carefully managed depending on where the feedstock for a gigafactory is coming from, who is providing it and their ability to source product for a multitude of locations.

Technology risk

The EV battery market is fast evolving from a technological perspective, and manufacturing capacity therefore needs to be capable of adapting to meet likely future advances.

This may include refinement of the specification of input raw materials or adaptation of the layout and specification of the manufacturing plant itself. To some extent, this can all be managed through the feedstock and offtake terms originally agreed, but it is highly likely that EV car manufacturers will expect to benefit from technological improvements given the pace of change. Without this, longer-term offtake arrangements are unlikely to be available.

Recycling

If the gigafactory can be co-located with other parts of the EV manufacturing chain, then it opens up the possibility of introducing a recycling facility to recycle and recover battery materials that can be put straight back into the manufacturing process.

This will have undoubted economic and environmental benefits and considering the recycling strategy at the outset of any project may add significant value.

Regulatory risk

The battery sector is undergoing massive regulatory change and the current landscape is dynamic.

Recent legislation includes:

- US Inflation Reduction Act (IRA) – This has significant ramifications for the EV industry more generally, but chief amongst them is the extension and expansion of a clean vehicle tax credit. Critically, eligibility for this tax credit is based (in part) upon the critical minerals and batteries being sourced and assembled in the US or in countries with whom the US has a free trade agreement. Further, phasing in through the end of 2024, there is a complete prohibition on inputs sourced from companies that are subject to the jurisdiction of China or a few other countries. Whilst there is a lot of detail in the Inflation Reduction Act regarding the eligibility criteria (which go beyond the scope of this paper), the implication is that the US needs to stimulate its own gigafactory and EV sector. In recognition of this, the Inflation Reduction Act contains separate manufacturing tax credits at a rate of 10% of the cost of critical mineral production, 10% of the cost of electrode active materials and $45/KWh for cell and module production located in the US. Unlike most other US tax credits, the battery manufacturing tax credits are refundable from the US government for up to five years. The IRA represents a significant investment by the US in developing a battery supply chain in the country.

- EU Draft Battery Regulation 2020 – This regulation is making its way through the EU legislative process but will potentially have wide-reaching effects, including the introduction of a cap on the carbon footprint of any battery. That could mean a major impact on the mining and processing of the raw materials comprising any battery and it will therefore be central to the business strategy of any developer of a gigafactory. The ramifications are also being felt far beyond the EU.

- EU Draft Directive on Corporate Sustainability Due Diligence – This directive is also making its way through the EU legislative process but will ultimately provide that businesses (both EU and non-EU) must conduct due diligence to identify the actual or potential human rights and environmental impacts of their business and then take steps to cease or mitigate any negative impacts. Like the battery regulations, the ramifications for the EV supply chain are significant and will impact any developer of a gigafactory.

Whilst the impact of such regulatory changes will be broad and largely positive for the gigafactory sector in Europe and North America, the common feature of all this change is a growing focus on the entirety of the EV supply chain. In our view, understanding and managing the wider supply chain will be one of the critical factors in the development of any successful gigafactory.

Our practice and experience

Akin acts across the whole battery value chain, from mining companies on the extraction of raw materials, to developers of lithium processing facilities, gigafactory developers, car manufacturers, feedstock suppliers, financial institutions, private equity funds, private credit funds and traders, all of whom value our ability to navigate issues (such as those discussed above) in a commercial and pragmatic manner. What separates us from our peers is our knowledge of the whole value chain, and our ability to deliver a single team of experienced professionals to support a project located anywhere in the world. We’re able to advise on every aspect of processing development from inception, through design, engineering and planning, to financing and decommissioning. Our areas of focus include construction, licensing, feedstock supply, offtake arrangements, joint ventures, M&A, project finance, debt finance and alternative mine finance, as well as disputes, restructuring and investigations.

Key contacts for this piece

Daniel Giemajner

Partner

daniel.giemajner@akingump.com

London

T+44 20.7661.5521

F+44 20.7012.9601

v-card

Matt Hardwick

Partner

matt.hardwick@akingump.com

London

T+44 20.7661.5533

F+44 20.7012.9601

v-card

Alex Harrison

Partner

alex.harrison@akingump.com

London

T+44 20.7661.5532

F+44 20.7012.9601

v-card

Wider Akin Gump contacts

Ike Emehelu

Partner

iemehelu@akingump.com

New York

T+1 212.872.8182

F+1 212.872.1002

v-card

Matt Kapinos

Partner

mkapinos@akingump.com

Houston

T+1 713.250.2117

F+1 713.236.0822

v-card

Shaun Lascelles

Partner

shaun.lascelles@akingump.com

London

T+44 20.7012.9839

F+44 20.7012.9601

v-card

Simon Rootsey

Partner

simon.rootsey@akingump.com

London

T+44 20.7012.9838

F+44 20.7012.9601

v-card

Paul Greening

Partner

paul.greening@akingump.com

Singapore

T+65 6579.9070

F+65 6579.9009

v-card

Justin Williams

Partner

williamsj@akingump.com

London

T+44 20.7012.9660

F+44 20.7012.9601

v-card