Green Mortgages

A Rostrum thought leadership report for the

Intermediary Mortgage Lenders Association

Introduction

Over the last few decades, environmental issues have been rising up the political agenda as people across the globe recognise the challenges posed by climate change. More frequent and extreme weather patterns such as severe flooding, devastating wildfires and rising sea levels have further heightened the awareness of environmental pressures and the effect that inaction on these issues could have in the future.

In 2019, the UK Government committed to taking real action to make Britain carbon neutral by 2050. Tackling fossil fuels and encouraging a switch from petrol or diesel cars to electric were part of the 2050 plan, but reducing the country’s carbon emissions by addressing inefficient housing stock has also become an area the Government is seeking to address.

The onset of the coronavirus pandemic has served to intensify this further, with the natural world enjoying some respite from human activities as a result of government-imposed lockdown measures. Reports of more wildlife sightings outside usual habitats and within town centres have become commonplace, while less movement on a global and domestic scale has resulted in a significant reduction in pollution and improved water and air quality throughout the world.

However, as countries slowly start to emerge from lockdown, there have been calls to ensure that we do not forget the lessons learned from Covid-19 as we start to rebuild economies. Issues such as being less wasteful, achieving greater sustainability and the decarbonisation of the economy have been brought to the forefront of people’s minds, while the hashtag #buildbackbetter has been trending on social media in the UK as people strive to highlight the significance of creating future jobs, cities and homes that help to fight the climate crisis.

Thank you to all those who contributed to the research programme for Green Mortgages – lenders, brokers and customers - and to the team at Rostrum for pulling it all together into this report. We hope you find the results interesting – the insights and findings will certainly inform our discussions with the Government and other stakeholders in the coming months.

Climate concerns

Prior to the onset of Covid-19, growing concerns on issues relating to climate change had already led to greater awareness about the need to create more energy efficient homes and green financial products, such as green mortgages.

First outlined in the UK government’s 2017 blueprint for a low carbon future, Clean Growth Strategy, green mortgages offer borrowers preferential terms if they can demonstrate that the property for which they are borrowing meets certain environmental standards.

For some, this could be an energy efficient new build home, while for others it could be a commitment from the borrower to invest in renovating an existing building to improve its environmental performance. The incentive for borrowers is a lower interest rate or higher loan amount from their lender.

The rationale behind the products is that those living in such properties would receive a preferential rate from their lender as they are less likely to default on their mortgages repayments due to savings made on energy bills.

While there is logic behind this train of thought, and a clear financial incentive for borrowers to take out a green mortgage, the green mortgage market is still in its infancy, accounting for a very small proportion of the UK’s circa £265bn mortgage market{{1}}{{{The new ‘normal’ - prospects for 2020 and 2021, IMLA </br> Source: IMLA }}}.

However, with more companies seeking to improve their energy efficiency and carbon footprint, coupled with the lessons learned from Covid-19, green mortgage products may become more mainstream.

Climate concerns

Prior to the onset of Covid-19, growing concerns on issues relating to climate change had already led to greater awareness about the need to create more energy efficient homes and green financial products, such as green mortgages.

First outlined in the UK government’s 2017 blueprint for a low carbon future, Clean Growth Strategy, green mortgages offer borrowers preferential terms if they can demonstrate that the property for which they are borrowing meets certain environmental standards.

For some, this could be an energy efficient new build home, while for others it could be a commitment from the borrower to invest in renovating an existing building to improve its environmental performance. The incentive for borrowers is a lower interest rate or higher loan amount from their lender.

The rationale behind the products is that those living in such properties would receive a preferential rate from their lender as they are less likely to default on their mortgages repayments due to savings made on energy bills.

While there is logic behind this train of thought, and a clear financial incentive for borrowers to take out a green mortgage, the green mortgage market is still in its infancy, accounting for a very small proportion of the UK’s circa £265bn mortgage market{{1}}{{{The new ‘normal’ - prospects for 2020 and 2021, IMLA

Source: IMLA }}}.

However, with more companies seeking to improve their energy efficiency and carbon footprint, coupled with the lessons learned from Covid-19, green mortgage products may become more mainstream.

“People are increasingly conscious of their carbon footprint and how to reduce it, and with homes being responsible for one-quarter of UK carbon emissions, the housing market is a sharp area of focus.”

Craig McKinlay, New Business Director, Kensington Mortgages

Green shoots

Although the green mortgage sector and the wider green finance market is still in its infancy, it is a growing part of the UK financial services sector. Over the last two years, there have been a number of developments in the green finance space that illustrate both the UK government’s commitment to creating more energy efficient homes and the willingness of the finance industry to embrace its role in delivering global and climate change objectives.

In July 2019, the UK government set itself the tough target of being a carbon net zero economy by 2050, meaning a drastic reduction in carbon emissions from homes, transport, farming and industry is needed in the next 30 years. Its Green Finance Strategy, which outlined plans for a £5 million fund to help the financial sector develop green home finance products, like green mortgages, swiftly followed.

Since then, a small number of green mortgages have been launched. The first High Street lender to launch into this market was Barclays in April 2018, in a move which saw the bank offer green mortgages on new build properties with an energy efficient rating of 81 and above or with an energy efficiency band of A or B.

Soon after, a handful of additional lenders have followed suit, including Nationwide, Saffron Building Society and Kensington Mortgages, with other lenders intending to launch a green mortgage product in the future.

Growth of the market

In a bid to discover how the green mortgage market is faring two years since the first product launch, the Intermediary Mortgage Lenders Association (IMLA) conducted research into the current state of green mortgages in the UK.

Garnering the views of consumers, lenders and brokers, IMLA’s research aims to understand the current demand for green products, the challenges facing borrowers, lenders and brokers, and what the future could hold for the green mortgage market.

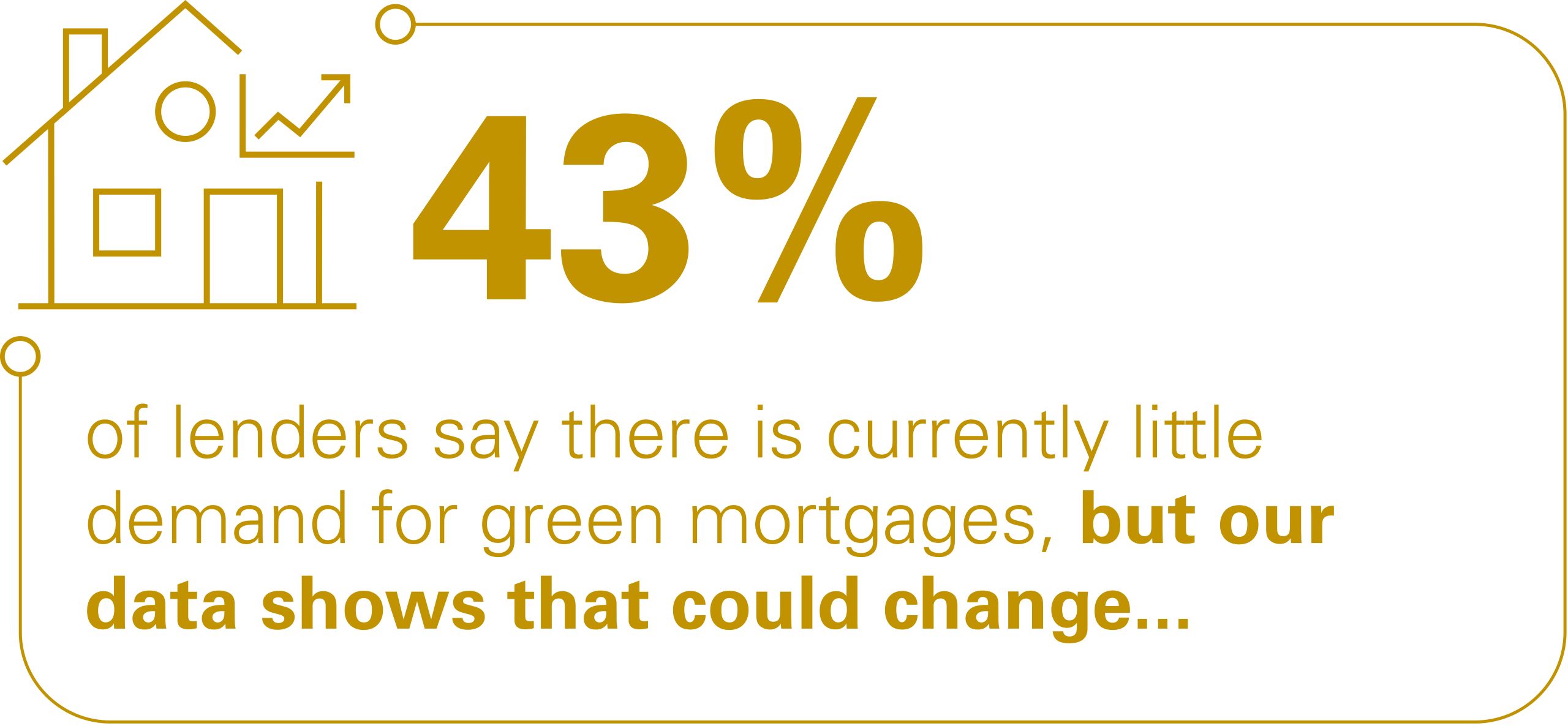

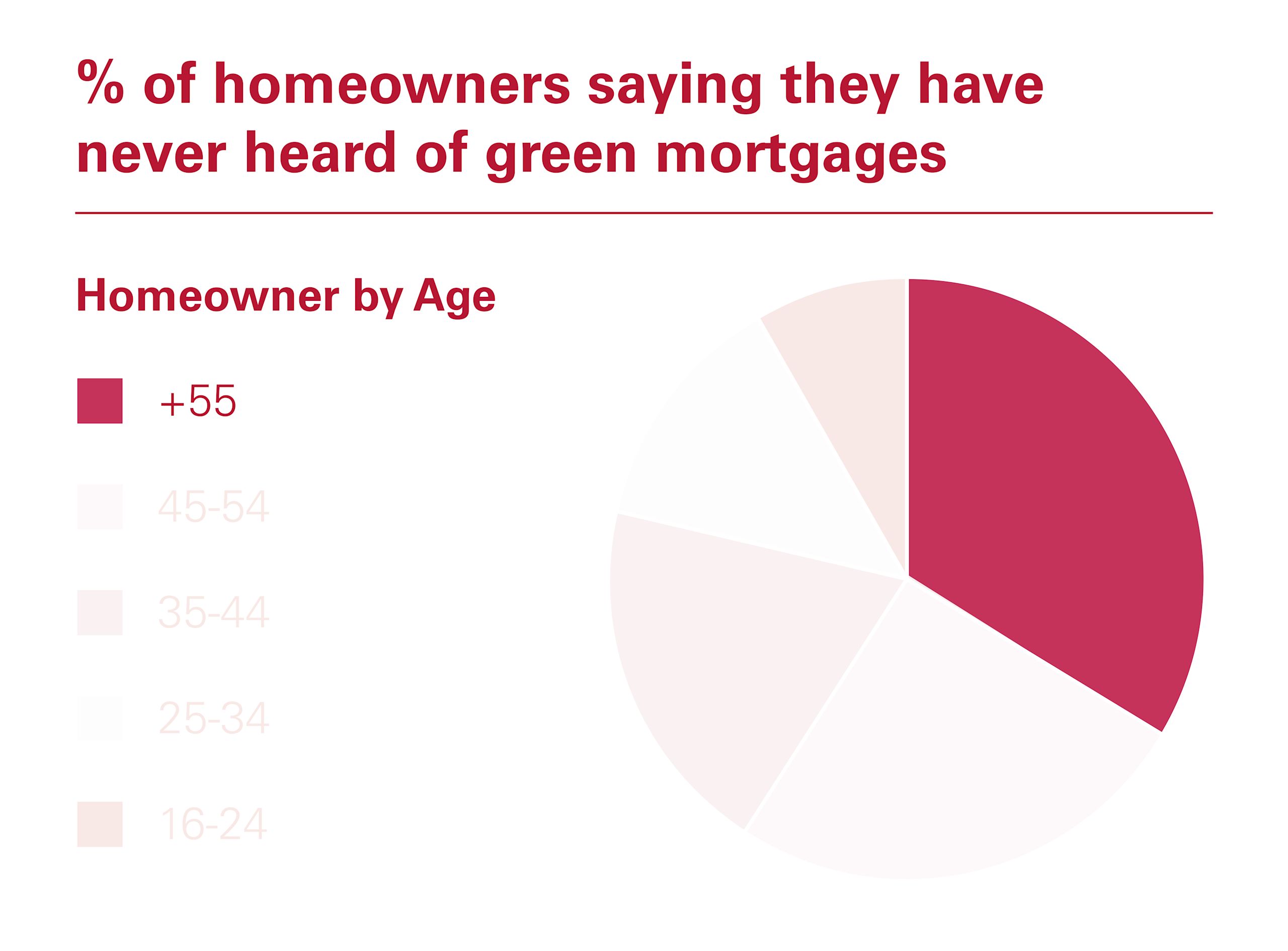

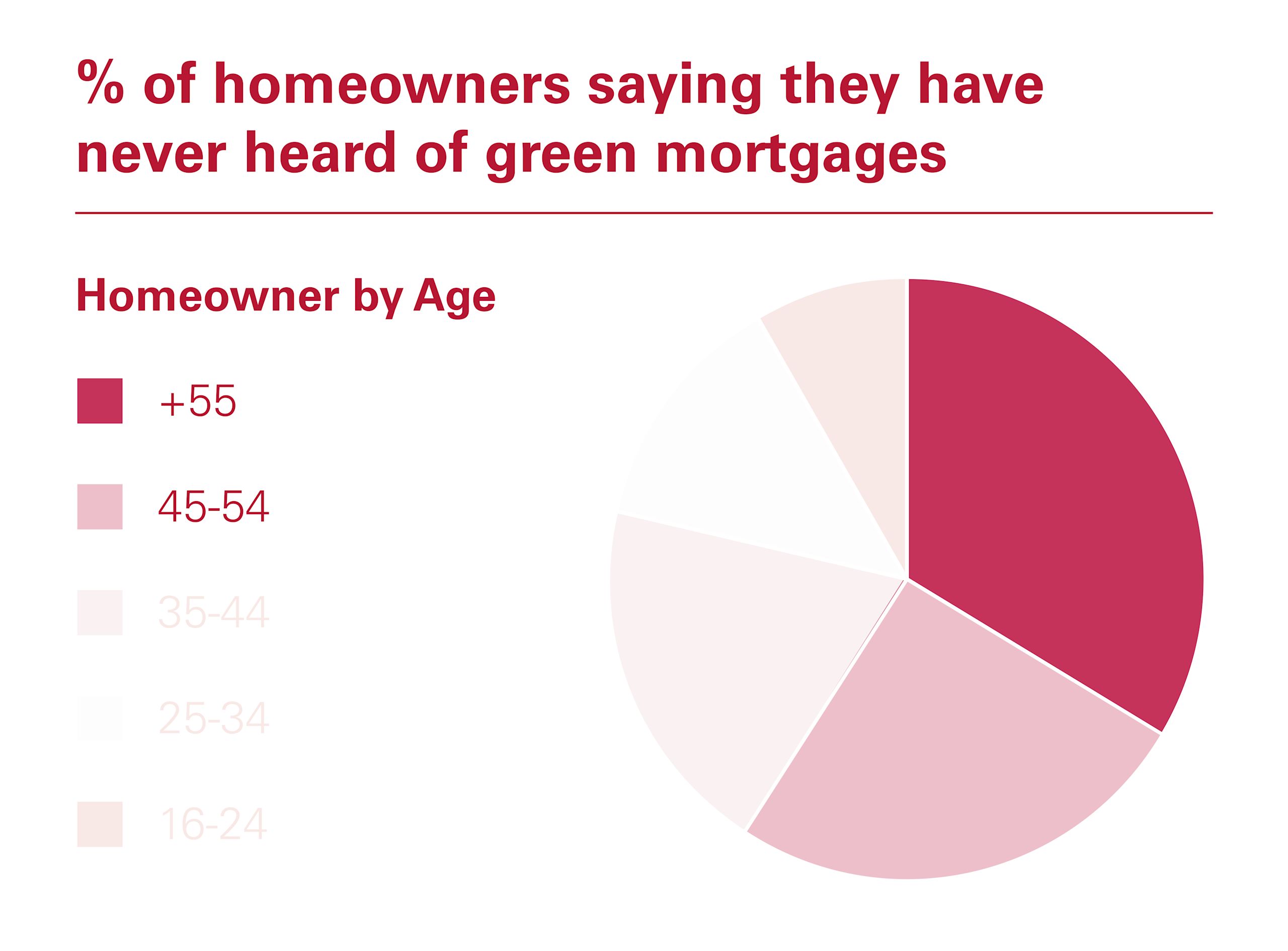

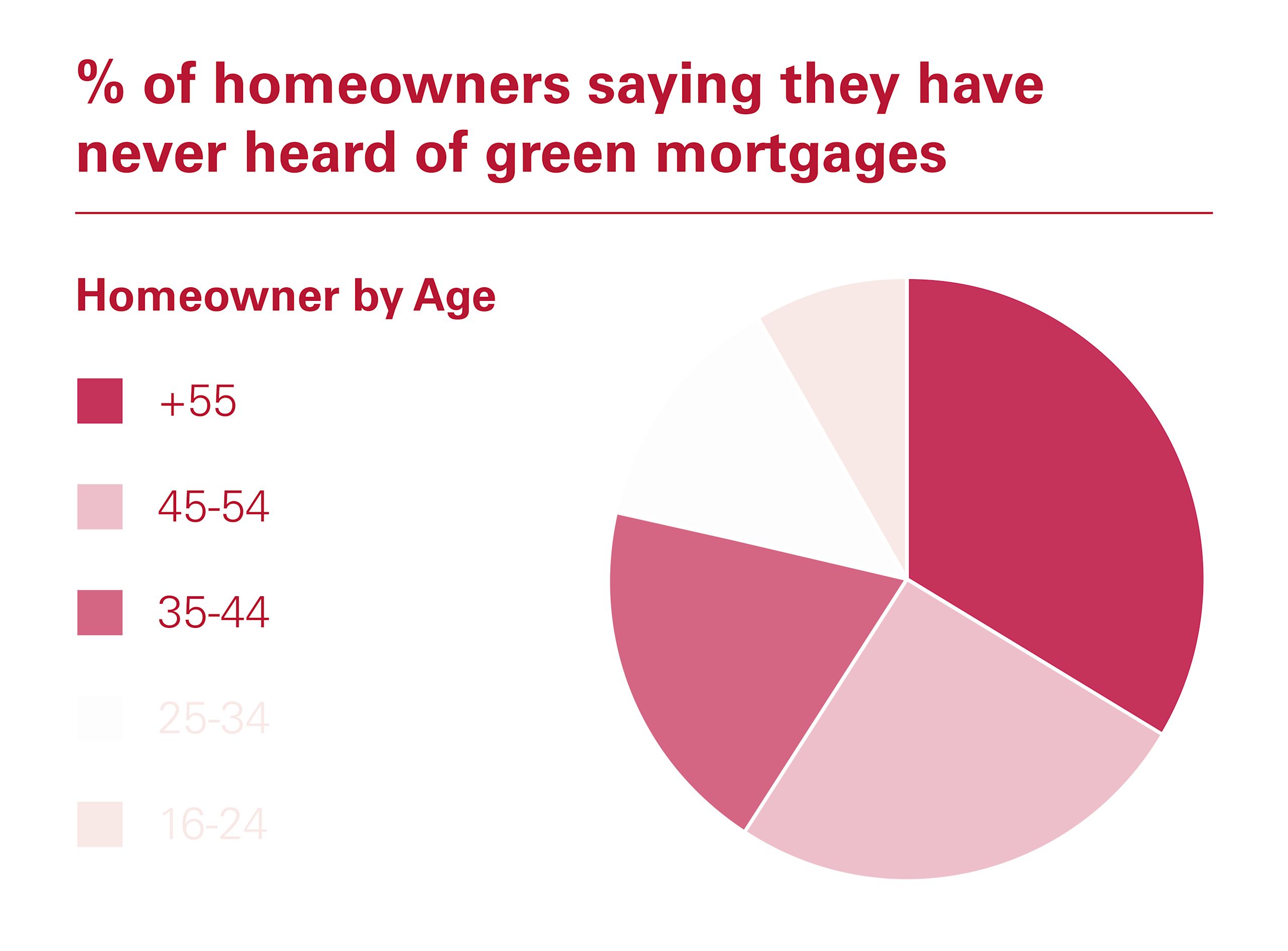

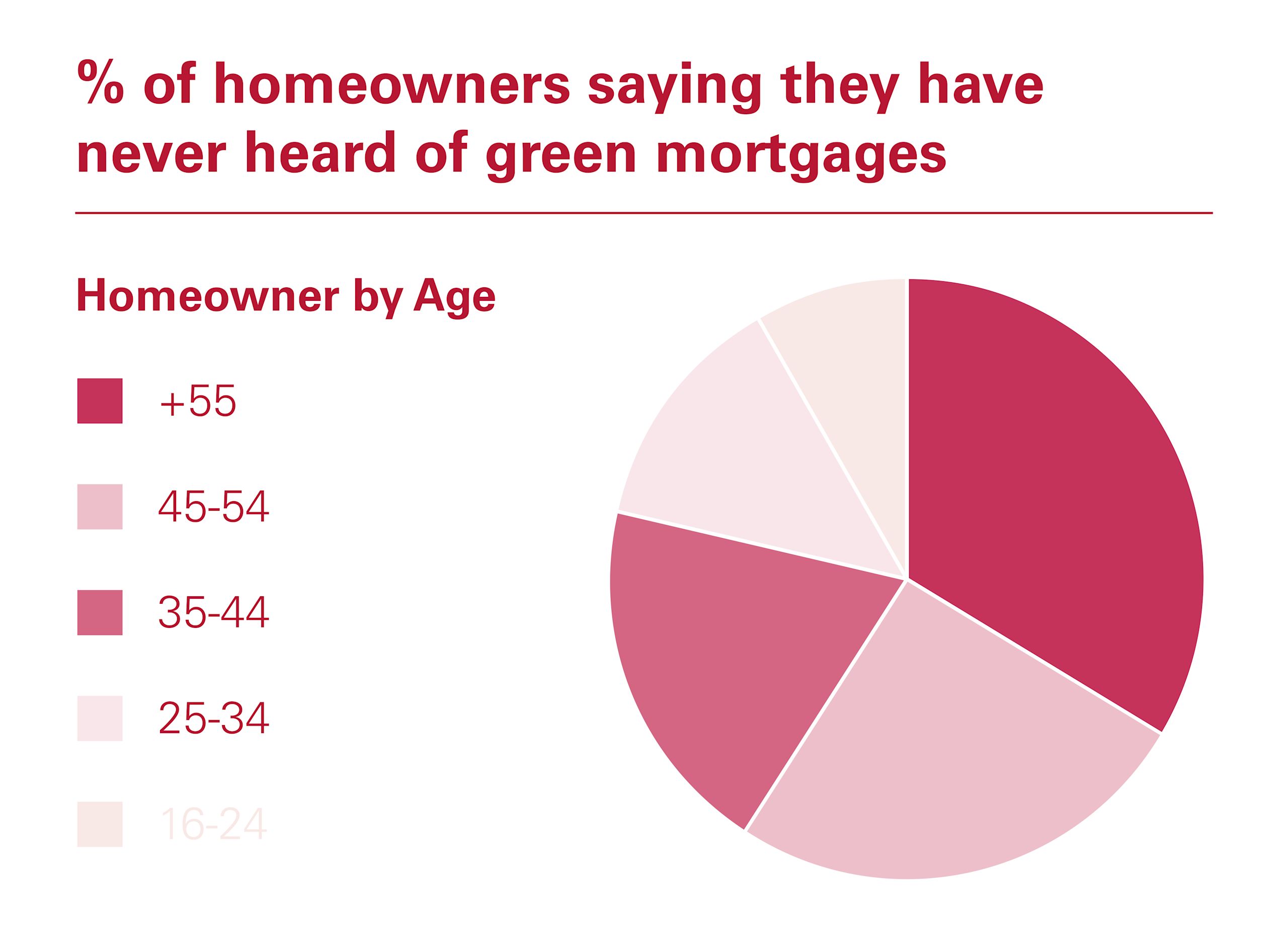

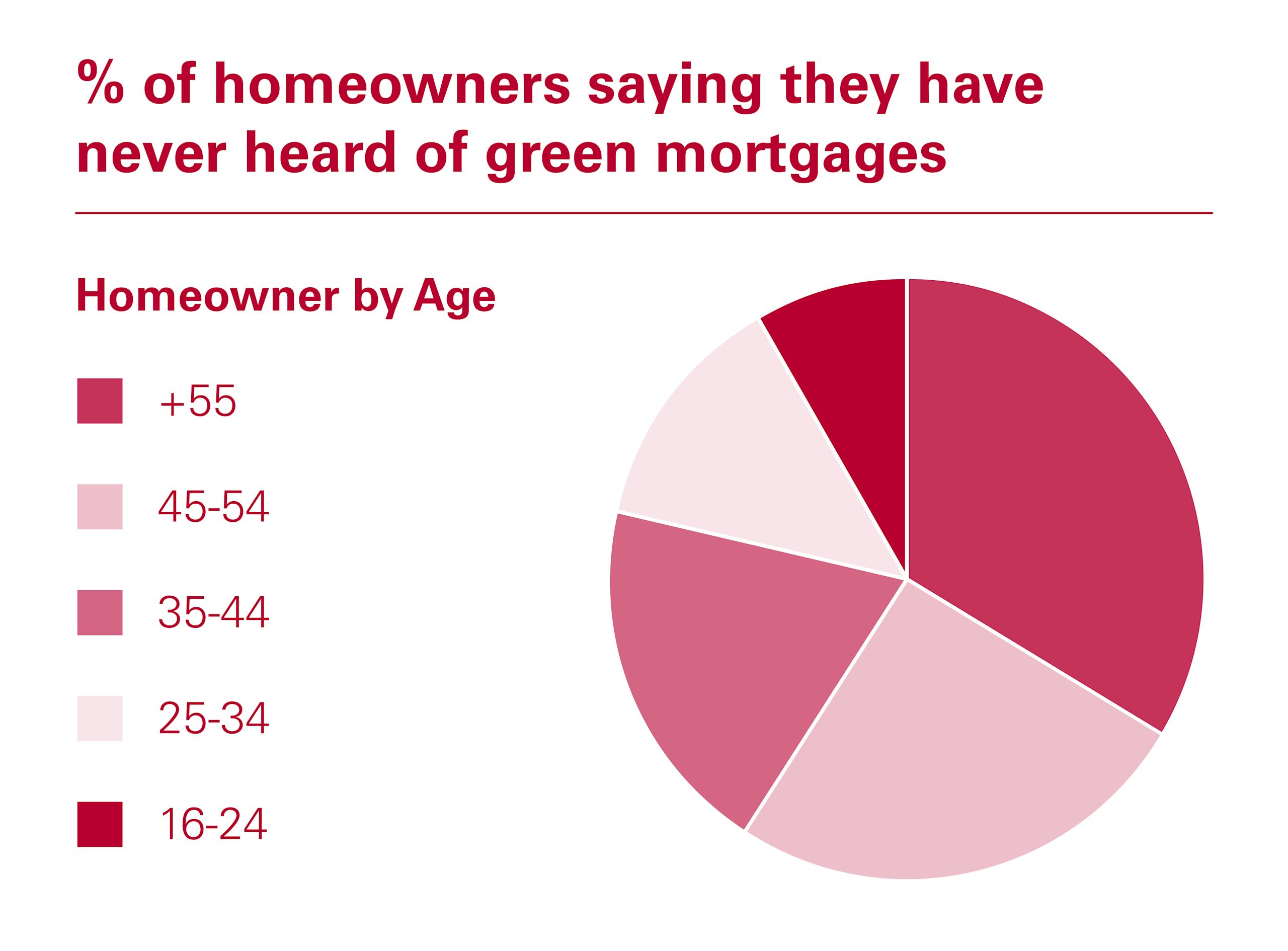

As expected, the research found that there is an ongoing lack of customer awareness about green finance products. 43% of consumers have never heard of a green mortgage. This is unsurprising given the infancy of the sector, which has only really seen a small number of players come to market in the last 12 months.

Similarly, borrowers on three and five-year term mortgages are unlikely to have conducted a search of the market if they have not yet come to the end of their current term, and are therefore unlikely to have come across any newly launched green products.

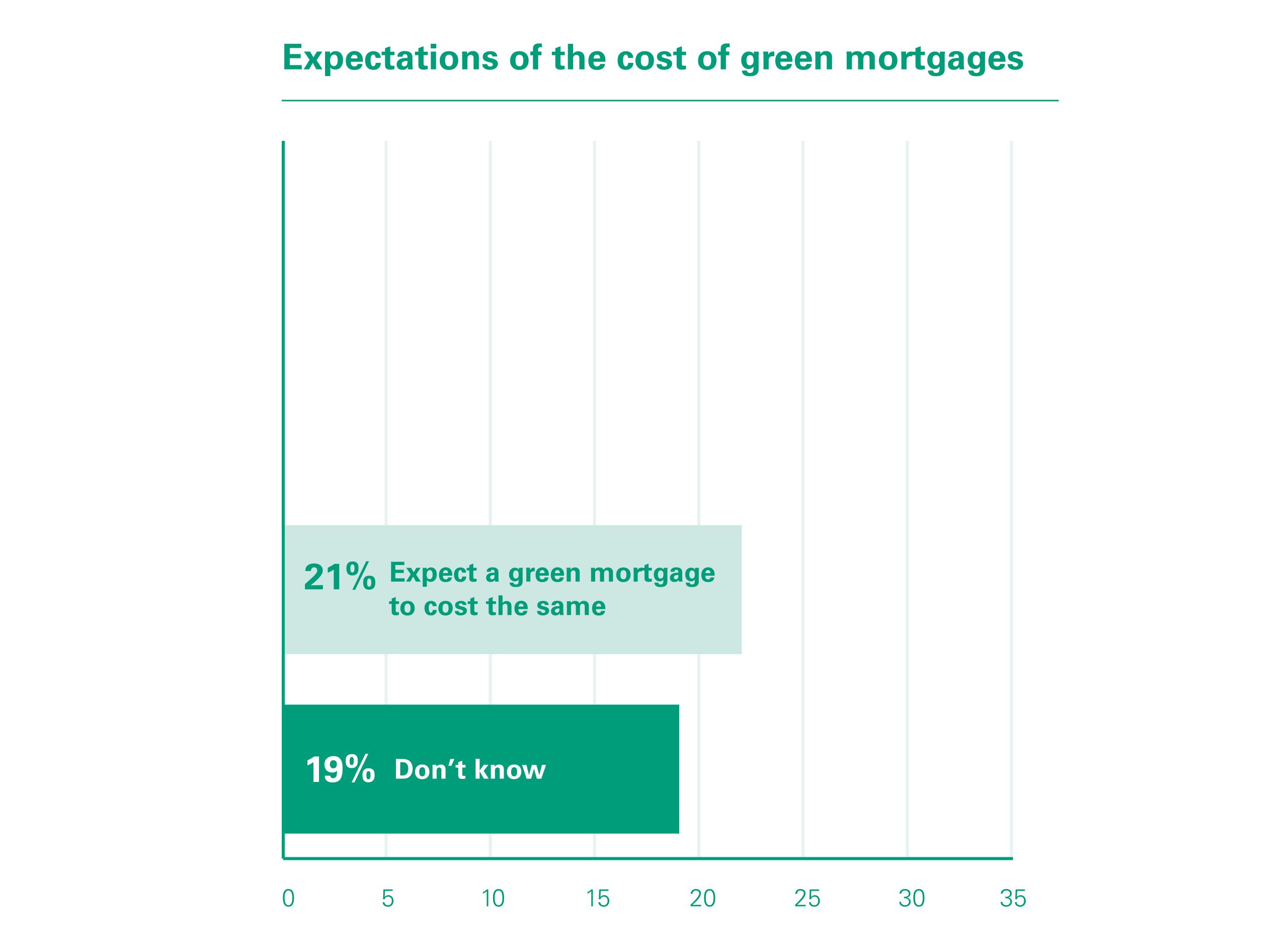

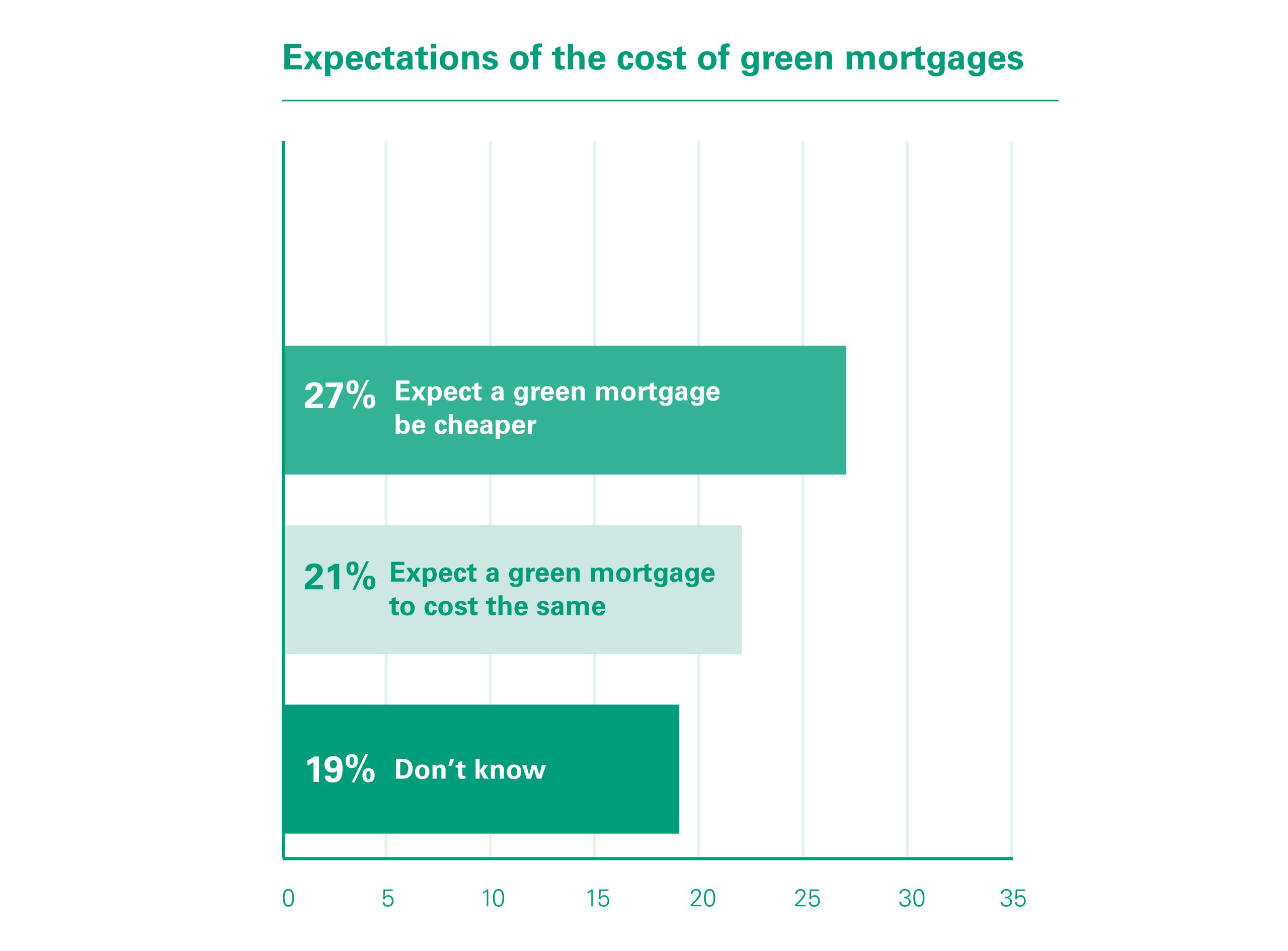

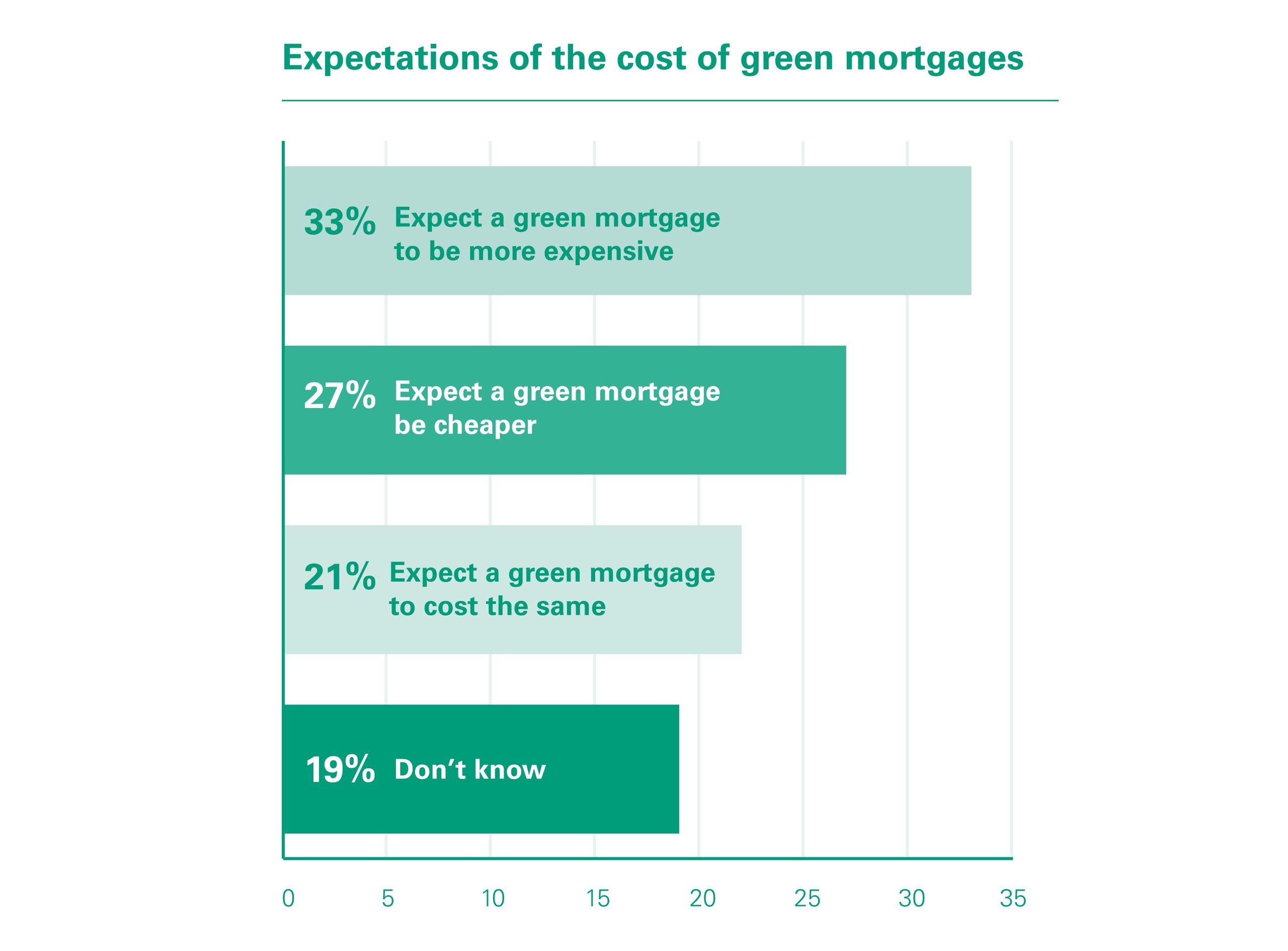

Interestingly, when it comes to the costs associated with taking out a green mortgage, a third of consumers (33%) said they would expect the products to be more expensive than a typical mortgage offering, while one in five (20%) said they would be willing to pay an extra £100 a month in repayments for taking out a green mortgage, if it helped to lower their carbon footprint.

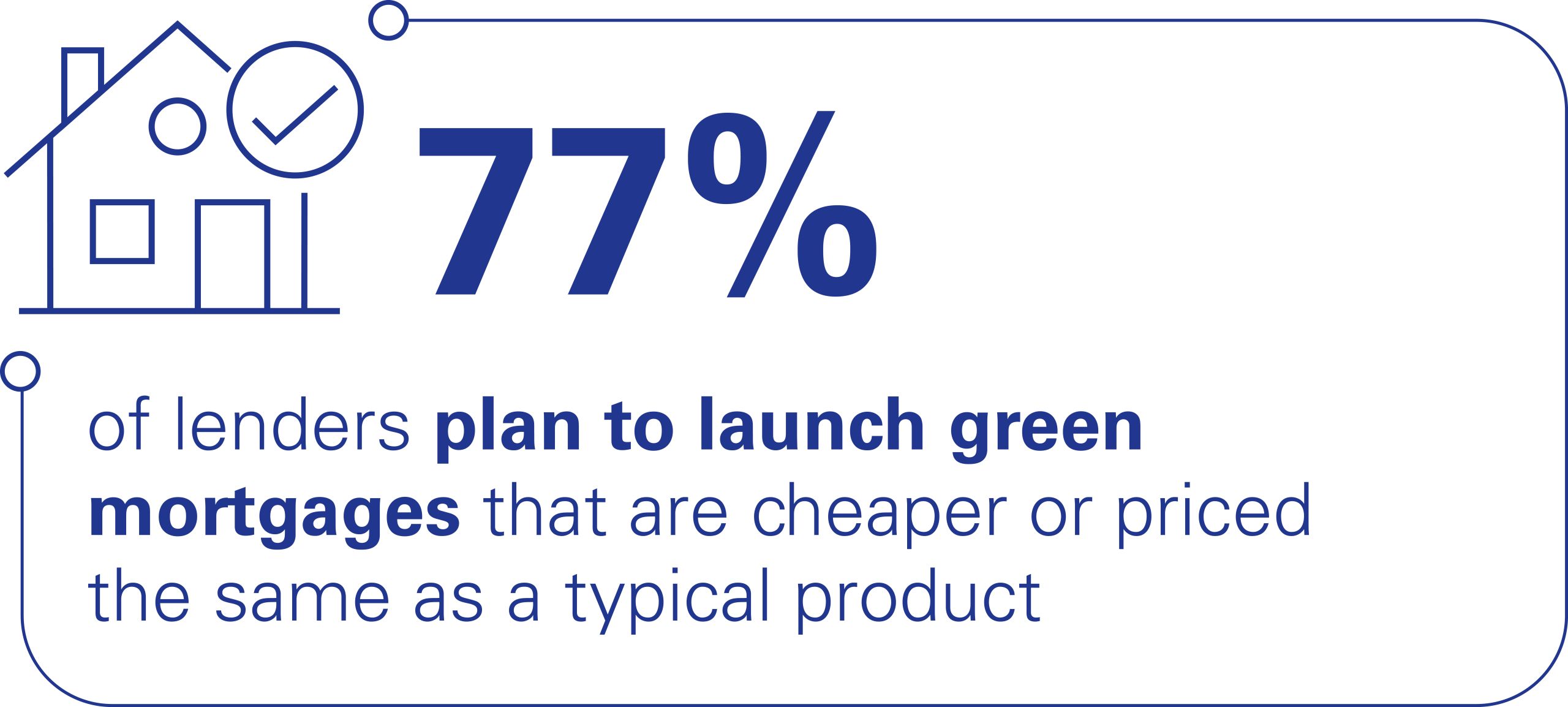

However, despite the perception that green mortgages would cost more than a conventional product, the research showed that the opposite is in fact true. Two-thirds of lenders (65%) responding to the survey said they have launched or plan to launch products that cost the same as a conventional mortgage product, while 12% have already launched options that are cheaper. A quarter (24%) said they are yet to decide on a price point.

Growth of the market

In a bid to discover how the green mortgage market is faring two years since the first product launch, the Intermediary Mortgage Lenders Association (IMLA) conducted research into the current state of green mortgages in the UK.

Garnering the views of consumers, lenders and brokers, IMLA’s research aims to understand the current demand for green products, the challenges facing borrowers, lenders and brokers, and what the future could hold for the green mortgage market.

As expected, the research found that there is an ongoing lack of customer awareness about green finance products. 43% of consumers have never heard of a green mortgage. This is unsurprising given the infancy of the sector, which has only really seen a small number of players come to market in the last 12 months.

Similarly, borrowers on three and five-year term mortgages are unlikely to have conducted a search of the market if they have not yet come to the end of their current term, and are therefore unlikely to have come across any newly launched green products.

Interestingly, when it comes to the costs associated with taking out a green mortgage, a third of consumers (33%) said they would expect the products to be more expensive than a typical mortgage offering, while one in five (20%) said they would be willing to pay an extra £100 a month in repayments for taking out a green mortgage, if it helped to lower their carbon footprint.

However, despite the perception that green mortgages would cost more than a conventional product, the research showed that the opposite is in fact true. Two-thirds of lenders (65%) responding to the survey said they have launched or plan to launch products that cost the same as a conventional mortgage product, while 12% have already launched options that are cheaper. A quarter (24%) said they are yet to decide on a price point.

The impact of Covid-19

There is no doubting the impact of the coronavirus pandemic on the UK housing industry, with lockdown in particular bringing the market to a standstill, before a stamp duty freeze helped to inject some much needed, but possibly short-lived life into the housing market.

And with the threat of a recession looming and many people worrying about their jobs and homes going forward, homeowners may start to look at ways to improve their existing homes rather than run the risk of moving in a time of uncertainty.

With this in mind, the IMLA research considered the longer-term impact of Covid-19 on the housing market and asked survey respondents whether the pandemic could help to spearhead growth in green mortgages as homeowners stay put and look to make energy-saving efficiencies to their homes.

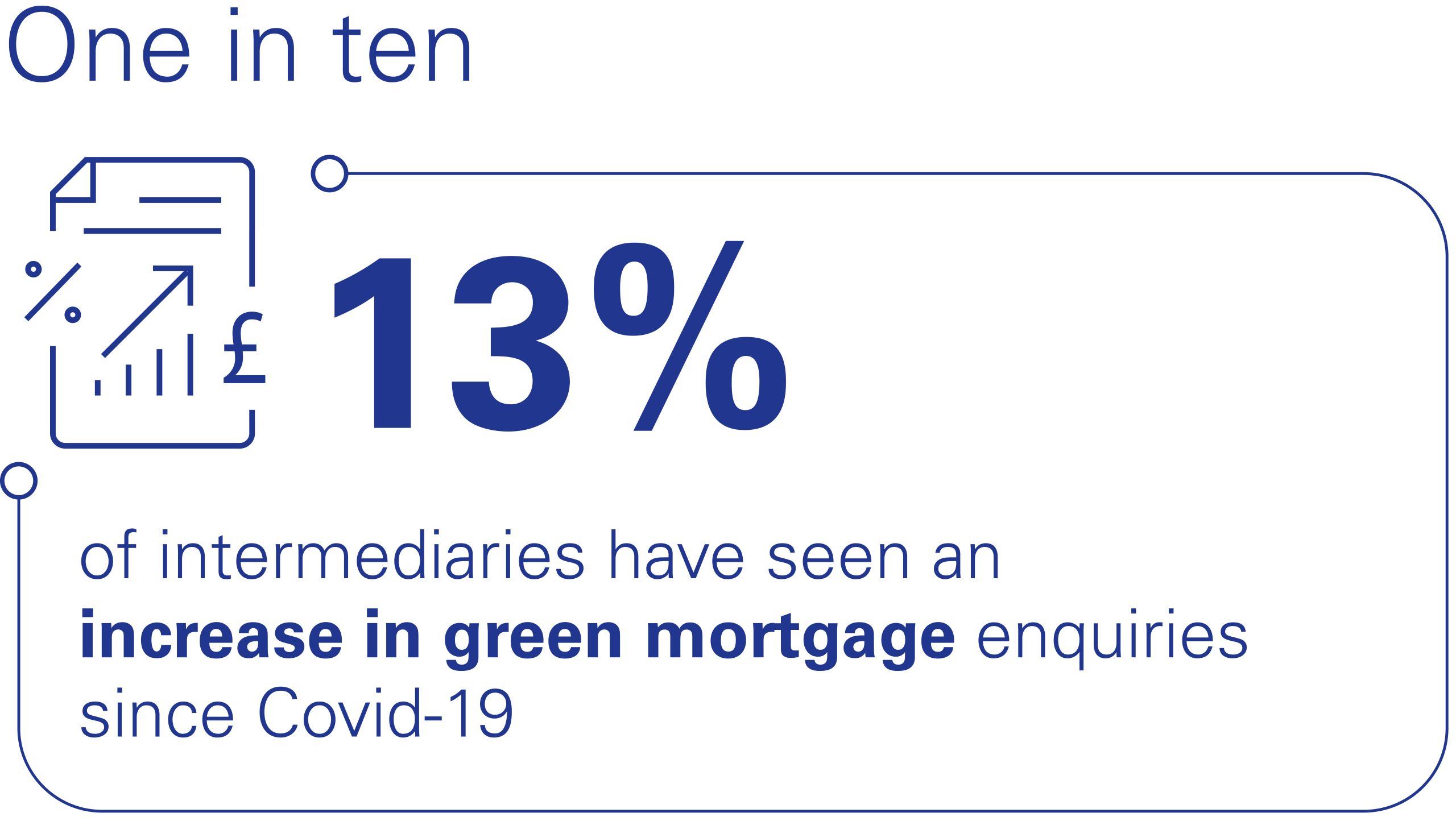

The findings show that one in ten (13%) brokers said they have seen an increase in enquiries for green mortgages post Covid-19. This follows 15% of brokers who had already received enquiries from clients about green mortgages or had clients take out the products prior to the coronavirus pandemic.

Unsurprisingly, given the infancy of the green mortgage market, 92% said they have seen no change to the level of enquiries about green mortgages, suggesting more needs to be done to improve awareness among consumers.

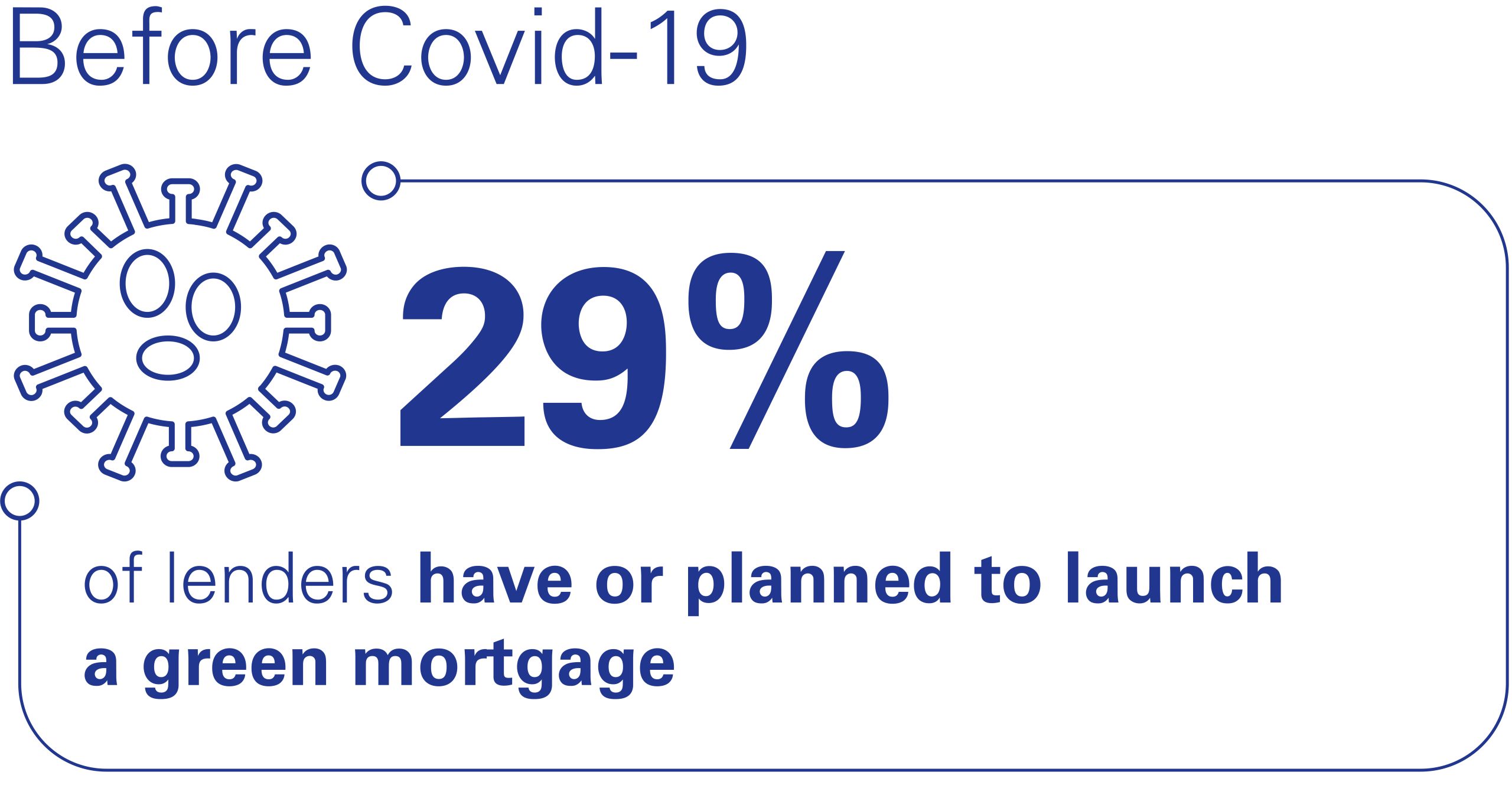

However, awareness of green mortgages may improve going forward as more lenders come to market, increasing both the number of green mortgage offerings and market competition. In total, the research found that 57% of lenders surveyed confirmed that they still plan to launch a green mortgage offering post Covid-19. This is compared to the 17% who had already launched a product prior to the outbreak of the coronavirus pandemic.

Interestingly, over a quarter (29%) of lenders surveyed said they had launched or planned to launch a mortgage that is only available to properties with an EPC C rating and above. A mortgage that provides a financial incentive such as vouchers for buyers to make their homes more energy efficient was outlined as being a key product feature by 21% of lenders when launching a green mortgage offering

“Providing logical incentives, staying innovative with green product development and producing marketing that educates borrowers on the simple yet effective ways to improve the energy efficiency of a home, is a winning combination to making steady strides towards the further adoption of green mortgages.”

Matthew Tooth, Chief Commercial Officer, LendInvest

Demand for green mortgages

Although green mortgages is still very much a young market, the research showed that despite a lack of awareness among consumers, both lenders and brokers were optimistic about the growth of the green mortgage sector in the future.

It found that the majority of lenders (74%) still expect demand for green mortgages to grow over the next few years, with 83% expecting the ability to save money on energy bills as being the biggest driver behind market growth.

Indeed, saving money on energy bills was in fact cited as the biggest driver behind the preparedness to take out a green mortgage by 53% of consumers, followed by making energy improvements to their homes (43%). Accessing better mortgage rates was cited as a key driver for 29% of consumers, with just 9% of borrowers saying they would only take out a green mortgage if it were mandatory.

Mortgage brokers responding to the survey said they also expect to see an uptick in the number of borrowers taking out green mortgages, with 58% saying they expect demand for the products to grow in the next few years.

This is in line with the findings that more than a third (35%) of brokers plan to advise on these products more often in the future, compared to 2% currently. It is also reflective of the fact that a combination of factors such as an increased number of lenders offering green mortgages, government initiatives such as the Green Homes Grant Scheme and increased funding are likely to create greater awareness of the sector.

Demand for green mortgages

Although green mortgages is still very much a young market, the research showed that despite a lack of awareness among consumers, both lenders and brokers were optimistic about the growth of the green mortgage sector in the future.

It found that the majority of lenders (74%) still expect demand for green mortgages to grow over the next few years, with 83% expecting the ability to save money on energy bills as being the biggest driver behind market growth.

Indeed, saving money on energy bills was in fact cited as the biggest driver behind the preparedness to take out a green mortgage by 53% of consumers, followed by making energy improvements to their homes (43%). Accessing better mortgage rates was cited as a key driver for 29% of consumers, with just 9% of borrowers saying they would only take out a green mortgage if it were mandatory.

Mortgage brokers responding to the survey said they also expect to see an uptick in the number of borrowers taking out green mortgages, with 58% saying they expect demand for the products to grow in the next few years.

This is in line with the findings that more than third (35%) of brokers plan to advise on these products more often in the future, compared to 2% currently. It is also reflective of the fact that a combination of factors such as an increased number of lenders offering green mortgages, government initiatives such as the Green Homes Grant Scheme and increased funding are likely to create greater awareness of the sector.

“Lenders could stimulate the growth of the green mortgage market by offering discounted rates for homeowners who bring the energy performance rating up to a high standard, switch their boiler to a heat pump, or decide to add a green roof to the property. However, these types of features would likely be offered on variable rate products, which are not suitable for every customer.”

Alex Smith, Capricorn Financial Consultancy

“To us, it’s clear that green mortgages will only grow in popularity and there is a window of opportunity here for lenders to develop innovative products which incentivise people to save money and reduce their household emissions.”

Craig McKinlay, Kensington Mortgages

Barriers to success

As with all attempts at innovation, green mortgages have come under fire from those who believe the market has too many barriers to entry. Lack of awareness, the length of time required to reap the rewards and mismatched incentives in the case

of tenants and landlords, where the person making the investment is not necessarily the one to benefit, are all potential barriers to market growth and ultimately, the creation of more energy efficient homes in the UK.

Similarly, while building new carbon-neutral housing is vitally important, for others it is the improvements – or lack thereof – to 29 million existing homes in the UK that could prove most problematic. Indeed, a key barrier to the growth of the green mortgage market is frequently cited as being the cost of home improvements to create greater efficiencies in older properties{{2}}{{{K housing: Fit for the future? Committee for Climate Change, February 2019.</br>Source: The CCC}}}.

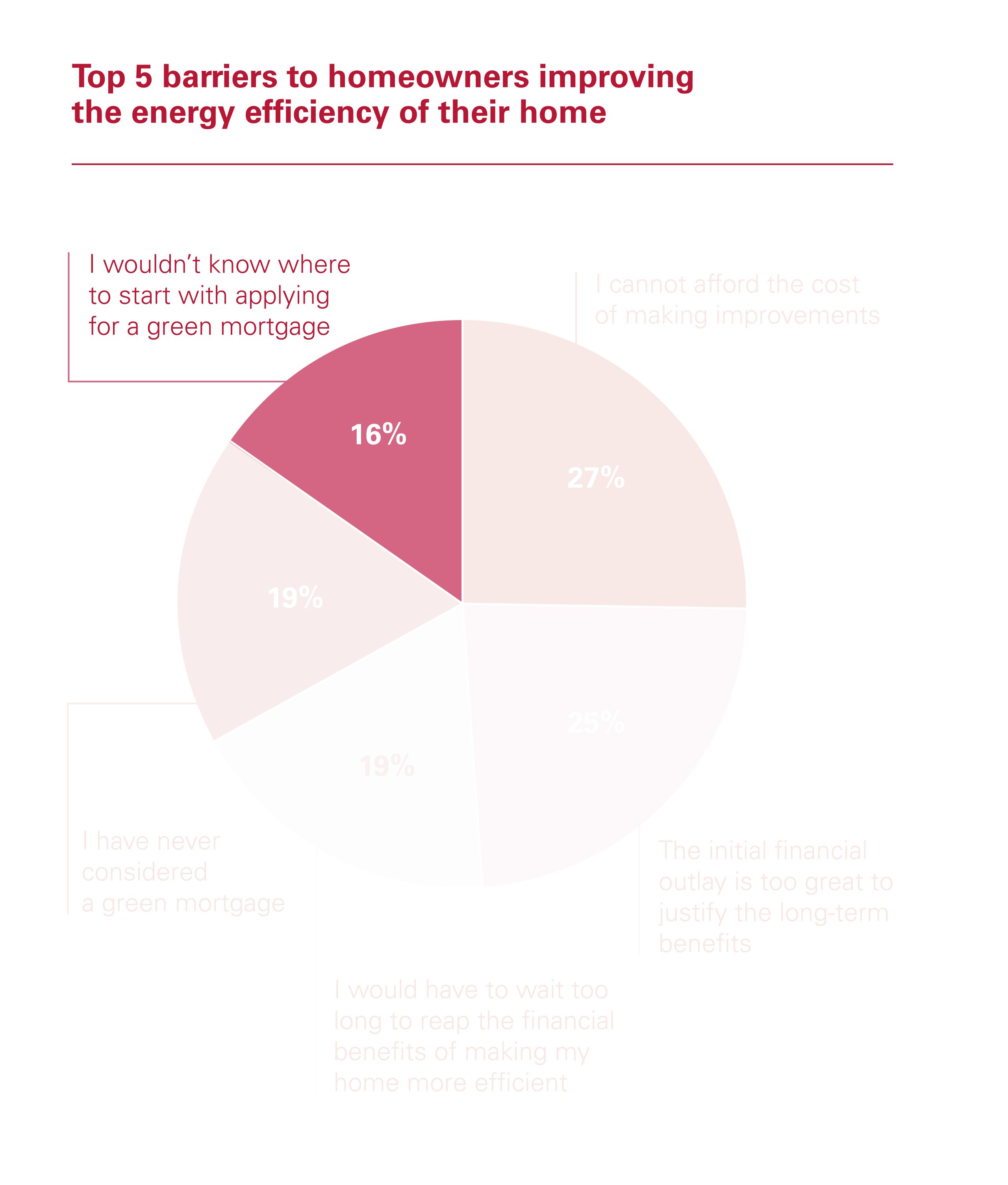

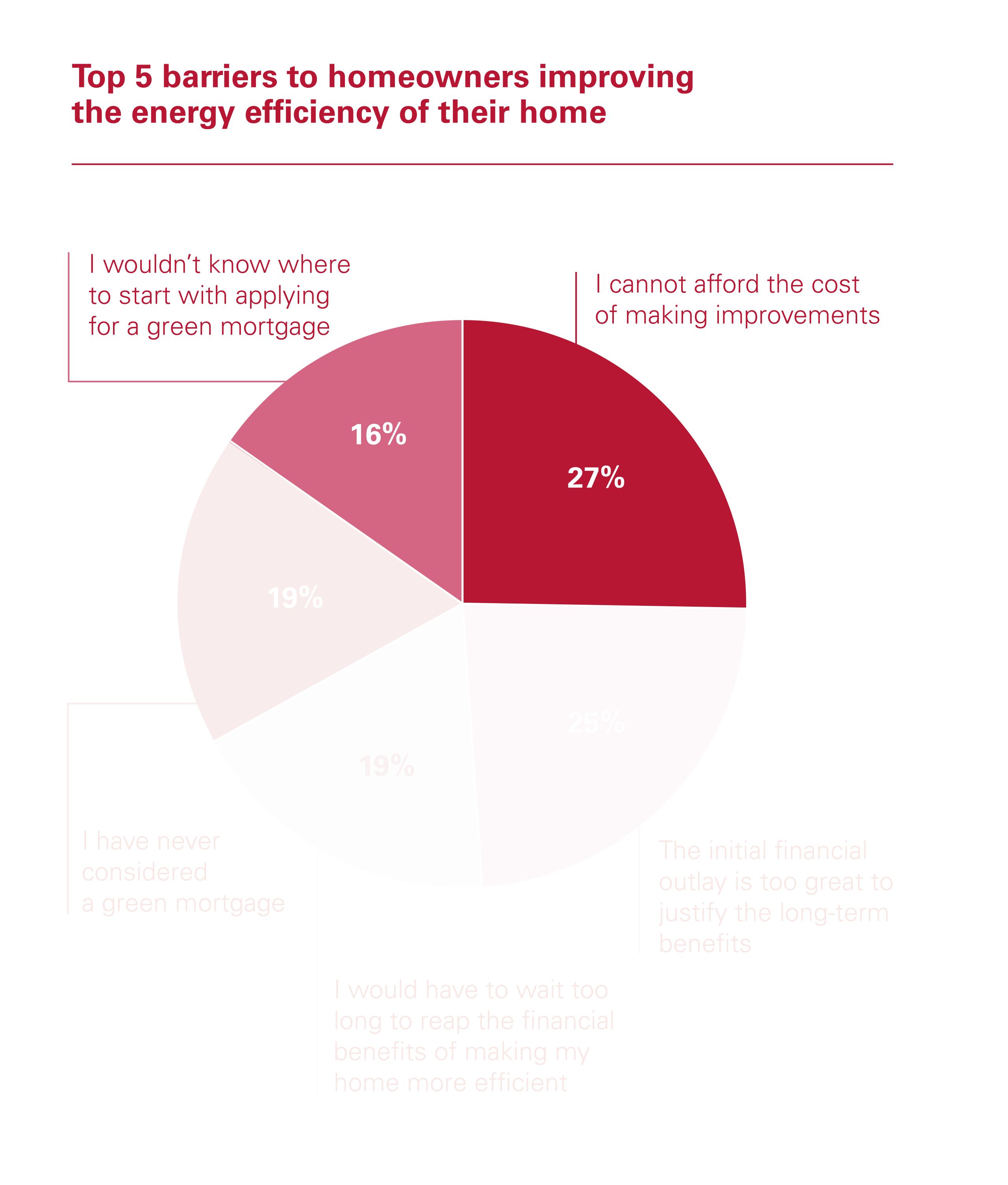

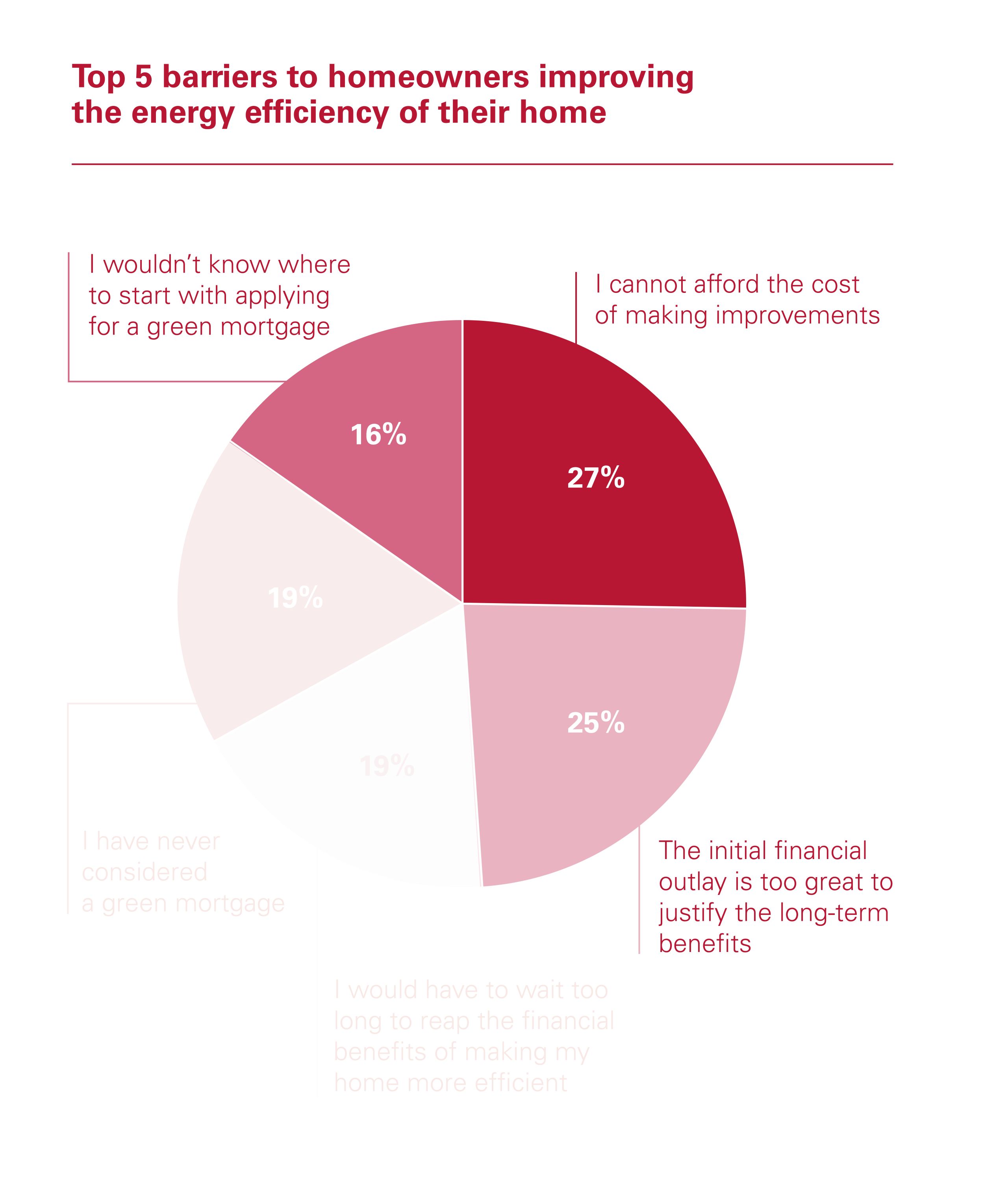

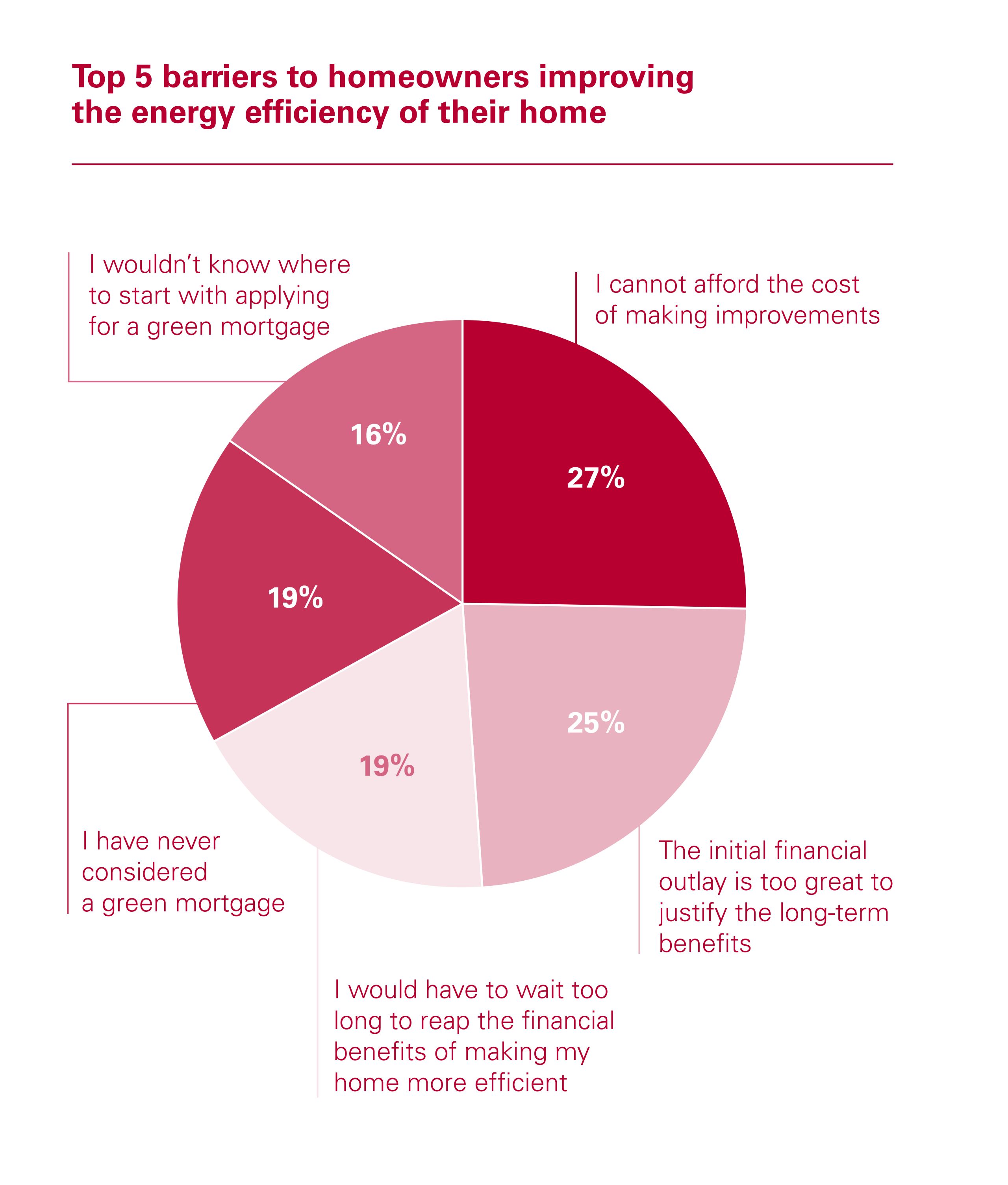

In fact, the research found that the upfront costs associated with making home improvements to existing homes in order to create greater energy efficiencies was cited by over a quarter (27%) of consumers as a key barrier to taking out a green mortgage, while 19% said the length of time they would have to wait to reap the financial benefits of making their home more efficient was just too long.

In addition, a further 25% said the initial financial outlay needed to improve the energy efficiency of a home was just too great to justify the longer-term benefits. This was also cited as a key barrier to consumer take-up by 75% of brokers and 84% of mortgage lenders.

Barriers to success

As with all attempts at innovation, green mortgages have come under fire from those who believe the market has too many barriers to entry. Lack of awareness, the length of time required to reap the rewards and mismatched incentives in the case

of tenants and landlords, where the person making the investment is not necessarily the one to benefit, are all potential barriers to market growth and ultimately, the creation of more energy efficient homes in the UK.

Similarly, while building new carbon-neutral housing is vitally important, for others it is the improvements – or lack thereof – to 29 million existing homes in the UK that could prove most problematic. Indeed, a key barrier to the growth of the green mortgage market is frequently cited as being the cost of home improvements to create greater efficiencies in older properties{{2}}{{{K housing: Fit for the future? Committee for Climate Change, February 2019.

Source: The CCC}}}.

In fact, the research found that the upfront costs associated with making home improvements to existing homes in order to create greater energy efficiencies was cited by over a quarter (27%) of consumers as a key barrier to taking out a green mortgage, while 19% said the length of time they would have to wait to reap the financial benefits of making their home more efficient was just too long.

In addition, a further 25% said the initial financial outlay needed to improve the energy efficiency of a home was just too great to justify the longer-term benefits. This was also cited as a key barrier to consumer take-up by 75% of brokers and 84% of mortgage lenders.

“There is scope for lenders to grow the green mortgages market - but there has to be a clear benefit articulated for the customer. Current contradictions need to be removed - for example, some lenders may not lend on a property with solar panels if the panels are leased. Green roofs can also be problematic to lend against.”

Alex Smith, Capricorn Financial Consultancy

Grants for green homes

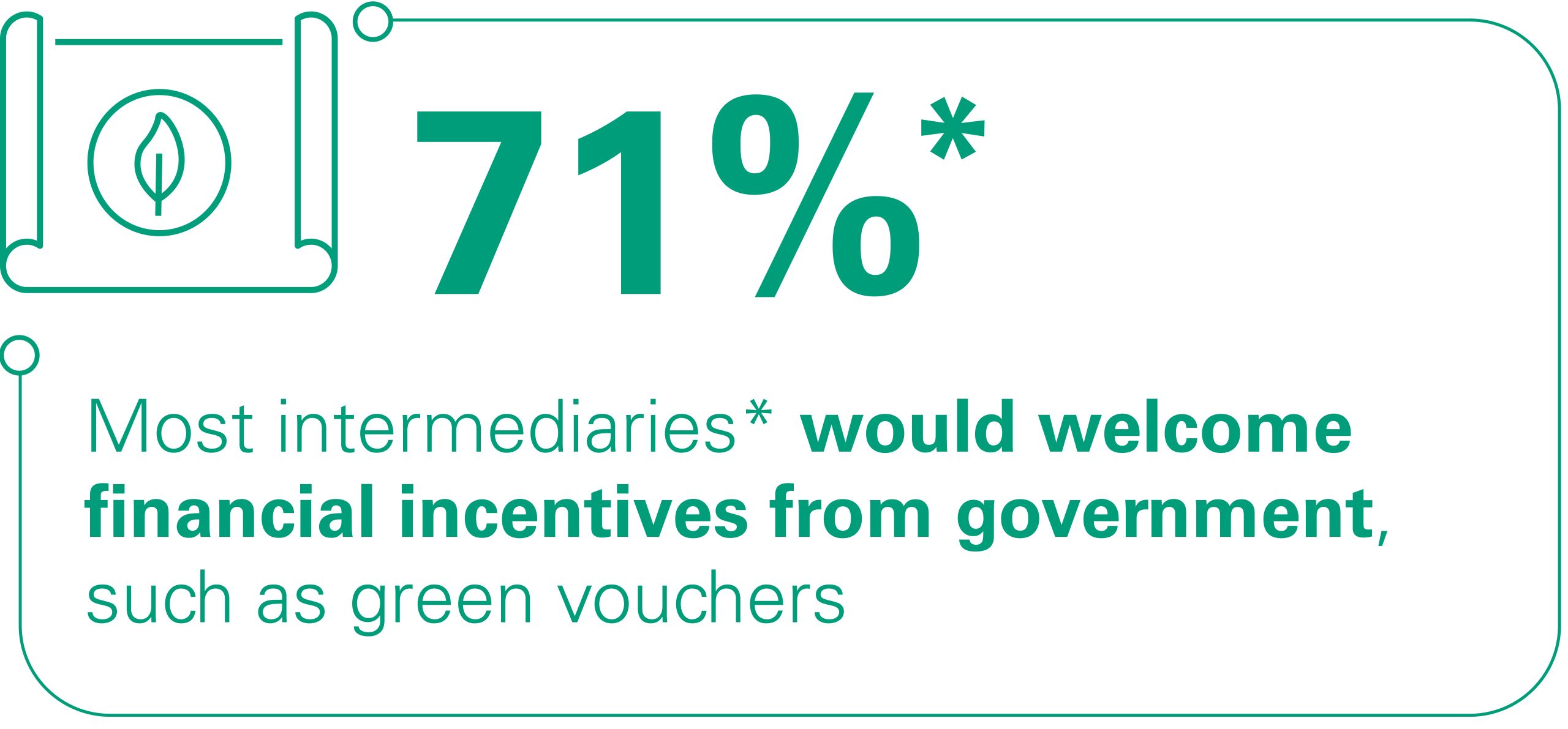

Another often cited barrier to the development of the sector is the lack of financial incentives from government, with 74% of lenders of the belief that this plays a key role in helping the market to move forward.

Therefore, the recent announcement of the £2bn Green Homes Grants package of investment for homeowners to implement energy efficient upgrades by Chancellor Rishi Sunak in his Summer Statement was broadly welcomed as a step in the right direction.

Under the scheme, homeowners will receive vouchers covering up to two-thirds of the costs up to £5,000 (£10,000 for low income households) to improve the energy efficiency of their homes, through measures such as insulation and heat pump installation. A further £1bn has been earmarked to improve the energy efficiency of public buildings such as schools and hospitals to reduce carbon emissions.

The measures have been warmly received by UK industry and could see up to 650,000 homes retrofitted. It could also help households save up to £300 a year on their bills as well as cut carbon by half a mega tonne per year.

However, although welcome, the scheme will merely scratch the surface of addressing the energy inefficiencies of the UK’s existing house stock. Such measures alone are unlikely to help the government achieve its net zero target, although they are nonetheless a welcome step. The government has also taken further action to give consumers peace of mind that any work carried out will be to a high standard and to ensure they are protected from unscrupulous scammers. This included requiring any contractors undertaking work covered by the scheme to be TrustMark accredited, as well as certified to install heat pump and solar thermal installations.

The future of green mortgages

Although the government has made progress in supporting the evolution of a green mortgage market through a number of pledges and funding initiatives over the last few years, it is clear from IMLA’s research that there is still a long way to go before green mortgages become a mainstream product.

At present, consumer awareness of green mortgages is low. There are a number of barriers preventing those familiar with the products from getting onboard such as upfront costs of repairs to make homes more energy efficient as well as the time taken to recoup the initial outlay.

The green mortgages market is, however, poised for future growth, with more lenders set to enter the market, competition and awareness will both increase. Similarly, a wider range of product offerings should mean that brokers are more likely to put green mortgages higher on the agenda when talking to customers.

One of the fundamental problems with green mortgages is not necessarily the products themselves, or even the lack of awareness among consumers, but the existing housing stock in the UK. Some dwellings are hundreds of years old, others have poor insulation and even worse EPC ratings and many are unfit for purpose in a carbon net zero world. In fact, about 20% of dwelling in England alone, some 4.7 million homes, failed to even meet the country’s ‘Decent Homes Standard’ in 2016{{3}}{{{UK housing: Fit for the future? Committee for Climate Change, February 2019.</br>Source: The CCC}}}. A further 1.2 million households in England are also considered ‘fuel poor households’, with properties so inefficient that owner-occupiers struggle to meet the costs of keeping their homes warm{{4}}{{{Financing energy efficient buildings: the path to retrofit at scale, Green Finance Institute, May 2020. </br>Source: Green Finance Institute}}}.

It is the cost of carrying out extensive repairs and the retrofitting of these houses that poses the biggest challenge to the green mortgage market going forward. Home renovations are costly, and as the UK, and indeed the world, enters a Covid-19 induced recession, conducting extensive repairs to increase a house’s energy efficiency may be quite far down the agenda for many UK homeowners. A report by the Committee for Climate Change in February 2019 highlighted the financial challenges. Building a new home with ultra-high levels of fabric efficiency and an air source heat pump (an alternative to gas or oil boilers) would cost just shy of £5,000 for a new build property. However, this figure rose to more than £23,000 when it came to retrofitting an older home to an equivalent standard{{5}}{{{UK housing: Fit for the future? Committee for Climate Change, February 2019.</br>Source: The CCC}}}.

Government initiatives such as the Green Homes Grant Scheme will help to kick start the discussion, increase consumer awareness and give borrowers an incentive to reduce their homes’ carbon footprint.

But - with only an estimated 600,000 homes likely to benefit from the scheme{{6}}{{{Homeowners to see savings available under new Green Homes Grant Scheme, Gov.uk.</br>Source: UK Government}}} - it will not deliver the required improvements needed to help the government reach its carbon net zero target in 2050. Nor will it drive substantial growth in the green mortgage market.

The issues surrounding green mortgages and green finance are larger than simply home improvements. Tackling these issues requires more ethical and sustainable business practices across the board, with the creation of more energy efficient homes, jobs, public transport upgrades and sustainable city-planning projects all an integral part of the overall picture. We need more collaboration between government, the banking sector and industry stakeholders to better understand the barriers facing consumers and the intervention that is needed to overcome those challenges.

The green mortgage market can play a vital role in the journey to net zero going forward, but it is only a piece of the puzzle. It will take many more years before a better understanding of energy efficiency and perceived customer value is realised and green mortgage products play a bigger role in the mainstream mortgage market in the UK.

The future of green mortgages

Although the government has made progress in supporting the evolution of a green mortgage market through a number of pledges and funding initiatives over the last few years, it is clear from IMLA’s research that there is still a long way to go before green mortgages become a mainstream product.

At present, consumer awareness of green mortgages is low. There are a number of barriers preventing those familiar with the products from getting onboard such as upfront costs of repairs to make homes more energy efficient as well as the time taken to recoup the initial outlay.

The green mortgages market is, however, poised for future growth, with more lenders set to enter the market, competition and awareness will both increase. Similarly, a wider range of product offerings should mean that brokers are more likely to put green mortgages higher on the agenda when talking to customers.

One of the fundamental problems with green mortgages is not necessarily the products themselves, or even the lack of awareness among consumers, but the existing housing stock in the UK. Some dwellings are hundreds of years old, others have poor insulation and even worse EPC ratings and many are unfit for purpose in a carbon net zero world. In fact, about 20% of dwelling in England alone, some 4.7 million homes, failed to even meet the country’s ‘Decent Homes Standard’ in 2016 {{3}}{{{UK housing: Fit for the future? Committee for Climate Change, February 2019.</br>Source: The CCC}}}. A further 1.2 million households in England are also considered ‘fuel poor households’, with properties so inefficient that owner-occupiers struggle to meet the costs of keeping their homes warm {{4}}{{{Financing energy efficient buildings: the path to retrofit at scale, Green Finance Institute, May 2020. </br>Source: Green Finance Institute}}}.

It is the cost of carrying out extensive repairs and the retrofitting of these houses that poses the biggest challenge to the green mortgage market going forward. Home renovations are costly, and as the UK, and indeed the world, enters a Covid-19 induced recession, conducting extensive repairs to increase a house’s energy efficiency may be quite far down the agenda for many UK homeowners. A report by the Committee for Climate Change in February 2019 highlighted the financial challenges. Building a new home with ultra-high levels of fabric efficiency and an air source heat pump (an alternative to gas or oil boilers) would cost just shy of £5,000 for a new build property. However, this figure rose to more than £23,000 when it came to retrofitting an older home to an equivalent standard {{5}}{{{UK housing: Fit for the future? Committee for Climate Change, February 2019.Source: The CCC}}}.

Government initiatives such as the Green Homes Grant Scheme will help to kick start the discussion, increase consumer awareness and give borrowers an incentive to reduce their homes’ carbon footprint.

But - with only an estimated 600,000 homes likely to benefit from the scheme{{6}}{{{Homeowners to see savings available under new Green Homes Grant Scheme, Gov.uk.</br>Source: UK Government}}} - it will not deliver the required improvements needed to help the government reach its carbon net zero target in 2050. Nor will it drive substantial growth in the green mortgage market.

The issues surrounding green mortgages and green finance are larger than simply home improvements. Tackling these issues requires more ethical and sustainable business practices across the board, with the creation of more energy efficient homes, jobs, public transport upgrades and sustainable city-planning projects all an integral part of the overall picture. We need more collaboration between government, the banking sector and industry stakeholders to better understand the barriers facing consumers and the intervention that is needed to overcome those challenges.

The green mortgage market can play a vital role in the journey to net zero going forward, but it is only a piece of the puzzle. It will take many more years before a better understanding of energy efficiency and perceived customer value is realised and green mortgage products play a bigger role in the mainstream mortgage market in the UK.

This digital thought leadership report was researched, written and designed for IMLA by Rostrum

If you’d like Rostrum’s help to transform your approach to content marketing, please get in touch with Mark Houlding at Rostrum m.houlding@rostrum.agency