In 2021 global EV sales reached a

record-high of 6.9 million.

This constitutes a 107% increase from 2020 and represents the first time since 2012 that EV sales have doubled in a single year. 17% of all cars sold in Europe in 2021 were EVs. The electrification of (consumer) transport is well underway and yet, in the context of ambitious climate change targets, the pace of change is insufficient.

In addition, battery demand will come from numerous other sources, including those required to address intermittency issues associated with renewable energy production. Together, these processes will require an unprecedented volume of lithium extraction, processing and battery manufacturing. As a consequence, the battery value chain is in the spotlight like never before.

Investment is already flowing into battery and cathode manufacturing, as well as the subsequent manufacturing of EVs and utility-scale batteries by automakers and original equipment manufacturers (OEMs). Equally, investment in new raw material production is increasing, with new mines planned across North America, Europe and South America, albeit at a slower pace than is required to meet demand. However, there is a notable gap in the value chain; investment in lithium processing and conversion facilities is lagging far behind required capacity. Unless addressed, this will create a critical bottleneck in the production of battery-cells and a barrier to achieving net zero targets.

In this paper, we focus on the financing and development of new lithium processing and conversion facilities. We provide an overview of the current market and regulatory backdrop, the opportunities which are emerging in North America and Europe and how we can apply lessons learned in the downstream oil and gas and petrochemicals sectors to expedite the development of new facilities.

In 2021 global EV sales reached a record-high of 6.9 million.

This constitutes a 107% increase from 2020 and represents the first time since 2012 that EV sales have doubled in a single year. 17% of all cars sold in Europe in 2021 were EVs. The electrification of (consumer) transport is well underway and yet, in the context of ambitious climate change targets, the pace of change is insufficient.

In addition, battery demand will come from numerous other sources, including those required to address intermittency issues associated with renewable energy production. Together, these processes will require an unprecedented volume of lithium extraction, processing and battery manufacturing. As a consequence, the battery value chain is in the spotlight like never before.

Investment is already flowing into battery and cathode manufacturing, as well as the subsequent manufacturing of EVs and utility-scale batteries by automakers and original equipment manufacturers (OEMs). Equally, investment in new raw material production is increasing, with new mines planned across North America, Europe and South America, albeit at a slower pace than is required to meet demand. However, there is a notable gap in the value chain; investment in lithium processing and conversion facilities is lagging far behind required capacity. Unless addressed, this will create a critical bottleneck in the production of battery-cells and a barrier to achieving net zero targets.

In this paper, we focus on the financing and development of new lithium processing and conversion facilities. We provide an overview of the current market and regulatory backdrop, the opportunities which are emerging in North America and Europe and how we can apply lessons learned in the downstream oil and gas and petrochemicals sectors to expedite the development of new facilities.

It should be stressed that investment in these projects is required now; these are bespoke processing facilities, requiring sophisticated engineering and optimisation solutions, with long lead-times. If we do not find ways to facilitate investment in the short-term, then the effects will be felt throughout the battery ecosystem in the coming decade.

It should be stressed that investment in these projects is required now; these are bespoke processing facilities, requiring sophisticated engineering and optimisation solutions, with long lead-times. If we do not find ways to facilitate investment in the short-term, then the effects will be felt throughout the battery ecosystem in the coming decade.

The current market

China currently controls 65% of the world’s lithium processing infrastructure and is continuing to invest heavily, recognising its importance to the wider battery value chain.

This means that, even if the rest of the world is ramping up raw material, cathode and EV production, it still lags far behind China in terms of processing capability, creating a bottleneck which cannot be addressed overnight. Developing these facilities takes time and money and to move from final investment decision (FID) to full optimisation can take anywhere from five to 10 years – construction completion is not an end point.

The effect of this bottleneck is profound – demand will outstrip supply. At best, this will cause price increases for spodumene and brine concentrate, as well as processed lithium (i.e., lithium carbonate and lithium hydroxide monohydrate). At worst, it will create concerns over the security and independence of battery supply chains. Indeed, there is already growing concern from governments in the West that China’s stranglehold over processing capability could become a geo-political issue akin to that being experienced across energy markets in Europe as a result of recent events in Ukraine. This challenge wouldn’t necessarily require any nefarious action from China to become an issue either; the sheer scale of its carbon-neutral 2060 plans (including its own EV market) means that supply to Europe could be restricted simply by virtue of China electing to meet the needs of its own internal market first.

China’s electricity grid also remains significantly dependent on coal. Therefore, if the West continues to rely on China for its lithium processing needs it is difficult to argue that the EV and battery industry is meaningfully addressing climate change issues, rather than simply exporting a carbon footprint.

The current market

China currently controls 65% of the world’s lithium processing infrastructure and is continuing to invest heavily, recognising its importance to the wider battery value chain.

This means that, even if the rest of the world is ramping up raw material, cathode and EV production, it still lags far behind China in terms of processing capability, creating a bottleneck which cannot be addressed overnight. Developing these facilities takes time and money and to move from final investment decision (FID) to full optimisation can take anywhere from five to 10 years – construction completion is not an end point.

The effect of this bottleneck is profound – demand will outstrip supply. At best, this will cause price increases for spodumene and brine concentrate, as well as processed lithium (i.e., lithium carbonate and lithium hydroxide monohydrate). At worst, it will create concerns over the security and independence of battery supply chains. Indeed, there is already growing concern from governments in the West that China’s stranglehold over processing capability could become a geo-political issue akin to that being experienced across energy markets in Europe as a result of recent events in Ukraine. This challenge wouldn’t necessarily require any nefarious action from China to become an issue either; the sheer scale of its carbon-neutral 2060 plans (including its own EV market) means that supply to Europe could be restricted simply by virtue of China electing to meet the needs of its own internal market first.

China’s electricity grid also remains significantly dependent on coal. Therefore, if the West continues to rely on China for its lithium processing needs it is difficult to argue that the EV and battery industry is meaningfully addressing climate change issues, rather than simply exporting a carbon footprint.

What is being done?

In June, the United States, Australia, Canada, South Korea, Japan and many European countries established the Minerals Security Partnership to secure an alternative supply of critical metals to those sourced in China, including lithium.

What is being done?

In June, the United States, Australia, Canada, South Korea, Japan and many European countries established the Minerals Security Partnership to secure an alternative supply of critical metals to those sourced in China, including lithium.

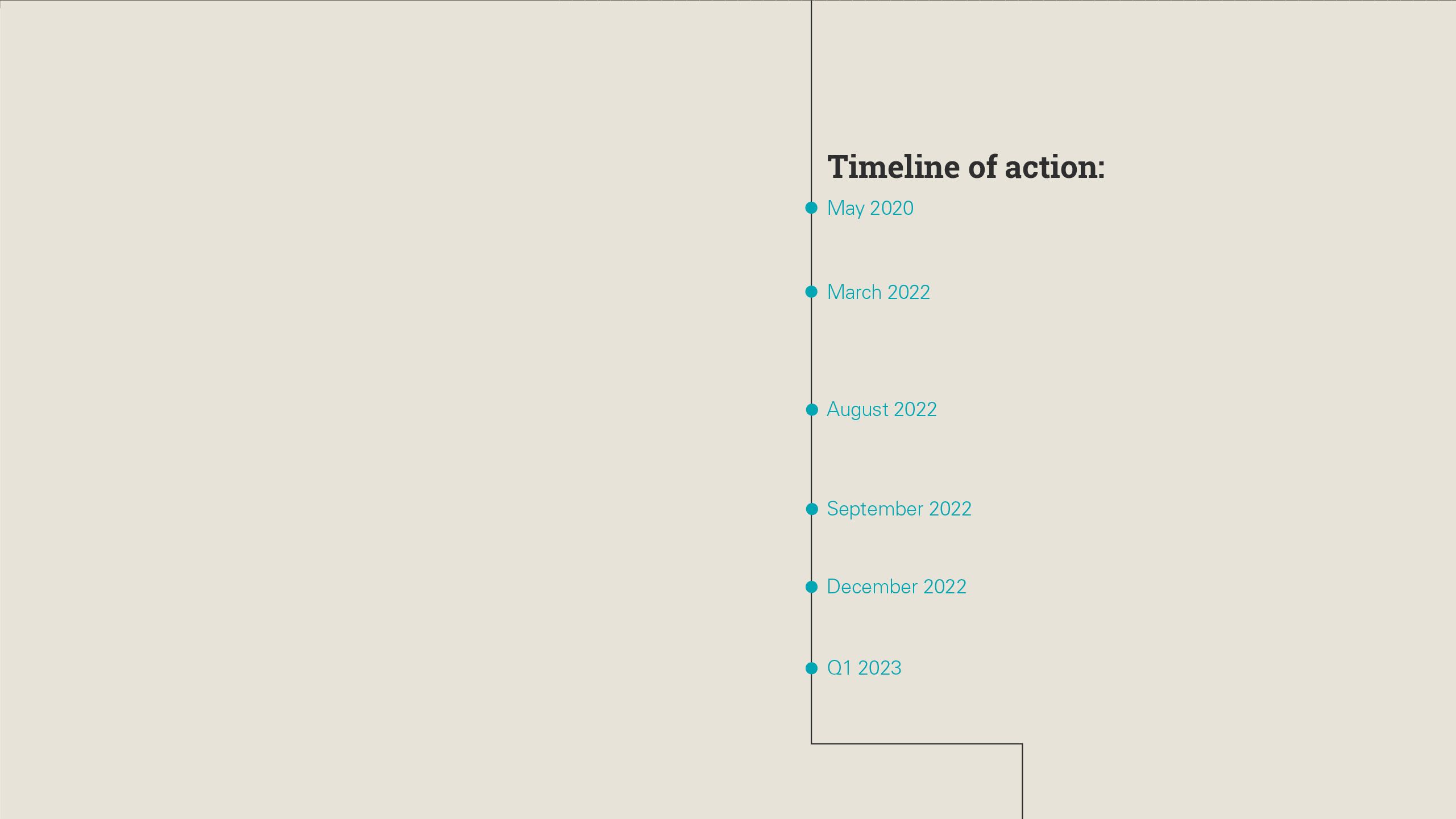

In August 2022, the U.S. pledged $370 billion for climate, clean energy and environmental justice projects, including domestic lithium mining and refining. This was followed in September by the European Commission’s (EC) announcement of the European Critical Raw Materials Act, with a goal to secure a reliable and robust supply chain for lithium and rare earths. These measures represent political headwinds seeking to reposition the battery value chain and stimulate lithium conversion and processing investment in the West. This creates a huge amount of opportunity, particularly for those who achieve first mover advantage. In addition, these political drivers are stimulating wider regulatory change.

In August 2022, the U.S. pledged $370 billion for climate, clean energy and environmental justice projects, including domestic lithium mining and refining. This was followed in September by the European Commission’s (EC) announcement of the European Critical Raw Materials Act, with a goal to secure a reliable and robust supply chain for lithium and rare earths. These measures represent political headwinds seeking to reposition the battery value chain and stimulate lithium conversion and processing investment in the West. This creates a huge amount of opportunity, particularly for those who achieve first mover advantage. In addition, these political drivers are stimulating wider regulatory change.

The current landscape is dynamic and recent legislation includes:

U.S. Inflation Reduction Act

This has significant ramifications for the battery industry, but chief amongst them is the introduction of a new clean vehicle tax credit. Critically, eligibility for this tax credit is based (in part) upon the critical minerals and batteries being sourced, processed and assembled in the U.S. or in countries with whom the U.S. has a free trade agreement. Whilst there is a significant amount of detail in the Inflation Reduction Act regarding the eligibility criteria (which go beyond the scope of this paper), the implication is that the U.S. needs to stimulate its own lithium conversion and processing sector. We are already seeing evidence of this.

European Union (EU) Batteries Regulation modernization

This has wide-reaching effects, but it includes the introduction of a cap on the carbon footprint of any battery. In addition, the measures propose a regulatory framework for collection and recycling targets and for sustainable and ethical material sourcing. This will have a major impact on the mining, processing and sourcing of the raw materials comprising any battery and therefore will be central to the business strategy of any developer of new lithium conversion and processing facilities.

Whilst the impact of such regulatory change is broad, the common features are a growing focus on the entirety of the battery supply chain, a desire to stimulate growth across all facets of that supply chain, and a desire for that supply chain to be as green as possible. For those interested in developing new processing capability, they will inevitably see these regulations as creating opportunity in the form of new, more localised partners and customers who actively want to buy processed lithium closer to battery manufacturing sites. This will be particularly pronounced if developers are able to power production through renewable energy sources (discussed further below). In the medium to longer-term, producers of lithium carbonate and lithium hydroxide monohydrate can expect increased scrutiny (and reporting requirements) from their customers as to the origin and carbon-intensity of their technology and raw materials. Plants will have to be designed with this in mind.

In addition, developers would do well to take note of the political risk which renewable energy generators in the United Kingdom and EU are currently experiencing.

In the face of the current energy supply crisis, renewable energy generators are finding themselves subject to windfall taxes which have been unilaterally imposed by governments across Europe. This is extremely rare in developed countries but raises the spectre of similar action being taken in the future in relation to other parts of the energy transition. For example, if a small amount of new lithium processing and conversion capacity was generated in Europe that gave a few participants the rights to dictate market pricing, there could be a risk (albeit hopefully small) of governments seeking to cap a developer’s upside if it is perceived to be holding back a wider decarbonisation agenda.

Whilst the impact of such regulatory change is broad, the common features are a growing focus on the entirety of the battery supply chain, a desire to stimulate growth across all facets of that supply chain, and a desire for that supply chain to be as green as possible. For those interested in developing new processing capability, they will inevitably see these regulations as creating opportunity in the form of new, more localised partners and customers who actively want to buy processed lithium closer to battery manufacturing sites. This will be particularly pronounced if developers are able to power production through renewable energy sources (discussed further below). In the medium to longer-term, producers of lithium carbonate and lithium hydroxide monohydrate can expect increased scrutiny (and reporting requirements) from their customers as to the origin and carbon-intensity of their technology and raw materials. Plants will have to be designed with this in mind.

In addition, developers would do well to take note of the political risk which renewable energy generators in the United Kingdom and EU are currently experiencing.

In the face of the current energy supply crisis, renewable energy generators are finding themselves subject to windfall taxes which have been unilaterally imposed by governments across Europe. This is extremely rare in developed countries but raises the spectre of similar action being taken in the future in relation to other parts of the energy transition. For example, if a small amount of new lithium processing and conversion capacity was generated in Europe that gave a few participants the rights to dictate market pricing, there could be a risk (albeit hopefully small) of governments seeking to cap a developer’s upside if it is perceived to be holding back a wider decarbonisation agenda.

There are a variety of issues that developers and financiers of new processing capability will need to navigate. These will inevitably require detailed and complex analysis (which goes beyond the scope of this paper), but the key issues include:

Operating model

At one end of the spectrum are developers operating a fully merchant ‘tolling’ facility. At the other end are those who will seek to buy spodumene or brine concentrate and sell the refined lithium hydroxide monohydrate or carbonate, thereby taking commodity price risk (on both the feedstock and offtake). Where the business sits along this spectrum will impact its overall risk profile and the nature of financing which it can expect to attract. It will also have a knock-on effect on the other key issues outlined below, particularly those regarding feedstock and commodity price exposure.

Feedstock

Volume certainty and chemical specification of feedstock is likely to be front and centre of any investment analysis. Investors and funders will wish to understand whether feedstock is coming from a single source or counterparty and the certainty of that supply. For example, how is that counterparty proposing to supply the facility? Is it a trader or producer? What does the credit analysis look like? How certain is supply given demand for lithium globally and what contractual protections are in place to prevent the supplier from simply breaching contract if it receives a better economic offer? If feedstock is expected to come from multiple sources then this potentially mitigates some of the concerns around volume and offtaker failure, but creates additional complexity if the resulting chemical specification is likely to be more varied. This may have implications for the ongoing optimisation of the plant (discussed below) and may necessitate some in-built design tolerance.

Ethical sourcing requirements are likely to feature in the near term, presenting challenges for conversion facilities relying on feedstock from multiple sources without fixed longer-term arrangements. Close attention will have to be paid to the labour conditions in countries in which raw materials are sourced and particularly the use of child labour. Certificates of origin, blockchain trackers and product passports are all terms we are likely to hear more about in the future.

Exposure to commodity price risk

Developer exposure to commodity price fluctuations, both in terms of feedstock and offtake, is critical. This is perfectly illustrated by the fact that the price of lithium has risen by approximately 600% in 12 months.

Any processing facility seeking debt finance whilst maintaining some level of pricing exposure will have to work through these issues with potential funders and can expect detailed market due diligence (namely the impact of new technologies, such as direct lithium extraction and recycling). The current gap in supply and demand means we could see more robust forecast pricing, which should support investment despite some degree of risk.

Offtake strategy

Achieving a binding, long-term, take or pay contract that has any degree of pricing certainty with an OEM or battery cell manufacturer is likely to be challenging (or potentially unattractive from an economic perspective). Whilst MoUs (memorandum of understanding) and framework agreements abound, these are not necessarily binding, long-term offtakes that can underpin a financing. There may be some possibility to achieve cap and collar structures that can enhance investment decisions, though only if feedstock costs are appropriately managed. Whilst typical project finance banks and export credit agencies (ECAs) may look for long-term certainty, we would suggest that parallels need to be drawn with the petrochemicals sector where it can be commonplace to achieve financial close without contracted offtake. There are lessons from the downstream oil and gas and petrochemicals sectors that can be transposed into a new lithium processing facility to facilitate investment and we would be happy to discuss these in more detail.

Mine integration

Some of the projects coming to market contemplate a ‘closed loop’ lithium solution, whereby a single company will develop a lithium mine and use the raw material produced from its mine as feedstock for its own processing and conversion facility. This has the potential to address certain issues regarding feedstock availability and specification but creates complexity, including ‘project on project risk’. Akin has experience addressing ‘project on project risk’ in the context of LNG (liquified natural gas), clean hydrogen and ‘infra off resource’ transactions. All of these are highly relevant precedents in the context of a closed loop lithium business.

Construction risk

Contracting frameworks will need to be carefully considered and the risk allocation of delay and cost overrun properly understood. The impact of construction delays on feedstock and offtake contracts will also need to be managed, particularly against a backdrop of other projects being late and over budget and losing anchor suppliers or customers as a result. There may be contractual and bespoke insurance solutions available to manage this risk.

Historically, there is precedent for fixed-price, turnkey engineering, procurement and construction (EPC) contracts in various process-based sectors, including lithium processing. However, in a growing sector with new technology and where delays and cost overruns have been highly publicised it may become more challenging to achieve these terms, particularly at economical rates. We are seeing the emergence of engineering, procurement and construction management (EPCm) contracting in this sector, which creates its own challenges in terms of interface, risk allocation and time and cost certainty, but when properly implemented can be an effective delivery tool.

Sustainability and power

Converting and processing lithium is energy intensive and manufacturing capacity of this scale requires a significant amount of stable and reliable power.

Whilst this creates some challenges regarding intermittency of supply, any dependency on fossil fuels may undermine the demand story or detract from the premium sometimes charged for a ‘green lithium’ product. The need for cheap and long-term renewable energy can be addressed in several ways, including through site location, a corporate PPA (power purchase agreement) or by co-locating a renewable energy source and battery storage system. Akin have experience assisting clients develop standalone renewable energy and Battery Energy Storage System (BESS) facilities or co-locating those with industrial plants or mine sites.

Sustainability considerations will also extend to the entire logistics and supply chain. Newer projects must plan ahead for likely future scrutiny, including the environmental impacts associated with extracting feedstock.

Waste material and by-products

The market for by-products from the refining process can have a material impact on project economics and sustainability credentials. For instance, there is a concern in certain quarters that the market outlook for sodium sulphate (a by-product of the sulphate process used to produce lithium hydroxide) is negative, as its main consumers (detergents and wood pulp industries) are shifting to alternative products. This could lead to material disposal costs for a project. Technological advances may see a shift away from the sulphate process to achieve lower production costs and more marketable by-products (e.g. nitrates and gypsum) to create financial upside for the project.

Allowing new plants/trains to come online and capacity expansions

Part of the short-term rationale for developing new processing and conversion capacity in North America or Europe is the ability to capitalize on first mover advantage and gain a material part of the value chain by subsequently expanding plant capacity or developing new trains or facilities. For investors and funders supporting the first plant, this will represent both an opportunity and a challenge. Whilst attracted by the potential for further growth, investors and funders will want to ensure there is no slippage of management focus and, ideally, that the first plant is operating at steady state before new facilities are developed (though this may not be commercially viable). In other sectors, such as mining and LNG, we have precedent for building in the flexibility to perform future expansions (and ‘baking’ this into financing documentation) subject to certain financial and technical tests being satisfied.

Mine integration

Some of the projects coming to market contemplate a ‘closed loop’ lithium solution, whereby a single company will develop a lithium mine and use the raw material produced from its mine as feedstock for its own processing and conversion facility. This has the potential to address certain issues regarding feedstock availability and specification but creates complexity, including ‘project on project risk’. Akin has experience addressing ‘project on project risk’ in the context of LNG (liquified natural gas), clean hydrogen and ‘infra off resource’ transactions. All of these are highly relevant precedents in the context of a closed loop lithium business.

Construction risk

Contracting frameworks will need to be carefully considered and the risk allocation of delay and cost overrun properly understood. The impact of construction delays on feedstock and offtake contracts will also need to be managed, particularly against a backdrop of other projects being late and over budget and losing anchor suppliers or customers as a result. There may be contractual and bespoke insurance solutions available to manage this risk.

Historically, there is precedent for fixed-price, turnkey engineering, procurement and construction (EPC) contracts in various process-based sectors, including lithium processing. However, in a growing sector with new technology and where delays and cost overruns have been highly publicised it may become more challenging to achieve these terms, particularly at economical rates. We are seeing the emergence of engineering, procurement and construction management (EPCm) contracting in this sector, which creates its own challenges in terms of interface, risk allocation and time and cost certainty, but when properly implemented can be an effective delivery tool.

Sustainability and power

Converting and processing lithium is energy intensive and manufacturing capacity of this scale requires a significant amount of stable and reliable power.

Whilst this creates some challenges regarding intermittency of supply, any dependency on fossil fuels may undermine the demand story or detract from the premium sometimes charged for a ‘green lithium’ product. The need for cheap and long-term renewable energy can be addressed in several ways, including through site location, a corporate PPA (power purchase agreement) or by co-locating a renewable energy source and battery storage system. Akin have experience assisting clients develop standalone renewable energy and Battery Energy Storage System (BESS) facilities or co-locating those with industrial plants or mine sites.

Sustainability considerations will also extend to the entire logistics and supply chain. Newer projects must plan ahead for likely future scrutiny, including the environmental impacts associated with extracting feedstock.

Waste material and by-products

The market for by-products from the refining process can have a material impact on project economics and sustainability credentials. For instance, there is a concern in certain quarters that the market outlook for sodium sulphate (a by-product of the sulphate process used to produce lithium hydroxide) is negative, as its main consumers (detergents and wood pulp industries) are shifting to alternative products. This could lead to material disposal costs for a project. Technological advances may see a shift away from the sulphate process to achieve lower production costs and more marketable by-products (e.g. nitrates and gypsum) to create financial upside for the project.

Allowing new plants/trains to come online and capacity expansions

Part of the short-term rationale for developing new processing and conversion capacity in North America or Europe is the ability to capitalize on first mover advantage and gain a material part of the value chain by subsequently expanding plant capacity or developing new trains or facilities. For investors and funders supporting the first plant, this will represent both an opportunity and a challenge. Whilst attracted by the potential for further growth, investors and funders will want to ensure there is no slippage of management focus and, ideally, that the first plant is operating at steady state before new facilities are developed (though this may not be commercially viable). In other sectors, such as mining and LNG, we have precedent for building in the flexibility to perform future expansions (and ‘baking’ this into financing documentation) subject to certain financial and technical tests being satisfied.

Availability of finance and conclusion

There is an indisputable need for new lithium processing and conversion facilities in North America and Europe.

Without this, the gap in the battery value chain will continue to grow and ultimately act as a bottleneck for achieving net zero targets (as well as creating broader geopolitical concerns). Fortunately, for the right projects there is both political and commercial support. We are seeing increasing appetite from private equity, private credit, commercial banks and multilaterals, all of whom are keen to support the sector provided that the key issues outlined above are appropriately managed. Whilst these are bespoke facilities, in most instances there is no need to reinvent the wheel. Solutions which have been successfully deployed in the downstream oil and gas and petrochemicals sectors can also be adopted to successfully deliver new projects in this space.

Key contacts for this piece

Daniel Giemajner

Partner

daniel.giemajner@akingump.com

London

T+44 20.7661.5521

F+44 20.7012.9601

v-card

Matt Hardwick

Partner

matt.hardwick@akingump.com

London

T+44 20.7661.5533

F+44 20.7012.9601

v-card

Wider Akin Gump contacts

Ike Emehelu

Partner

iemehelu@akingump.com

New York

T+1 212.872.8182

F+1 212.872.1002

v-card

Alex Harrison

Partner

alex.harrison@akingump.com

London

T+44 20.7661.5532

F+44 20.7012.9601

v-card

Matthew Kapinos

Partner

mkapinos@akingump.com

Houston

T+1 713.250.2117

F+1 713.236.0822

v-card

Shaun Lascelles

Partner

shaun.lascelles@akingump.com

London

T+44 20.7012.9839

F+44 20.7012.9601

v-card

Simon Rootsey

Partner

simon.rootsey@akingump.com

London

T+44 20.7012.9838

F+44 20.7012.9601

v-card

Our practice and experience

Akin acts across the whole battery value chain, from mining companies on the extraction of raw materials, to developers of lithium processing facilities, gigafactory developers, car manufacturers, feedstock suppliers, financial institutions, private equity funds, private credit funds and traders, all of whom value our ability to navigate issues (such as those discussed above) in a commercial and pragmatic manner. What separates us from our peers is our knowledge of the whole value chain, and our ability to deliver a single team of experienced professionals to support a project located anywhere in the world. We’re able to advise on every aspect of processing development from inception, through design, engineering and planning, to financing and decommissioning. Our areas of focus include construction, licensing, feedstock supply, offtake arrangements, joint ventures, M&A, project finance, debt finance and alternative mine finance, as well as disputes, restructuring and investigations.